- United States

- /

- Biotech

- /

- NasdaqGS:CABA

The Bull Case For Cabaletta Bio (CABA) Could Change Following Early RESET-PV Results Without Preconditioning - Learn Why

Reviewed by Sasha Jovanovic

- Cabaletta Bio announced initial results from the RESET-PV trial, revealing that rese-cel (resecabtagene autoleucel) achieved complete peripheral B cell depletion and encouraging early clinical responses in patients with pemphigus vulgaris without requiring preconditioning therapy.

- This approach could signal a shift toward more streamlined autoimmune disease treatments, as the company reported strong safety outcomes and sustained patient response in early data.

- We’ll explore how these early clinical results without preconditioning could impact Cabaletta Bio’s investment narrative and future growth prospects.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

What Is Cabaletta Bio's Investment Narrative?

For investors considering Cabaletta Bio, the core appeal centers on its novel approach to autoimmune disease, aiming to reset the immune system with a single CAR T cell therapy dose. The latest RESET-PV trial data, showing that rese-cel could deliver complete B cell depletion and early clinical responses without preconditioning, is a potentially meaningful shift. So far, this safety and efficacy signal appears to be resonating, as seen in the 30% share price surge after the announcement. In the big picture, this outcome could accelerate short-term catalysts such as new trial enrollments and expansion into other autoimmune indications, though it also raises the bar for continued compelling data in larger cohorts. Risks persist, including recurring operating losses, reliance on further capital raising, and the need to validate early clinical findings through additional studies. While the results improve sentiment, maintaining momentum depends on sustaining these favorable trends and managing cash needs in a period of heavy dilution and no near-term revenue. However, continued funding needs remain an important consideration for investors.

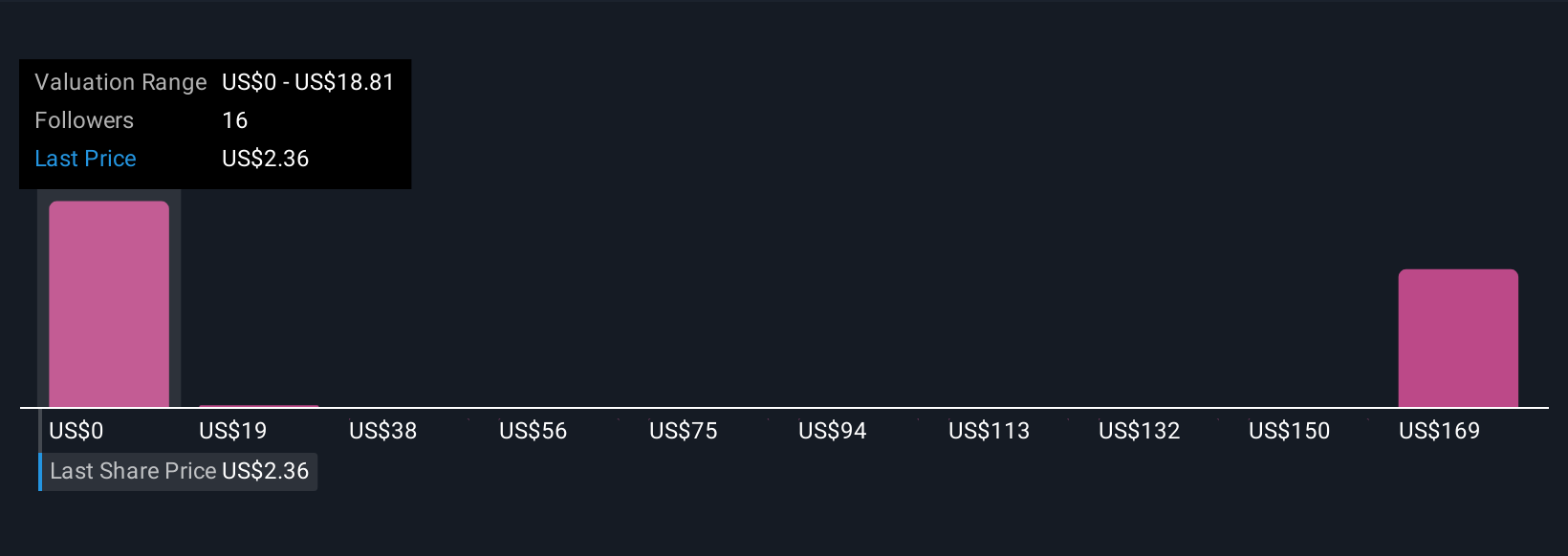

Despite retreating, Cabaletta Bio's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 7 other fair value estimates on Cabaletta Bio - why the stock might be a potential multi-bagger!

Build Your Own Cabaletta Bio Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cabaletta Bio research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free Cabaletta Bio research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cabaletta Bio's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CABA

Cabaletta Bio

A clinical-stage biotechnology company, focuses on the discovery and development of engineered T cell therapies for patients with autoimmune diseases.

Excellent balance sheet with moderate risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion