- United States

- /

- Biotech

- /

- NasdaqCM:CLDX

Celldex Therapeutics (CLDX): Assessing Valuation as Barzolvolimab Hype and Biotech Optimism Drive Renewed Investor Focus

Reviewed by Kshitija Bhandaru

Celldex Therapeutics (CLDX) has seen renewed interest as excitement builds over barzolvolimab's outlook in chronic urticaria, along with broader positive momentum across small and mid-cap biotech stocks.

See our latest analysis for Celldex Therapeutics.

Celldex's renewed buzz has helped power an impressive rebound, with a 15% share price return over the past 90 days highlighting the strength of recent momentum. While the 1-year total shareholder return remains negative at nearly -10%, investors are watching to see if the rally continues as pivotal trial results approach and sector enthusiasm remains high.

Given the surge of interest in biotech innovation, it's the perfect time to explore fresh opportunities with our healthcare screener: See the full list for free.

With shares rebounding, a promising drug pipeline, and investor optimism at new highs, the key question now is whether Celldex Therapeutics is still undervalued or if the market has already priced in the company's future growth.

Price-to-Book Ratio of 2.7x: Is it justified?

Celldex Therapeutics is currently trading at a price-to-book ratio of 2.7x, which suggests the market is placing a premium on its net assets compared to its US biotech peers. With the last close price at $26.47, the company appears slightly expensive when assessed by this metric.

The price-to-book ratio compares a company’s market value to its book value. Essentially, it shows how much investors are willing to pay for each dollar of net assets. For a biotech like Celldex, this ratio can reflect market expectations for future breakthroughs or pipeline success, as strong R&D prospects can justify higher multiples even in the absence of profits.

Celldex’s price-to-book ratio of 2.7x is just above the US Biotechs industry average of 2.5x but is notably below the peer group average of 3x. This puts it in a middle ground: more expensive than the broader industry, yet cheaper than its closest competitors. The current valuation signals that investors are optimistic, but not excessively so, about pipeline catalysts and potential long-term value.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 2.7x (ABOUT RIGHT)

However, disappointing trial results or unexpected regulatory setbacks could quickly dampen investor optimism. This may shift sentiment even as recent momentum remains strong.

Find out about the key risks to this Celldex Therapeutics narrative.

Another View: SWS DCF Model Suggests a Contrasting Valuation

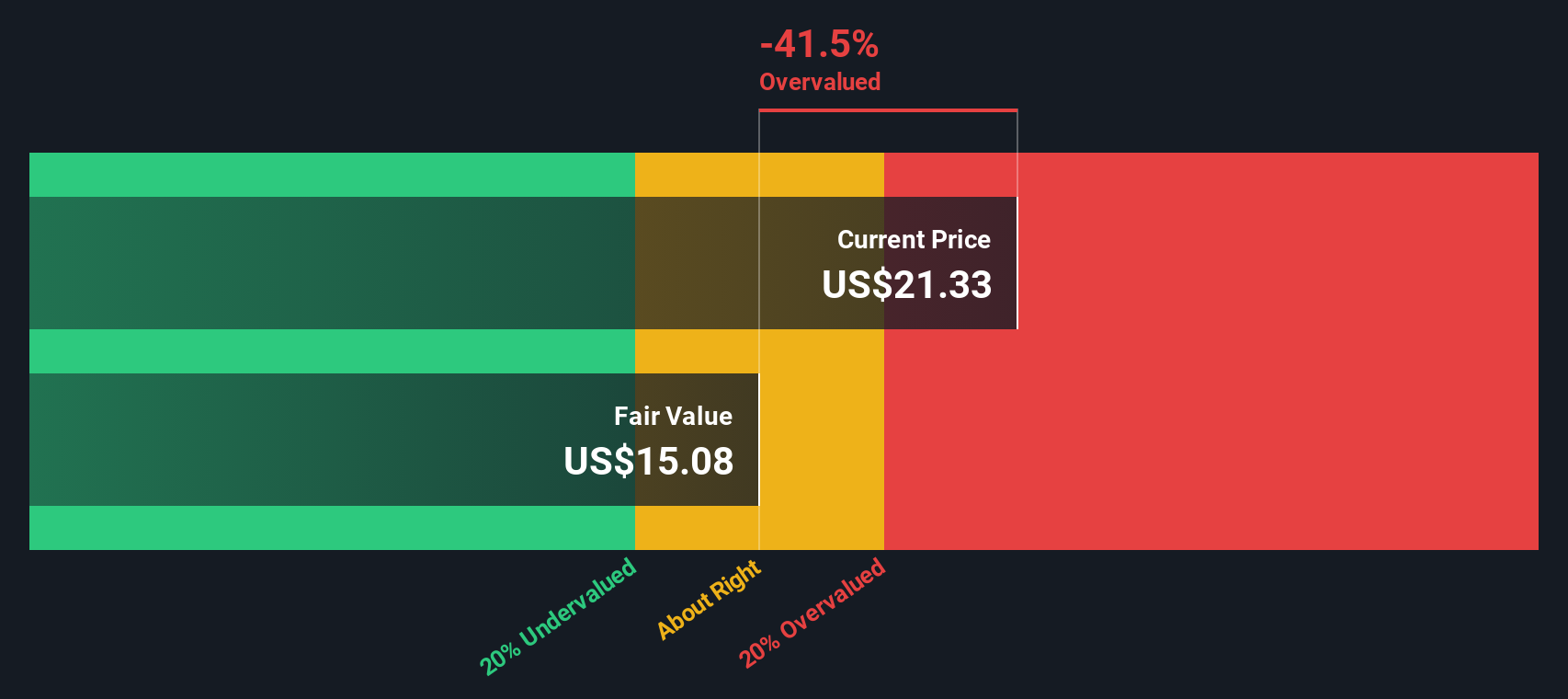

While the price-to-book ratio positions Celldex in a middle ground among biotechs, our DCF model presents a different perspective. According to the SWS DCF model, Celldex’s estimated fair value is $7.33 per share, which is significantly below its current market price of $26.47. This suggests the stock may be trading at a premium far above what fundamental cash flow analysis implies. However, does this disconnect signal excessive optimism, or could there be factors the model is not accounting for?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Celldex Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Celldex Therapeutics Narrative

For those who want to dig into the numbers and shape their own outlook, it takes just a few minutes to build your own perspective. Do it your way

A great starting point for your Celldex Therapeutics research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you want to stay a step ahead and find your next opportunity, check out these high-potential investing routes below before everyone else does.

- Tap into future growth by reviewing these 25 AI penny stocks, companies transforming industries through artificial intelligence and automation.

- Secure potential long-term income when you scan these 18 dividend stocks with yields > 3%, delivering yields above 3% for investors seeking steady returns.

- Seize the chance to invest early by considering these 3564 penny stocks with strong financials, poised for substantial financial breakthroughs and strong balance sheets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CLDX

Celldex Therapeutics

A biopharmaceutical company, engages in developing therapeutic antibodies for patients with severe inflammatory, allergic, autoimmune, and other diseases.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives