In the midst of a volatile U.S. market, where concerns about AI valuations have led to fluctuations in major indices like the Dow Jones and Nasdaq, investors are closely watching earnings reports and economic indicators amid a historic government shutdown. As tech stocks face renewed scrutiny, identifying high-growth opportunities requires careful consideration of companies' adaptability to current trends and their potential for innovation in an uncertain economic landscape.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Exelixis | 11.10% | 22.30% | ★★★★★☆ |

| Palantir Technologies | 26.74% | 29.17% | ★★★★★★ |

| Workday | 11.19% | 32.07% | ★★★★★☆ |

| Praxis Precision Medicines | 70.78% | 67.85% | ★★★★★★ |

| RenovoRx | 65.52% | 68.63% | ★★★★★☆ |

| Circle Internet Group | 27.53% | 82.41% | ★★★★★☆ |

| OS Therapies | 56.64% | 68.61% | ★★★★★☆ |

| Gorilla Technology Group | 32.75% | 122.61% | ★★★★★☆ |

| Aldeyra Therapeutics | 42.92% | 73.80% | ★★★★★☆ |

| Zscaler | 15.72% | 40.94% | ★★★★★☆ |

Click here to see the full list of 79 stocks from our US High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Compass Therapeutics (CMPX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Compass Therapeutics, Inc. is a clinical-stage biopharmaceutical company specializing in the development of antibody-based therapeutics for treating various human diseases, with a market capitalization of $650.26 million.

Operations: Compass Therapeutics focuses on developing antibody-based therapeutics primarily for oncology applications in the United States. The company operates as a clinical-stage biopharmaceutical entity, with its business model centered around research and development activities aimed at advancing innovative treatments.

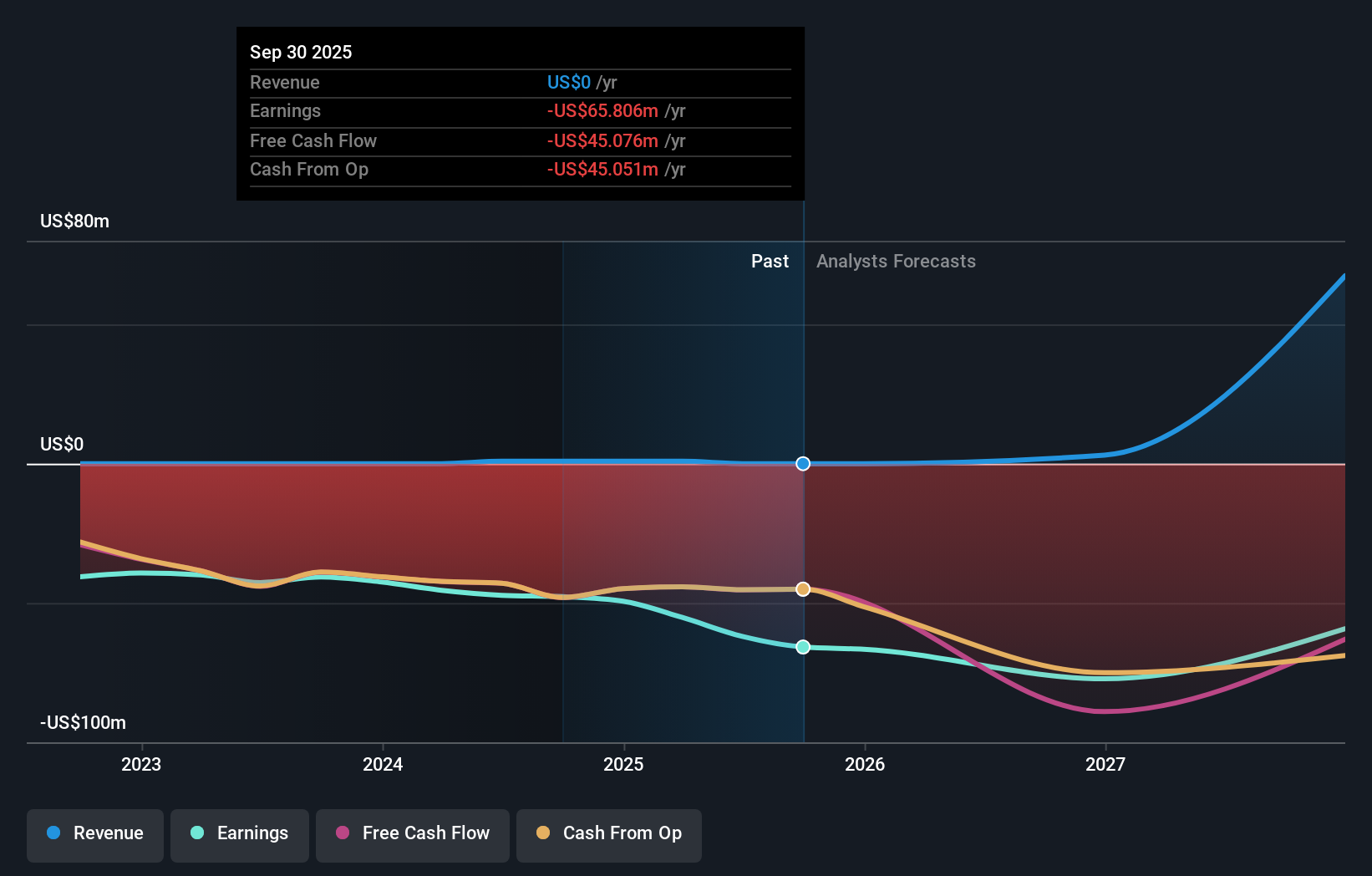

Compass Therapeutics, despite its challenging financials with a net loss widening to $50.77 million from $34.34 million year-over-year as of September 2025, shows potential in the high-growth biotech sector. The firm's inclusion in the S&P Biotechnology Select Industry Index underscores its relevance in an industry driven by innovation and R&D intensity. Notably, Compass is navigating through significant R&D phases, evident from its active participation in multiple high-profile healthcare conferences, signaling ongoing endeavors to overturn unprofitability through strategic advancements and potentially lucrative drug developments. This strategy could be pivotal as it aims for profitability within three years amidst a volatile share price landscape.

- Take a closer look at Compass Therapeutics' potential here in our health report.

Explore historical data to track Compass Therapeutics' performance over time in our Past section.

Stoke Therapeutics (STOK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Stoke Therapeutics, Inc. is an early-stage biopharmaceutical company focused on developing treatments for severe genetic diseases through the upregulation of protein expression, with a market cap of $1.39 billion.

Operations: Stoke Therapeutics focuses on developing therapies for severe genetic diseases by enhancing protein expression. As an early-stage biopharmaceutical company, it does not currently generate revenue from product sales.

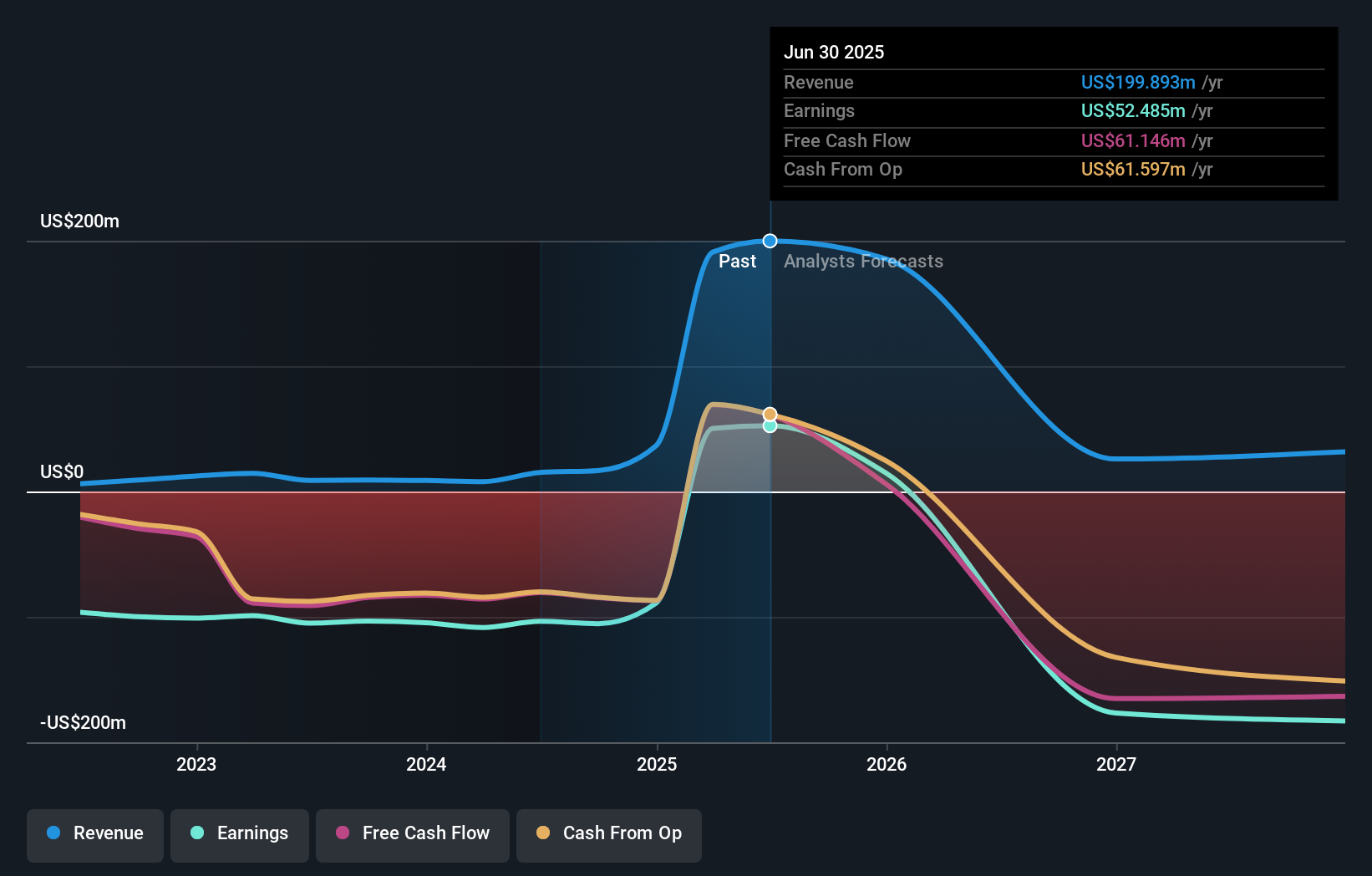

Stoke Therapeutics, despite its recent net loss of $38.35 million for Q3 2025, shows promise with a substantial increase in sales to $183.02 million over nine months, reflecting a strong revenue growth rate of 20.1% annually. This performance is complemented by an impressive forecast of earnings growth at 41.6% per year, signaling potential recovery and profitability ahead. The company's strategic focus on R&D is evident from its participation in the FALCON study and development of STK-002 for treating optic atrophy, underscoring its commitment to addressing unmet medical needs through innovative therapies.

Vishay Precision Group (VPG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vishay Precision Group, Inc. operates in the precision measurement and sensing technologies sector across the United States, Europe, Israel, Asia, and Canada with a market cap of $473.93 million.

Operations: Vishay Precision Group specializes in precision measurement and sensing technologies, generating revenue through its diverse geographic operations. The company's cost structure and financial performance details are not specified in the provided data.

Vishay Precision Group, with its modest annual revenue growth of 5.3%, contrasts sharply against a backdrop of high-growth tech sectors, yet it's the company's earnings forecast that intrigues, projecting a robust increase of 33.7% annually. This growth is underpinned by strategic executive appointments aiming to enhance product strategy and operations efficiency, signaling a potential shift towards more dynamic market positioning. Moreover, recent financials reveal an encouraging turnaround from a net loss to a net income of $7.86 million in Q3 2025, alongside consistent R&D investment that could further solidify its competitive edge in precision technology.

Turning Ideas Into Actions

- Unlock more gems! Our US High Growth Tech and AI Stocks screener has unearthed 76 more companies for you to explore.Click here to unveil our expertly curated list of 79 US High Growth Tech and AI Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VPG

Vishay Precision Group

Engages in the precision measurement and sensing technologies business in the United States, Europe, Israel, Asia, and Canada.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)