- United States

- /

- Metals and Mining

- /

- NYSEAM:UAMY

December 2024 Penny Stocks On The US Exchange To Watch

Reviewed by Simply Wall St

As the U.S. stock market navigates a week of critical inflation data, with major indices experiencing slight declines, investors remain keenly focused on potential opportunities in various sectors. Penny stocks, a term that may seem outdated but still resonates with those interested in smaller or emerging companies, offer intriguing possibilities for growth at lower price points. By identifying stocks with strong financials and solid fundamentals, investors can uncover hidden gems that might provide stability and potential upside amidst broader market fluctuations.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.43 | $1.94B | ★★★★☆☆ |

| BAB (OTCPK:BABB) | $0.86 | $6.25M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $144.14M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.89 | $87.66M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.24 | $8.83M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.49 | $49.17M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9113 | $81.96M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.84 | $410.03M | ★★★★☆☆ |

Click here to see the full list of 700 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Arbe Robotics (NasdaqCM:ARBE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Arbe Robotics Ltd. is a semiconductor company that offers 4D imaging radar solutions to tier 1 automotive suppliers and manufacturers across various countries including China, the United States, and Germany, with a market cap of $147.26 million.

Operations: The company's revenue is derived from its Auto Parts & Accessories segment, totaling $1.02 million.

Market Cap: $147.26M

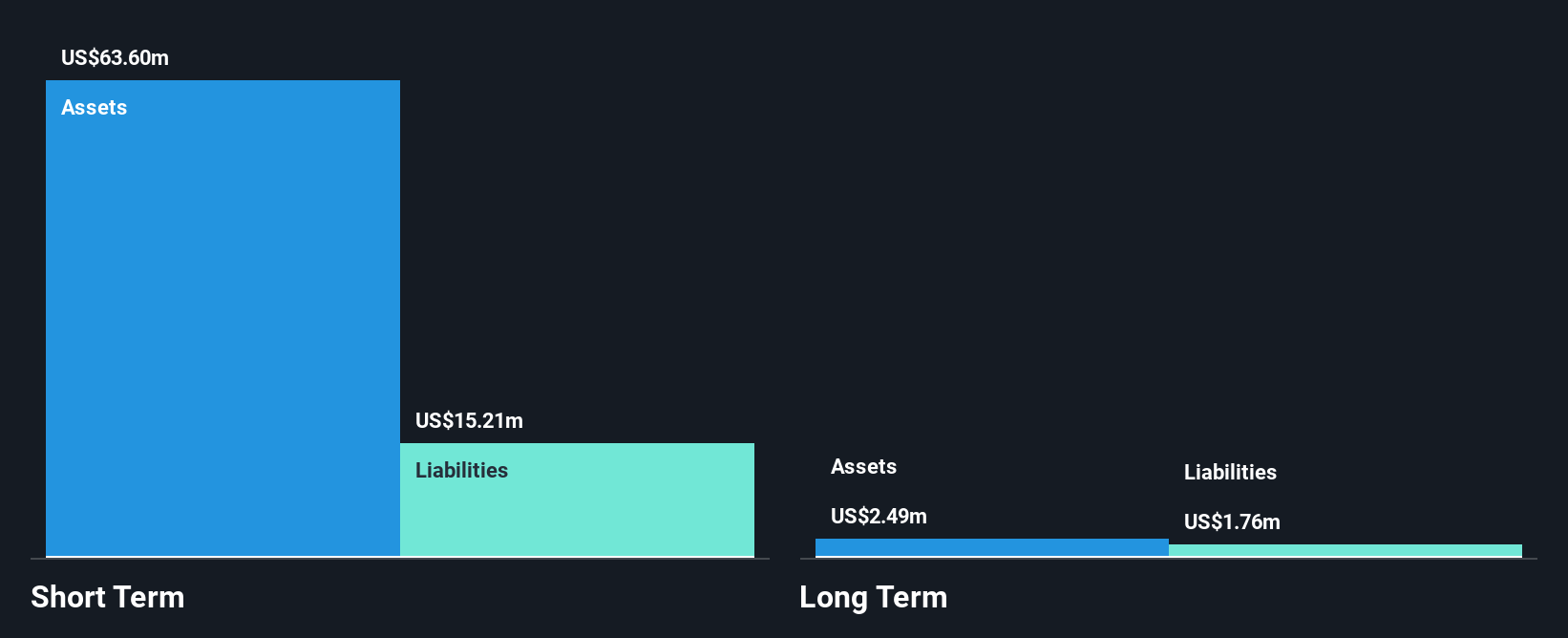

Arbe Robotics, with a market cap of US$147.26 million, operates in the semiconductor industry offering 4D imaging radar solutions. Despite having short-term assets of US$52.2 million that cover both its short and long-term liabilities, the company remains pre-revenue with sales of only US$0.669 million for the first nine months of 2024 and a net loss increasing to US$37.12 million from last year. Recent equity offerings have diluted shareholders but provided additional capital, extending its cash runway beyond previous estimates. The management team is experienced; however, profitability challenges persist as earnings remain negative despite forecasted growth in revenue for 2025.

- Get an in-depth perspective on Arbe Robotics' performance by reading our balance sheet health report here.

- Gain insights into Arbe Robotics' outlook and expected performance with our report on the company's earnings estimates.

One Stop Systems (NasdaqCM:OSS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: One Stop Systems, Inc. designs, manufactures, and markets high-performance computing and storage hardware and software for edge deployments globally, with a market cap of $56.59 million.

Operations: The company's revenue is derived from two main segments: Bressner, contributing $28.79 million, and the combined operations of One Stop Systems, Inc. (including Concept Development Inc.), generating $23.92 million.

Market Cap: $56.59M

One Stop Systems, Inc., with a market cap of US$56.59 million, is navigating financial challenges as it remains unprofitable with increasing net losses, reported at US$6.82 million for Q3 2024. Despite this, the company has secured significant new orders from defense and AI sectors, potentially bolstering future revenue streams. It possesses more cash than debt and maintains a positive free cash flow sufficient for over three years' runway. However, shareholder dilution occurred recently and both its board and management teams are relatively inexperienced. Revenue is projected to grow by 9.47% annually despite current volatility in share price.

- Jump into the full analysis health report here for a deeper understanding of One Stop Systems.

- Assess One Stop Systems' future earnings estimates with our detailed growth reports.

United States Antimony (NYSEAM:UAMY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: United States Antimony Corporation produces and sells antimony, silver, gold, precious metals, and zeolite products in the United States and Canada with a market cap of $206.03 million.

Operations: The company's revenue is primarily derived from its Antimony operations in the United States, generating $6.44 million, followed by Zeolite products at $2.80 million and Precious Metals at $0.49 million.

Market Cap: $206.03M

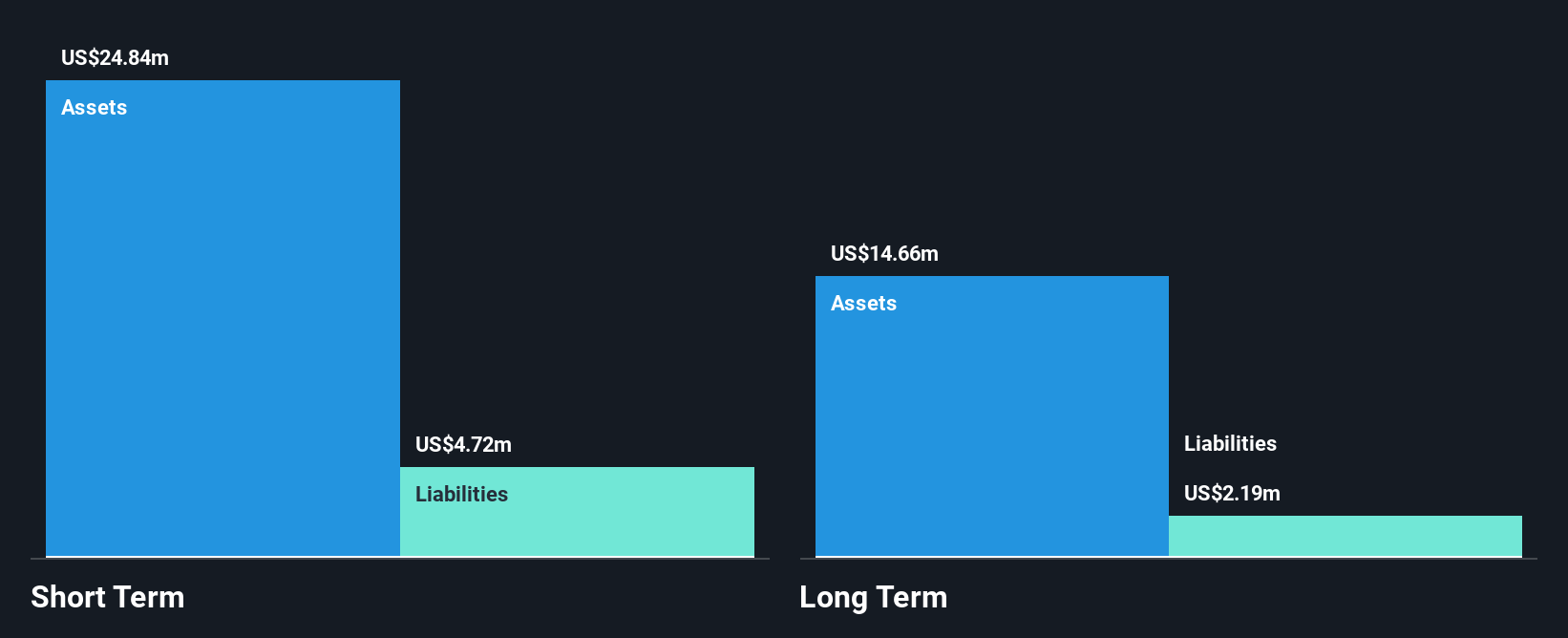

United States Antimony Corporation, with a market cap of US$206.03 million, is unprofitable but demonstrates potential through strategic expansion and financial management. Recent staking of 24 new claims in Alaska enhances its position as a critical mineral supplier amidst global antimony supply constraints. The company reported Q3 2024 sales of US$2.42 million, an increase from the previous year, though it remains unprofitable with net losses narrowing to US$0.73 million. Despite high share price volatility and an inexperienced board, UAMY's cash reserves exceed liabilities and debt levels have significantly decreased over five years, indicating financial resilience.

- Take a closer look at United States Antimony's potential here in our financial health report.

- Evaluate United States Antimony's prospects by accessing our earnings growth report.

Seize The Opportunity

- Embark on your investment journey to our 700 US Penny Stocks selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:UAMY

United States Antimony

Produces and sells antimony, silver, gold, precious metals, and zeolite products in the United States, and Canada.

Flawless balance sheet with high growth potential.