- United States

- /

- Biotech

- /

- NasdaqGM:CDNA

CareDx, Inc's (NASDAQ:CDNA) Shares Bounce 26% But Its Business Still Trails The Industry

CareDx, Inc (NASDAQ:CDNA) shares have continued their recent momentum with a 26% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 13% is also fairly reasonable.

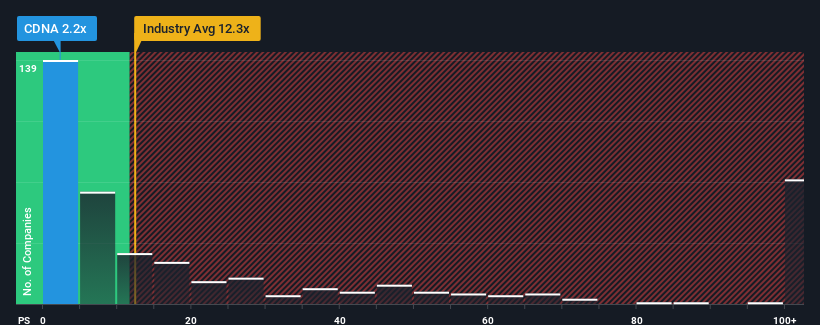

In spite of the firm bounce in price, CareDx's price-to-sales (or "P/S") ratio of 2.2x might still make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 12.3x and even P/S above 54x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for CareDx

What Does CareDx's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, CareDx's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on CareDx.How Is CareDx's Revenue Growth Trending?

In order to justify its P/S ratio, CareDx would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered a frustrating 6.7% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 75% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 12% as estimated by the seven analysts watching the company. With the industry predicted to deliver 1,198% growth, that's a disappointing outcome.

With this information, we are not surprised that CareDx is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On CareDx's P/S

Even after such a strong price move, CareDx's P/S still trails the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that CareDx's P/S is on the lower end of the spectrum. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

You always need to take note of risks, for example - CareDx has 2 warning signs we think you should be aware of.

If these risks are making you reconsider your opinion on CareDx, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CDNA

CareDx

Engages in the discovery, development, and commercialization of diagnostic solutions for transplant patients and caregivers in the United States and internationally.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives