- United States

- /

- Biotech

- /

- NasdaqCM:CELC

Celcuity (CELC) Valuation Check After Paradigm-Shifting VIKTORIA-1 Breast Cancer Data Update

Reviewed by Simply Wall St

Celcuity (CELC) recently presented new Phase 3 VIKTORIA-1 data for gedatolisib to oncologists at the San Antonio Breast Cancer Symposium, showing clearly longer progression free survival versus fulvestrant in advanced HR positive, HER2 negative disease.

See our latest analysis for Celcuity.

These latest VIKTORIA-1 results land after a remarkable run for Celcuity, with a 30 day share price return of 23.61 percent and a 1 year total shareholder return of 740.65 percent, which some investors may see as evidence of bullish momentum as they reprice its long term potential.

If this kind of clinical driven share price surge has your attention, it could be worth exploring other innovative healthcare names through healthcare stocks to see what else the market might be overlooking.

Yet with shares already near analyst targets after a multi fold rally, the key question now is whether Celcuity remains mispriced relative to gedatolisib’s potential or if the market is already discounting years of future growth.

Price to Book of 41.6x: Is it justified?

Celcuity trades on a price to book ratio of 41.6 times, a level that implies a rich valuation relative to its current fundamentals and peers.

Price to book compares the market value of the company to the net assets on its balance sheet, a metric often used for early stage or unprofitable biotechs where traditional earnings based measures are less meaningful.

At 41.6 times book value, investors appear to be paying a substantial premium for Celcuity’s pipeline and forecast growth, rather than its present asset base or lack of revenue. This suggests expectations for future profitability are already aggressive.

The gap to the wider US Biotechs industry is extreme. Celcuity’s 41.6 times price to book multiple towers over the sector average of 2.7 times and even the 10.2 times peer average, underscoring how much more investors are willing to pay for each dollar of net assets compared with alternatives.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to book of 41.6x (OVERVALUED)

However, setbacks in gedatolisib’s late stage trials or delays in regulatory timelines could quickly challenge today’s optimistic valuation and fragile sentiment.

Find out about the key risks to this Celcuity narrative.

Another View on Value

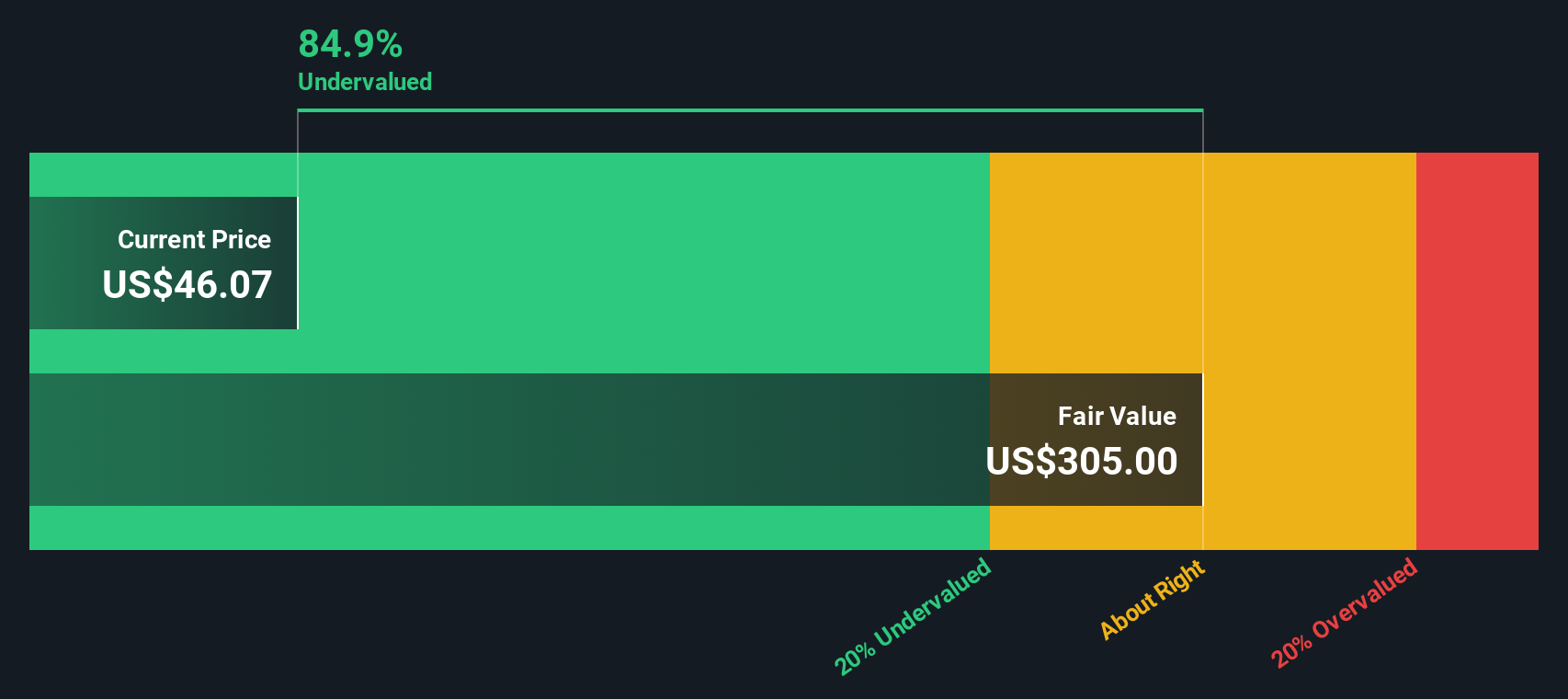

Our DCF model tells a very different story from the lofty price to book. On this view, Celcuity at $105.25 trades about 78 percent below an estimated fair value of $488.08. This implies the market may be underestimating gedatolisib’s cash flow potential. Could expectations still be too cautious?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Celcuity for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Celcuity Narrative

If you see the numbers differently or want to stress test your own assumptions, you can quickly build a personalized Celcuity view in under three minutes: Do it your way.

A great starting point for your Celcuity research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before the next catalyst hits, give yourself options by lining up fresh ideas from powerful stock screeners that surface quality, momentum and income opportunities fast.

- Target long term wealth potential by focusing on these 907 undervalued stocks based on cash flows that the market has not fully appreciated yet.

- Ride transformational innovation by zeroing in on these 26 AI penny stocks positioned to benefit from rapid advances in artificial intelligence.

- Lock in reliable cash flow potential by concentrating on these 13 dividend stocks with yields > 3% that can strengthen your portfolio’s income engine.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CELC

Celcuity

A clinical-stage biotechnology company, focuses on the development of targeted therapies for the treatment of various solid tumors in the United States.

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)