- United States

- /

- Biotech

- /

- NasdaqGM:CDNA

Why Investors Shouldn't Be Surprised By CareDx, Inc's (NASDAQ:CDNA) 28% Share Price Plunge

CareDx, Inc (NASDAQ:CDNA) shares have had a horrible month, losing 28% after a relatively good period beforehand. The recent drop has obliterated the annual return, with the share price now down 6.6% over that longer period.

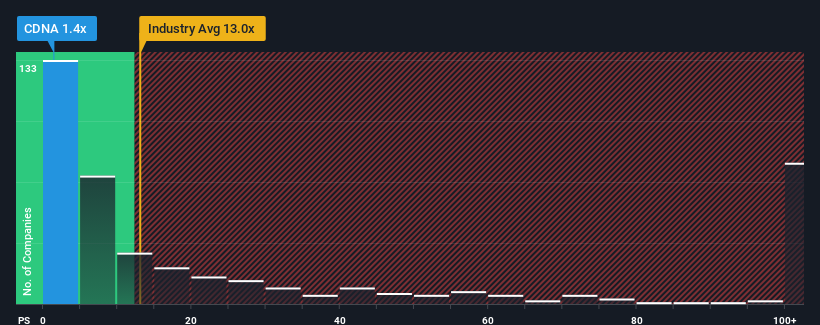

Since its price has dipped substantially, CareDx may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1.4x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 13x and even P/S higher than 59x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for CareDx

What Does CareDx's Recent Performance Look Like?

CareDx could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on CareDx.Is There Any Revenue Growth Forecasted For CareDx?

In order to justify its P/S ratio, CareDx would need to produce anemic growth that's substantially trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 13%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 46% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 3.9% each year over the next three years. With the industry predicted to deliver 163% growth each year, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why CareDx's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On CareDx's P/S

Shares in CareDx have plummeted and its P/S has followed suit. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As expected, our analysis of CareDx's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for CareDx that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CDNA

CareDx

Engages in the discovery, development, and commercialization of diagnostic solutions for transplant patients and caregivers in the United States and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives