- United States

- /

- Food

- /

- NYSE:BGS

January 2025's Undervalued Small Caps With Insider Action On US Markets

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 2.6% drop, yet it has shown resilience with a 24% rise over the past year and earnings projected to grow by 15% annually. In this dynamic environment, identifying small-cap stocks that are potentially undervalued and exhibit insider action can offer unique opportunities for investors seeking to capitalize on emerging growth prospects.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| German American Bancorp | 14.5x | 4.8x | 47.99% | ★★★★☆☆ |

| Quanex Building Products | 34.5x | 0.9x | 37.92% | ★★★★☆☆ |

| ProPetro Holding | NA | 0.7x | 37.25% | ★★★★☆☆ |

| ChromaDex | 273.5x | 4.4x | 37.17% | ★★★☆☆☆ |

| Limbach Holdings | 36.7x | 1.9x | 43.41% | ★★★☆☆☆ |

| RGC Resources | 17.5x | 2.4x | 20.34% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Tilray Brands | NA | 1.5x | -79.64% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -73.70% | ★★★☆☆☆ |

| Sabre | NA | 0.5x | -78.05% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

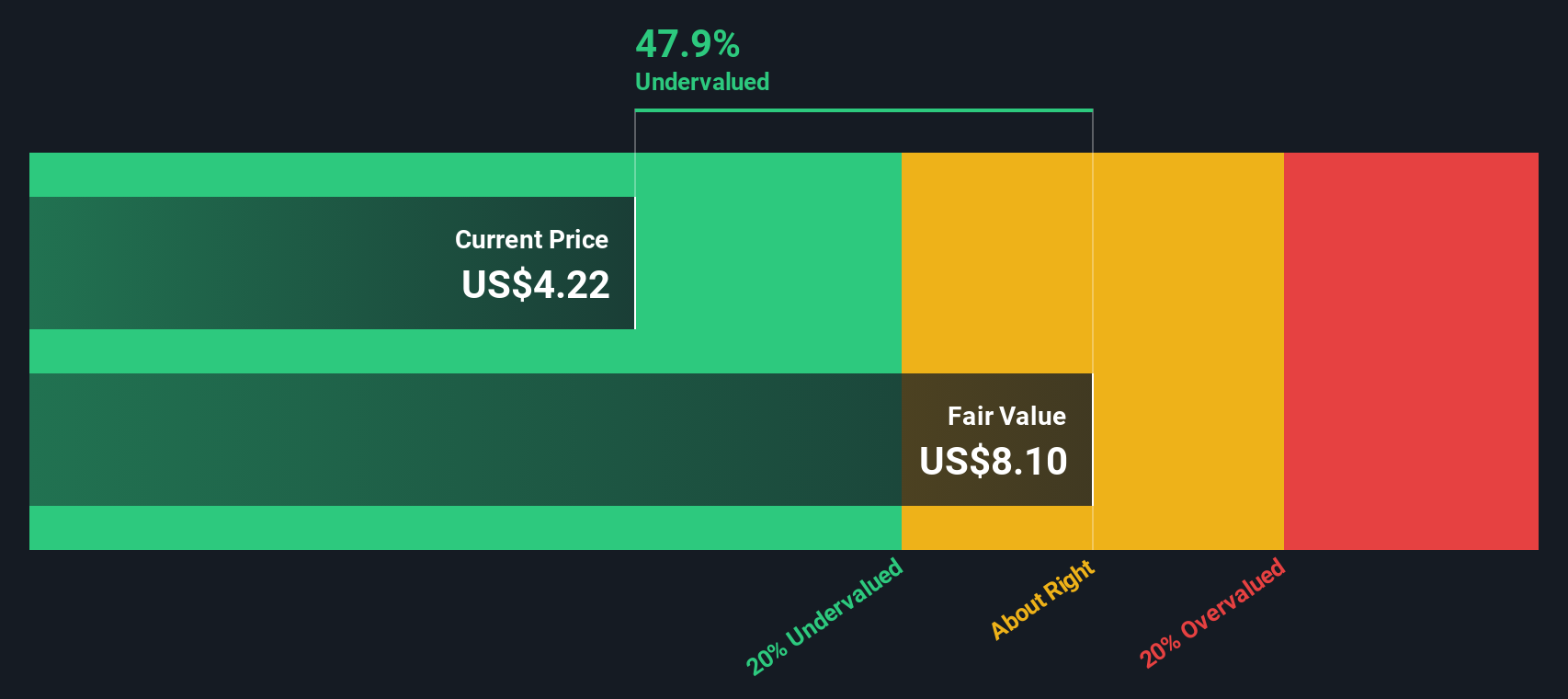

Celldex Therapeutics (NasdaqCM:CLDX)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Celldex Therapeutics focuses on the development, manufacturing, and commercialization of novel therapeutics with a market cap of $1.51 billion.

Operations: Revenue primarily comes from the development, manufacturing, and commercialization of novel therapeutics. The company has experienced fluctuations in gross profit margin, with a notable trend reaching -13.74% in the latest period. Operating expenses have varied over time but recently stood at $37.12 million for the last reported period.

PE: -10.9x

Celldex Therapeutics, a small company in the biotech sector, has seen insider confidence with recent share purchases. Despite reporting a net loss of US$42.12 million for Q3 2024, revenue increased to US$3.19 million from US$1.52 million year-over-year. The company is advancing its pipeline with promising Phase 2 results for barzolvolimab and initiated Phase 1a trials for CDX-622 targeting inflammatory disorders, indicating potential growth avenues despite current unprofitability and high-risk funding sources.

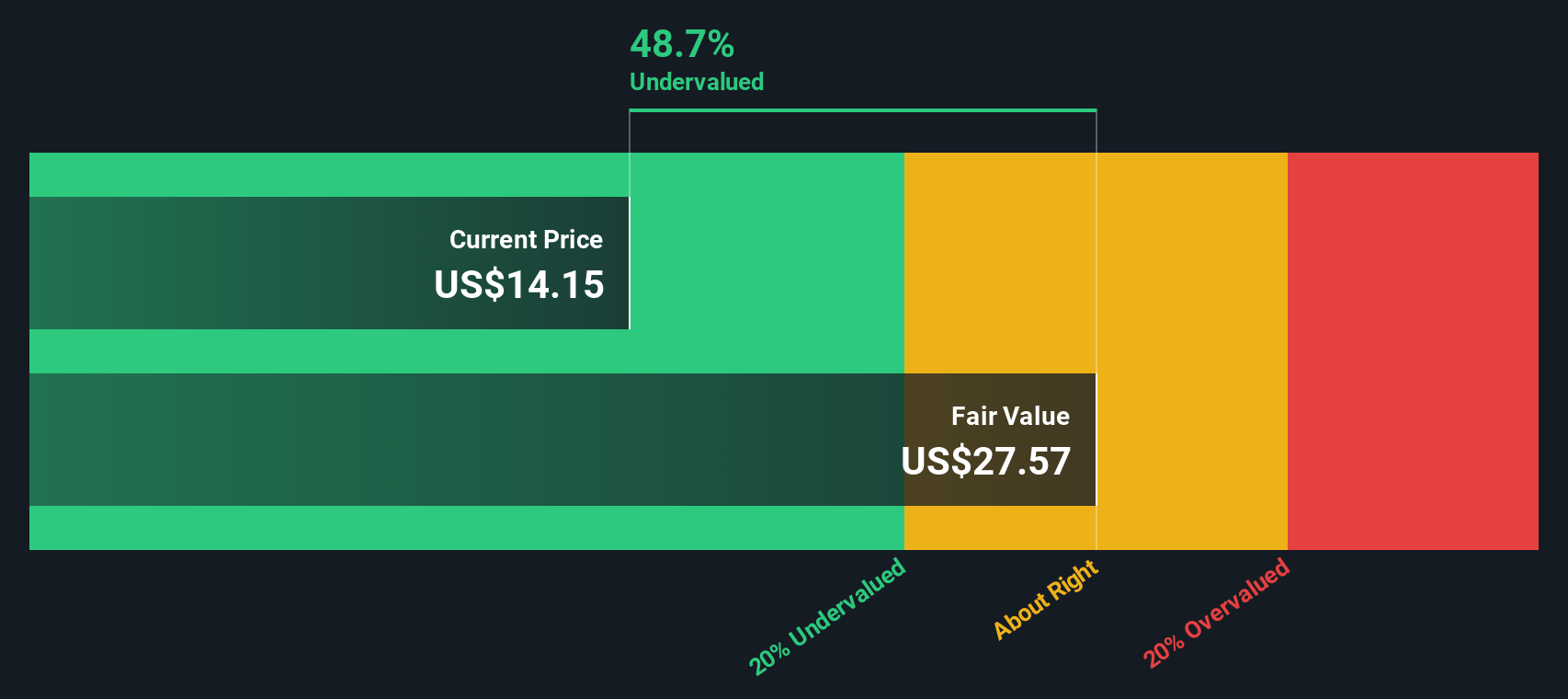

Trinity Capital (NasdaqGS:TRIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Trinity Capital operates primarily in providing financial services related to blank checks, with a market capitalization of approximately $0.62 billion.

Operations: Trinity Capital generates revenue primarily from its blank checks segment. The company has consistently achieved a gross profit margin of 100%, with operating expenses and non-operating expenses impacting net income. Over recent periods, net income margins have shown variability, reaching as high as 43.98% and experiencing negative values at times.

PE: 9.7x

Trinity Capital, a smaller company in the U.S., is drawing attention for its potential value. Despite earnings not fully covering interest payments, revenue showed growth with US$61.77 million in Q3 2024 compared to US$46.44 million the previous year. Insider confidence is evident with Steven Brown purchasing 19,350 shares worth approximately US$254K recently, reflecting belief in future prospects. The company has also initiated a share repurchase program up to US$30 million and expanded its credit facility to US$600 million, signaling strategic financial maneuvers aimed at enhancing shareholder value amidst high-risk funding sources and non-cash earnings challenges.

- Click here and access our complete valuation analysis report to understand the dynamics of Trinity Capital.

Examine Trinity Capital's past performance report to understand how it has performed in the past.

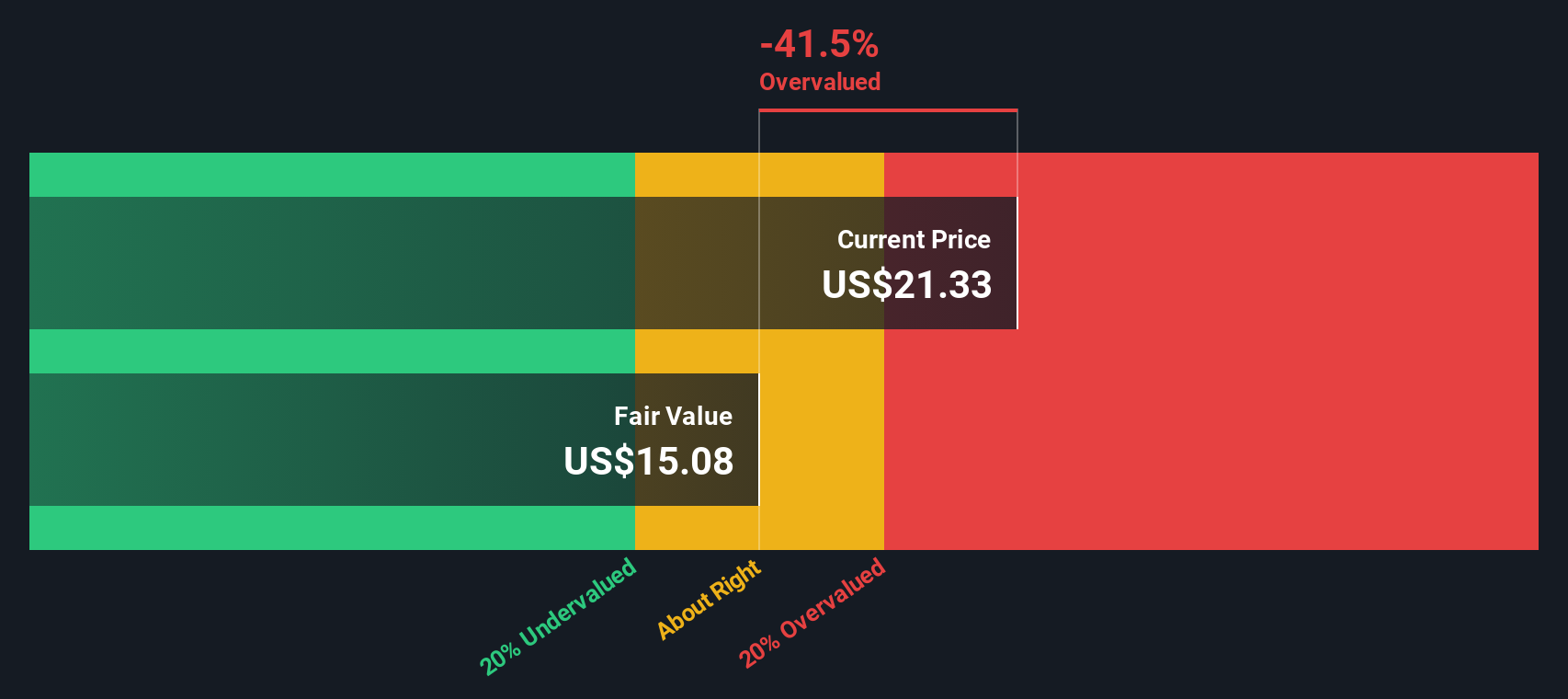

B&G Foods (NYSE:BGS)

Simply Wall St Value Rating: ★★★★★☆

Overview: B&G Foods is a manufacturer and distributor of shelf-stable and frozen foods, with a market cap of approximately $1.08 billion.

Operations: B&G Foods generates revenue primarily through its sales, with recent figures showing $2.06 billion. The company's cost of goods sold (COGS) is a significant expense, impacting its gross profit margin, which has recently been around 22.07%. Operating expenses and non-operating expenses further influence the financial outcomes, contributing to recent negative net income margins.

PE: -20.8x

B&G Foods, a small player in the U.S. market, shows potential for value-seeking investors. Despite its reliance on external borrowing, insider confidence is evident with Stephen Sherrill acquiring 125,000 shares worth approximately US$1.07 million. Recent earnings reveal a turnaround with a net income of US$7.46 million in Q3 2024 compared to last year's loss. The company projects annual sales between US$1.92 billion and US$1.95 billion and offers an attractive dividend yield of 8.6%.

- Dive into the specifics of B&G Foods here with our thorough valuation report.

Gain insights into B&G Foods' historical performance by reviewing our past performance report.

Next Steps

- Embark on your investment journey to our 43 Undervalued US Small Caps With Insider Buying selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if B&G Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BGS

B&G Foods

Manufactures, sells, and distributes a portfolio of shelf-stable and frozen foods, and household products in the United States, Canada, and Puerto Rico.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives