- United States

- /

- Life Sciences

- /

- NasdaqGS:BRKR

Top US Growth Companies With High Insider Ownership In September 2024

Reviewed by Simply Wall St

As the U.S. stock market experiences a mixed performance, with the S&P 500 and Nasdaq Composite showing gains while the Dow Jones Industrial Average slips amid banking sector concerns, investors are increasingly looking for resilient growth opportunities. In this environment, growth companies with high insider ownership can be particularly appealing due to their potential alignment of interests between company leaders and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.2% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 32.3% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 27.1% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 40.7% |

| On Holding (NYSE:ONON) | 28.4% | 24.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.1% | 95.9% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| BBB Foods (NYSE:TBBB) | 22.9% | 91.3% |

Below we spotlight a couple of our favorites from our exclusive screener.

Alpha and Omega Semiconductor (NasdaqGS:AOSL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Alpha and Omega Semiconductor Limited designs, develops, and supplies power semiconductor products for various applications globally, with a market cap of $950.61 million.

Operations: The company's revenue primarily comes from the design, development, and supply of power semiconductor products, generating $657.27 million.

Insider Ownership: 17.5%

Alpha and Omega Semiconductor has seen significant insider buying over the past three months, indicating strong confidence from within despite recent financial challenges. The company reported a net loss of US$11.08 million for the full year ending June 30, 2024, but earnings are forecast to grow substantially at 108.01% per year. Recent product innovations like the robust LFPAK MOSFET package highlight AOS's commitment to high-reliability applications in industrial and tech sectors, potentially driving future growth.

- Navigate through the intricacies of Alpha and Omega Semiconductor with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Alpha and Omega Semiconductor's current price could be inflated.

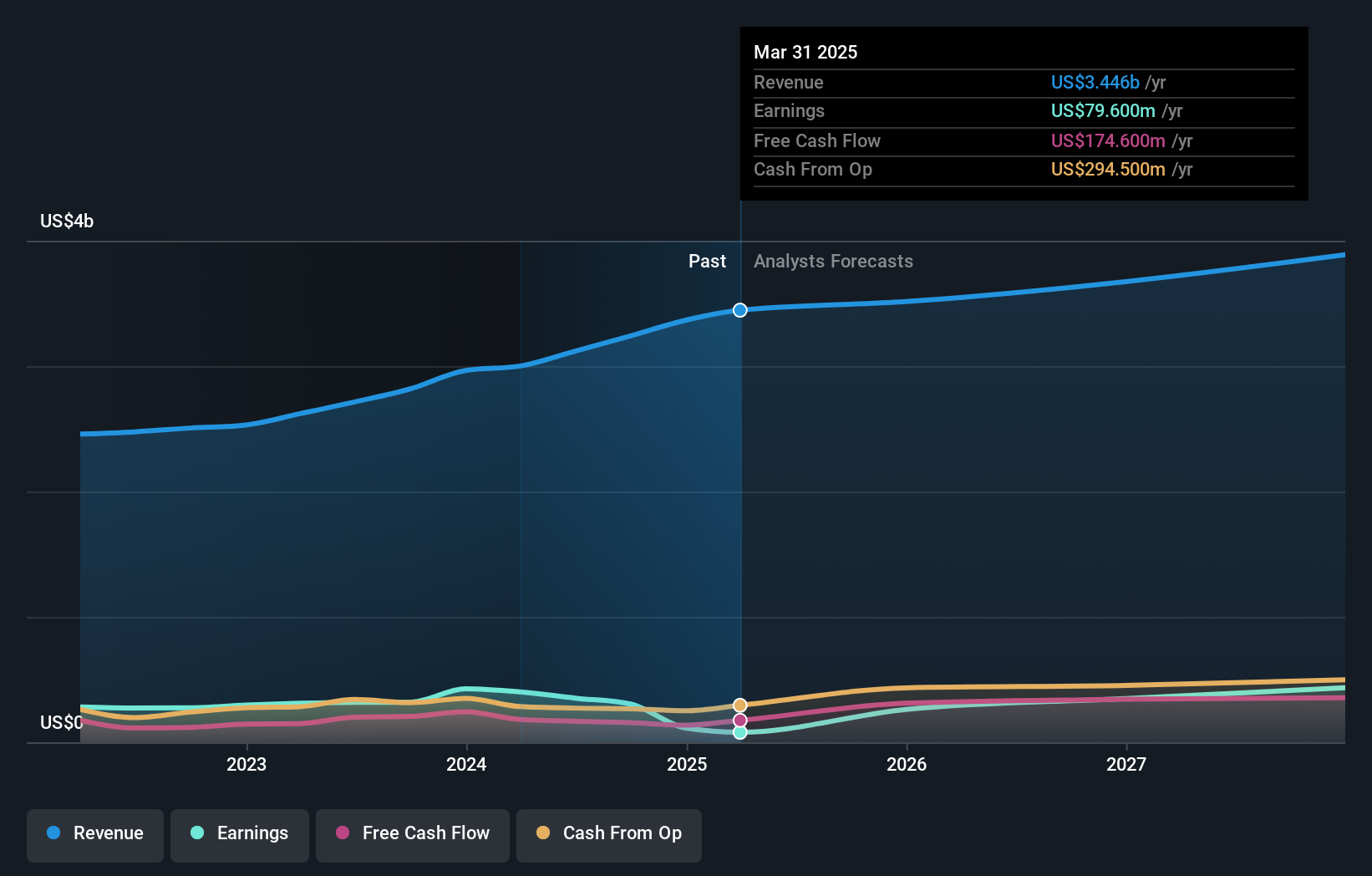

AppLovin (NasdaqGS:APP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: AppLovin Corporation operates a software-based platform that helps advertisers improve the marketing and monetization of their content both in the United States and internationally, with a market cap of $28.85 billion.

Operations: AppLovin's revenue segments include $1.49 billion from Apps and $2.47 billion from its Software Platform.

Insider Ownership: 38.4%

AppLovin has demonstrated robust growth, with recent earnings showing a significant increase in net income to US$309.97 million for Q2 2024, up from US$80.36 million a year ago. The company’s earnings are forecast to grow at 23.4% annually, outpacing the broader market's 15%. Despite being dropped from several Russell indexes, substantial insider buying over the past three months signals strong internal confidence in its future prospects.

- Take a closer look at AppLovin's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that AppLovin is priced lower than what may be justified by its financials.

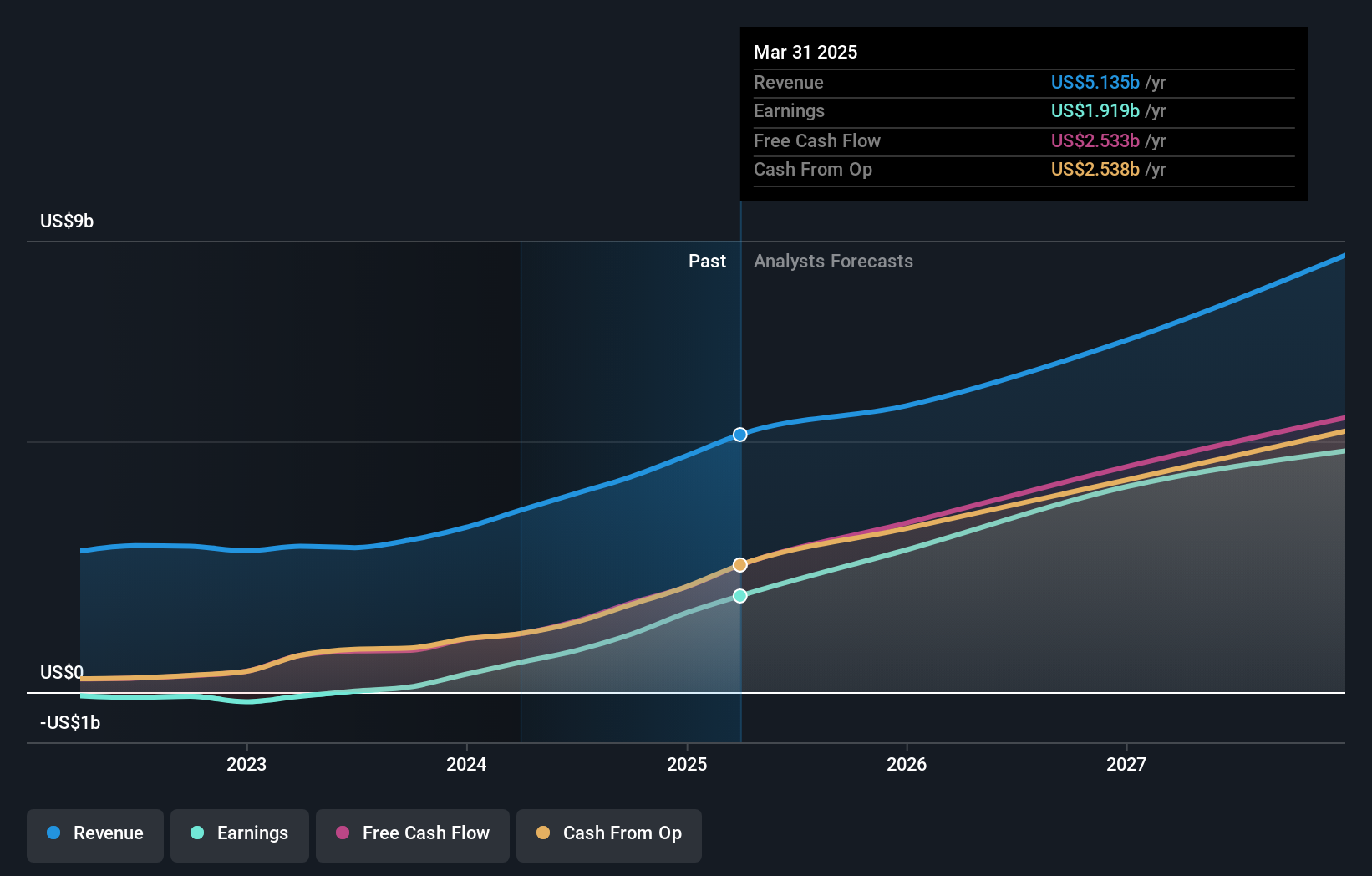

Bruker (NasdaqGS:BRKR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bruker Corporation, with a market cap of approximately $9.59 billion, develops, manufactures, and distributes scientific instruments and analytical and diagnostic solutions across the United States, Europe, the Asia Pacific region, and internationally.

Operations: The company's revenue segments include Bruker Nano at $1 billion, Bruker CALID at $990 million, Bruker Biospin at $856.50 million, and Bruker Energy & Supercon Technologies (BEST) at $288 million.

Insider Ownership: 29.5%

Bruker Corporation, trading at a favorable P/E ratio of 27.2x compared to the industry average, showcases strong growth potential with earnings forecasted to grow 20.8% annually, outpacing the US market. Despite recent shareholder dilution and slower revenue growth (8% per year) than the market, Bruker's substantial insider ownership and strategic initiatives like installing advanced NMR spectrometers underscore its commitment to innovation and long-term value creation.

- Click here and access our complete growth analysis report to understand the dynamics of Bruker.

- In light of our recent valuation report, it seems possible that Bruker is trading behind its estimated value.

Taking Advantage

- Dive into all 178 of the Fast Growing US Companies With High Insider Ownership we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Bruker might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BRKR

Bruker

Develops, manufactures, and distributes scientific instruments, and analytical and diagnostic solutions in the United States, Europe, the Asia Pacific, and internationally.

Good value with reasonable growth potential.