- United States

- /

- Biotech

- /

- NasdaqCM:CLDX

Celldex Therapeutics And 2 Other Undervalued Small Caps With Insider Action In US

Reviewed by Simply Wall St

The United States market has shown resilience, remaining flat over the last week while achieving a notable 24% increase over the past year, with earnings projected to grow by 15% annually. In this context, identifying promising small-cap stocks like Celldex Therapeutics and others can be key for investors seeking opportunities that align with current market dynamics and insider activity.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Plymouth Industrial REIT | 906.7x | 3.8x | 47.13% | ★★★★★☆ |

| Array Technologies | NA | 1.2x | 48.38% | ★★★★★☆ |

| ProPetro Holding | NA | 0.6x | 24.37% | ★★★★★☆ |

| McEwen Mining | 4.4x | 2.3x | 42.93% | ★★★★★☆ |

| OptimizeRx | NA | 1.2x | 41.50% | ★★★★★☆ |

| Quanex Building Products | 30.9x | 0.8x | 41.37% | ★★★★☆☆ |

| First United | 13.0x | 2.9x | 46.86% | ★★★★☆☆ |

| German American Bancorp | 14.7x | 4.9x | 46.81% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -75.04% | ★★★☆☆☆ |

| Sabre | NA | 0.4x | -37.51% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

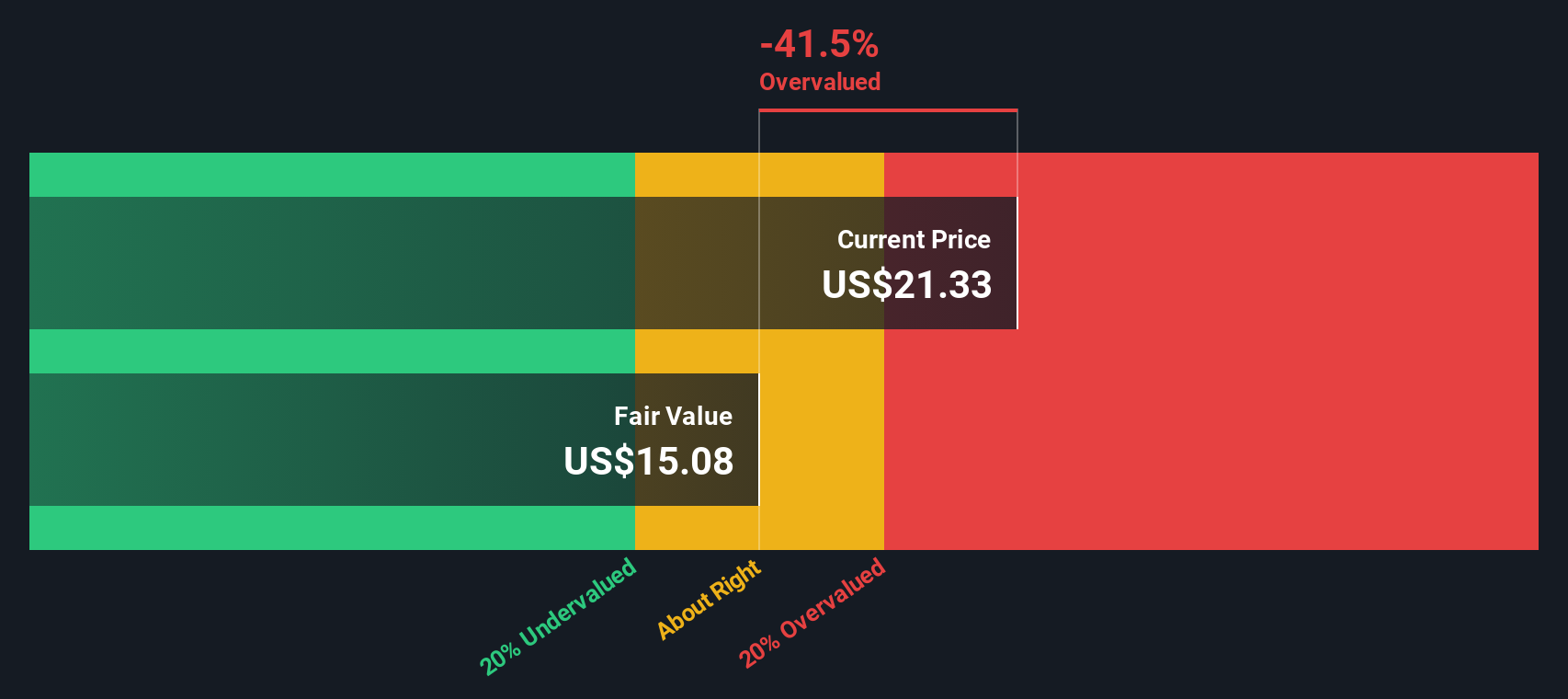

Celldex Therapeutics (NasdaqCM:CLDX)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Celldex Therapeutics is focused on the development, manufacturing, and commercialization of novel therapeutics with a market cap of approximately $1.63 billion.

Operations: Celldex Therapeutics generates revenue primarily from the development, manufacturing, and commercialization of novel therapeutics. The company has experienced fluctuating gross profit margins, with recent figures showing a gross profit margin of -13.74%. Operating expenses include significant allocations to general and administrative costs, which were $37.12 million in the latest period.

PE: -10.9x

Celldex Therapeutics, a small biotech firm, recently announced dosing the first patient in its Phase 1a study of CDX-622, targeting chronic inflammation. Despite a net loss of US$42.12 million for Q3 2024 and ongoing unprofitability, revenue rose to US$3.19 million from US$1.52 million year-over-year. Insider confidence is evident with recent share purchases by insiders over the past year, signaling potential belief in future growth amid their innovative therapeutic developments and presentations at key healthcare conferences.

- Click to explore a detailed breakdown of our findings in Celldex Therapeutics' valuation report.

Gain insights into Celldex Therapeutics' past trends and performance with our Past report.

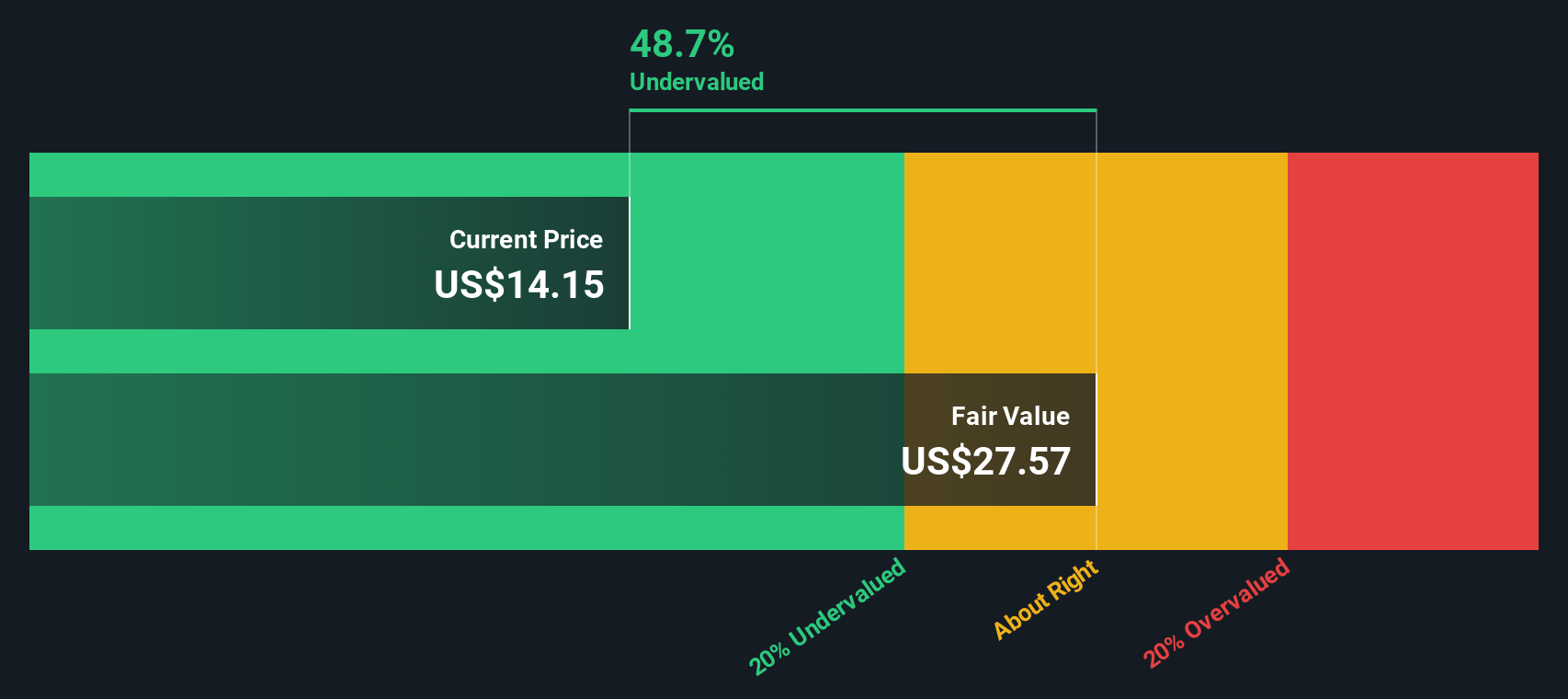

Trinity Capital (NasdaqGS:TRIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Trinity Capital is a financial services company that specializes in providing debt, equity, and equipment financing solutions to growth-stage companies, with a market capitalization of approximately $0.61 billion.

Operations: Trinity Capital generates revenue primarily from its blank checks segment, with recent figures showing $205.16 million. Over the analyzed period, the company consistently achieved a gross profit margin of 100%, indicating that all reported revenue translates directly into gross profit. Operating expenses have shown an upward trend, reaching $52.57 million in the latest period, impacting net income margins which have varied significantly over time but recently stood at 42.62%.

PE: 10.1x

Trinity Capital, a smaller player in the U.S. market, showcases potential with its recent financial maneuvers. Despite past shareholder dilution, they announced a $30 million share repurchase program on November 7, 2024, indicating insider confidence. However, reliance on external borrowing remains a risk factor as all liabilities come from this higher-risk source. The company expanded its credit facility to US$600 million in December 2024 and is poised for earnings growth of over 22% annually.

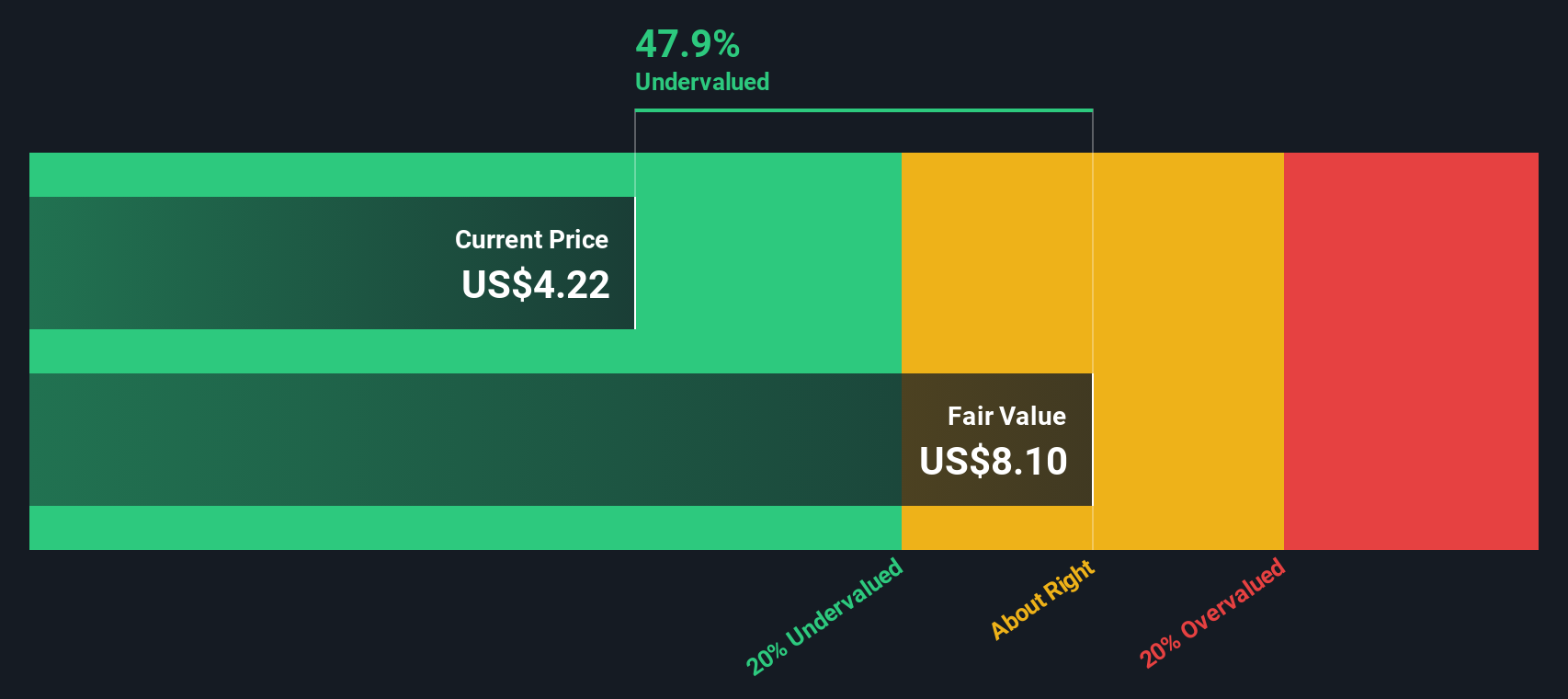

B&G Foods (NYSE:BGS)

Simply Wall St Value Rating: ★★★★★★

Overview: B&G Foods is a food company that manufactures, sells, and distributes a diverse portfolio of branded shelf-stable and frozen foods across North America with a market cap of approximately $1.33 billion.

Operations: B&G Foods generates revenue primarily through its product sales, with recent figures showing a decline in net income and gross profit margin. The gross profit margin has fluctuated, reaching 22.07% in the latest period from 19.09% previously. Operating expenses have remained significant, with general and administrative expenses constituting a substantial portion of these costs.

PE: -19.7x

B&G Foods, a player in the food industry, has shown signs of improvement with a shift from a net loss to a net income of US$7.46 million for Q3 2024. Although sales dipped to US$461.07 million from US$502.73 million the previous year, insider confidence is evident as Independent Chairman Stephen Sherrill purchased 125,000 shares valued at over US$1 million in recent months. The company revised its annual sales guidance to between US$1.92 billion and US$1.95 billion for 2024, indicating cautious optimism despite reliance on external borrowing for funding and interest payments not being well covered by earnings currently.

- Navigate through the intricacies of B&G Foods with our comprehensive valuation report here.

Explore historical data to track B&G Foods' performance over time in our Past section.

Seize The Opportunity

- Click here to access our complete index of 45 Undervalued US Small Caps With Insider Buying.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CLDX

Celldex Therapeutics

A biopharmaceutical company, engages in developing therapeutic antibodies for patients with severe inflammatory, allergic, autoimmune, and other diseases.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives