- United States

- /

- Building

- /

- NYSE:GFF

3 Stocks Estimated To Be Trading At Discounts Of Up To 42.8%

Reviewed by Simply Wall St

As the U.S. stock market navigates through a period of mixed performance with major indices setting new records despite challenges like a government shutdown, investors are keenly observing opportunities that may be undervalued amidst these fluctuations. In such an environment, identifying stocks that are trading at significant discounts can offer potential value, especially when considering broader economic factors and sector-specific developments.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Udemy (UDMY) | $6.76 | $13.43 | 49.7% |

| SLM (SLM) | $27.55 | $53.65 | 48.6% |

| Perfect (PERF) | $1.88 | $3.63 | 48.2% |

| Investar Holding (ISTR) | $22.83 | $45.29 | 49.6% |

| Hess Midstream (HESM) | $34.41 | $66.78 | 48.5% |

| HCI Group (HCI) | $193.48 | $376.13 | 48.6% |

| First Commonwealth Financial (FCF) | $16.81 | $32.97 | 49% |

| First Busey (BUSE) | $23.17 | $45.30 | 48.8% |

| Alnylam Pharmaceuticals (ALNY) | $456.35 | $884.81 | 48.4% |

| AGNC Investment (AGNC) | $10.06 | $19.36 | 48% |

Let's review some notable picks from our screened stocks.

Caris Life Sciences (CAI)

Overview: Caris Life Sciences, Inc. is an artificial intelligence TechBio company that offers molecular profiling services both in the United States and internationally, with a market cap of $8.94 billion.

Operations: The company generates revenue primarily from its biotechnology segment, which amounts to $533.85 million.

Estimated Discount To Fair Value: 35.4%

Caris Life Sciences appears undervalued based on cash flows, trading at US$31.78, significantly below its estimated fair value of US$49.21. Recent inclusion in multiple Russell indexes highlights increased market recognition. The company forecasts robust revenue growth between US$675 million and US$685 million for 2025, driven by innovative products like MI Cancer Seek and Caris Assure. Expected annual profit growth is high, with earnings projected to grow 80.16% annually, underscoring strong future potential amidst expanding clinical applications in precision oncology.

- In light of our recent growth report, it seems possible that Caris Life Sciences' financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Caris Life Sciences.

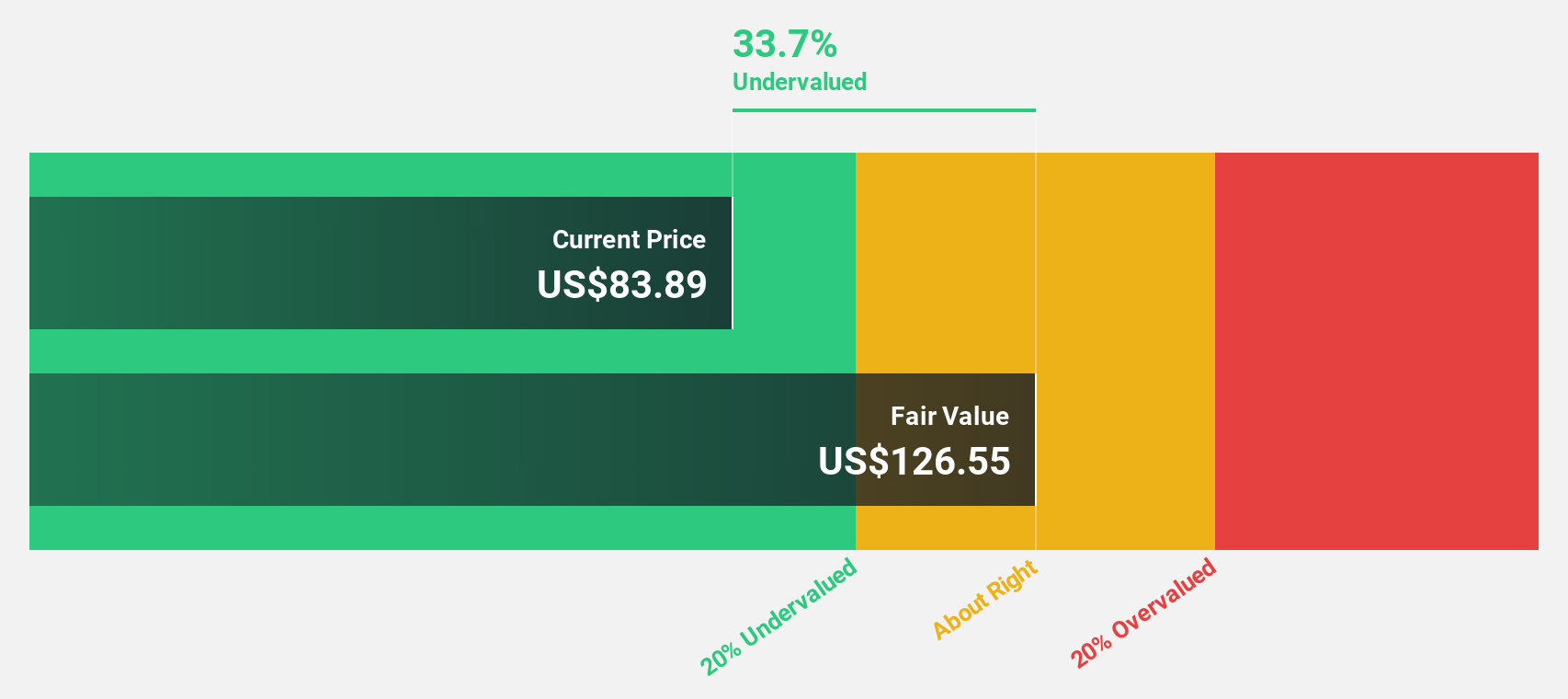

DexCom (DXCM)

Overview: DexCom, Inc. is a medical device company specializing in the design, development, and commercialization of continuous glucose monitoring systems globally, with a market cap of $26.29 billion.

Operations: DexCom generates revenue primarily from its continuous glucose monitoring systems, with the Patient Monitoring Equipment segment accounting for $4.30 billion.

Estimated Discount To Fair Value: 42.8%

DexCom trades at US$67.05, significantly below its estimated fair value of US$117.25, suggesting undervaluation based on cash flows. The company forecasts revenue growth of 14-15% for 2025, with earnings expected to grow significantly at 22.9% annually, surpassing the broader market's growth rate. Recent executive changes include Jacob S. Leach as interim CEO due to Kevin R. Sayer's medical leave, while DexCom continues to innovate in glucose monitoring technology and expand product features globally.

- Our expertly prepared growth report on DexCom implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of DexCom with our detailed financial health report.

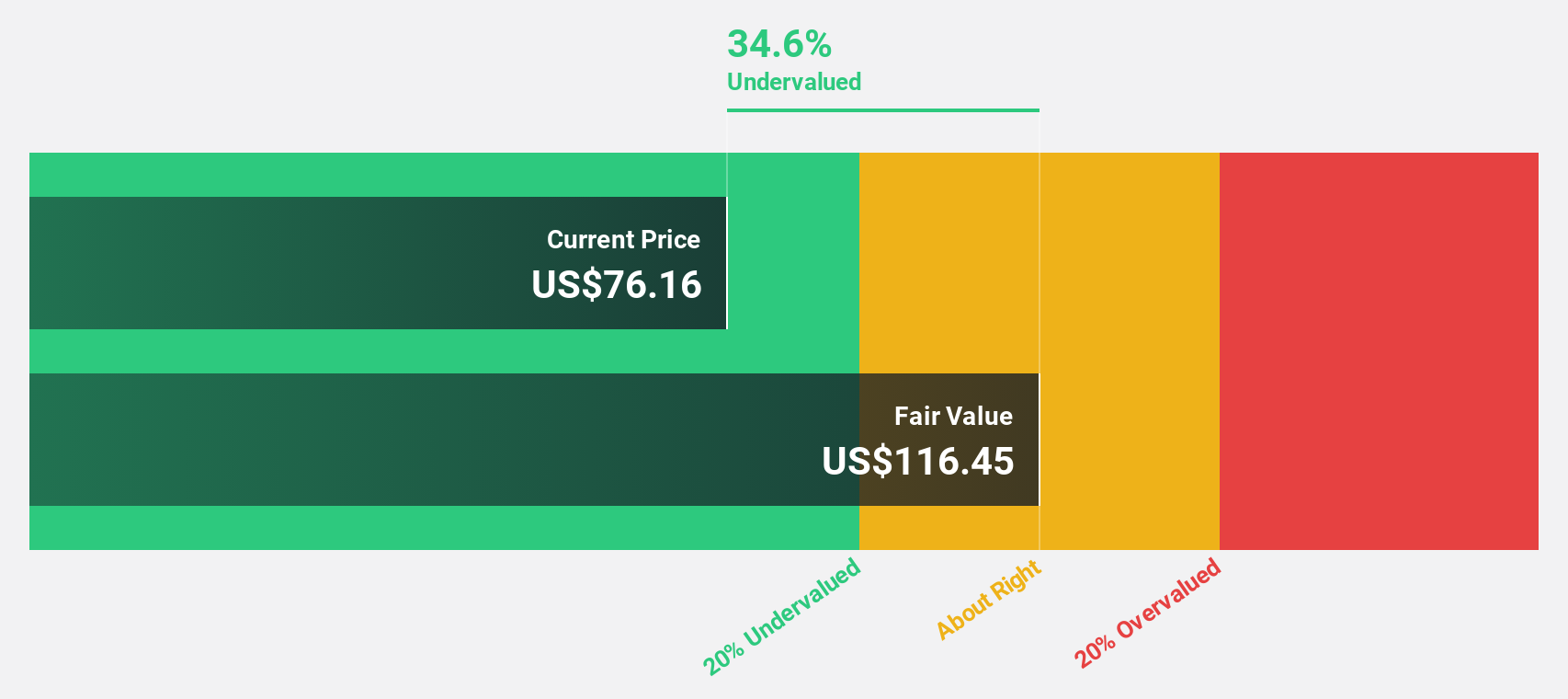

Griffon (GFF)

Overview: Griffon Corporation, with a market cap of approximately $3.62 billion, operates through its subsidiaries to offer consumer and professional as well as home and building products across the United States, Europe, Canada, Australia, and other international markets.

Operations: The company's revenue is derived from two main segments: Home and Building Products, contributing $1.57 billion, and Consumer and Professional Products, contributing $946.97 million.

Estimated Discount To Fair Value: 32.6%

Griffon Corporation trades at US$77.83, below its estimated fair value of US$115.46, highlighting potential undervaluation based on cash flows. Despite recent goodwill impairments of US$243.61 million and a lowered revenue forecast to US$2.5 billion for 2025, Griffon's earnings are expected to grow significantly by 67.4% annually over the next three years, outpacing the market's growth rate. The company recently completed a substantial share buyback program worth US$581.55 million since 2016.

- The analysis detailed in our Griffon growth report hints at robust future financial performance.

- Navigate through the intricacies of Griffon with our comprehensive financial health report here.

Seize The Opportunity

- Access the full spectrum of 201 Undervalued US Stocks Based On Cash Flows by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GFF

Griffon

Through its subsidiaries, provides consumer and professional, and home and building products in the United States, Europe, Canada, Australia, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives