- United States

- /

- Biotech

- /

- NasdaqCM:CELC

Celcuity (CELC) Is Up 7.2% After FDA Accepts Gedatolisib NDA for Advanced Breast Cancer Approval

Reviewed by Simply Wall St

- Celcuity Inc. recently announced that the FDA accepted its New Drug Application for gedatolisib in HR+/HER2- advanced breast cancer under the Real-Time Oncology Review program, following positive topline Phase 3 results from the VIKTORIA-1 trial’s PIK3CA wild-type cohort.

- The combination of gedatolisib with standard therapies showed unprecedented improvements in progression-free survival and risk reduction in this challenging cancer subtype.

- We’ll explore how FDA acceptance and the impressive clinical trial outcomes for gedatolisib could reshape Celcuity’s investment story.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Celcuity's Investment Narrative?

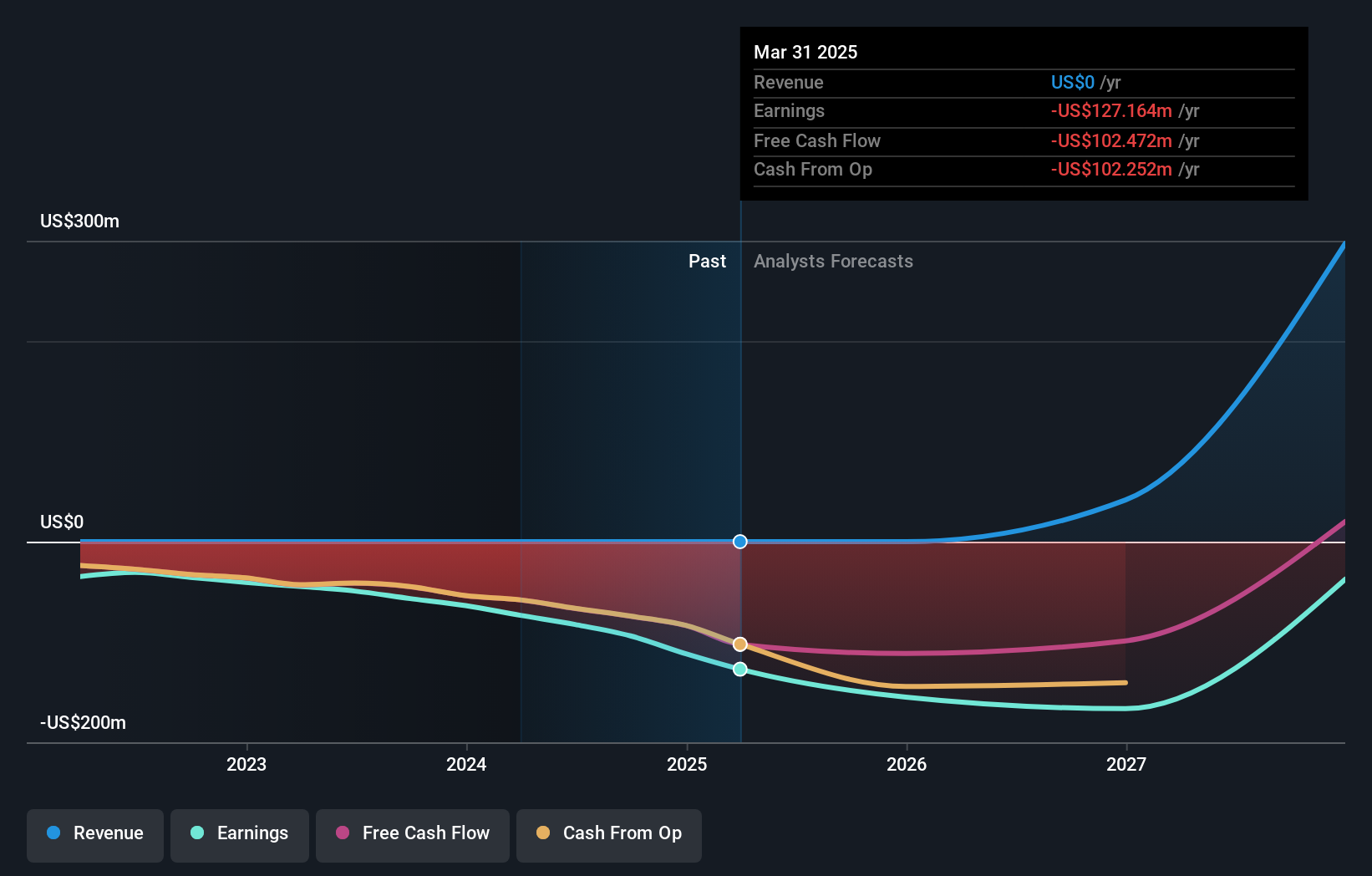

For anyone considering Celcuity shares, the belief centers on the company's ability to turn groundbreaking clinical science into commercial success, especially now, after the FDA's acceptance of its gedatolisib application for expedited oncology review. This news lifts a major near-term catalyst, as market sentiment may hinge more firmly on regulatory progress and approval timelines. With share prices reacting strongly and analysts maintaining price targets well above current levels, investor focus may shift from pure science risk to execution risk: questions about reimbursement, commercialization readiness, and further trial outcomes come to the fore. Still, Celcuity remains deeply unprofitable and reliant on fresh funding, with recent equity offerings and steep losses highlighting the financial runway risk. The recent news could recalibrate expectations, making diligence around approval, launch, and competition even more important for shareholders. But, despite this positive development, funding needs remain a key risk that can't be overlooked.

Celcuity's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore another fair value estimate on Celcuity - why the stock might be worth just $341.67!

Build Your Own Celcuity Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Celcuity research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Celcuity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Celcuity's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CELC

Celcuity

A clinical-stage biotechnology company, focuses on the development of targeted therapies for the treatment of various solid tumors in the United States.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives