- United States

- /

- Biotech

- /

- NasdaqGM:AUPH

Exploring Three High Growth Tech Stocks In The United States

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it is up 30% over the past year with earnings forecasted to grow by 15% annually. In this context of robust growth potential, identifying high growth tech stocks that align with these positive trends can be key for investors seeking opportunities in an evolving market landscape.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 23.83% | 24.32% | ★★★★★★ |

| Ardelyx | 25.47% | 69.63% | ★★★★★★ |

| Sarepta Therapeutics | 23.98% | 42.48% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.35% | 70.33% | ★★★★★★ |

| Clene | 75.76% | 61.26% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.94% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 243 stocks from our US High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Heron Therapeutics (NasdaqCM:HRTX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Heron Therapeutics, Inc. is a commercial-stage biotechnology company dedicated to improving patient care through the development and commercialization of therapeutic products, with a market capitalization of $266.17 million.

Operations: The company primarily generates revenue through its Drug Delivery Systems segment, which contributes $137.74 million.

Heron Therapeutics, with its focus on addressing critical medical needs in oncology and pain management, has been navigating a challenging financial landscape. Despite a volatile share price and current unprofitability, the company's strategic R&D investments are noteworthy; it dedicated significant resources to developing innovative therapies such as CINVANTI® and SUSTOL®, which do not require dilution with IV fluids—a crucial advantage during shortages like those caused by Hurricane Helene. This adaptability in product delivery underscores Heron's potential to leverage its R&D for sustained future growth, especially given the projected annual earnings increase of 71.2%. Moreover, recent corporate guidance anticipates a revenue uplift to $140 million - $146 million for 2024, reflecting an optimistic outlook amidst operational adjustments and market challenges.

- Delve into the full analysis health report here for a deeper understanding of Heron Therapeutics.

Understand Heron Therapeutics' track record by examining our Past report.

Aurinia Pharmaceuticals (NasdaqGM:AUPH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Aurinia Pharmaceuticals Inc. is a commercial-stage biopharmaceutical company dedicated to developing and commercializing therapies for diseases with unmet medical needs in the United States, with a market capitalization of approximately $1.31 billion.

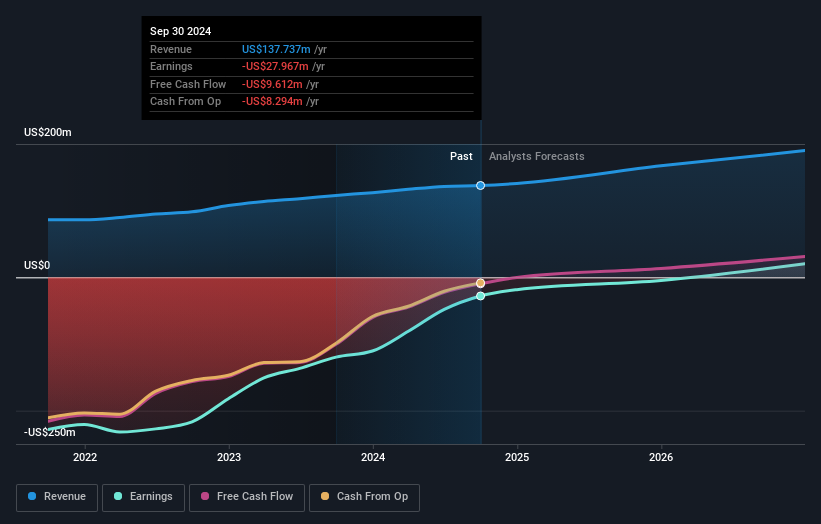

Operations: Aurinia Pharmaceuticals focuses on the research, development, and commercialization of therapeutic drugs, generating revenue primarily from these activities amounting to $220.36 million.

Aurinia Pharmaceuticals, amid a transformative phase, reported a significant revenue jump to $67.77 million in Q3 2024 from $54.52 million the previous year, marking a robust growth trajectory with a notable shift to profitability—$14.35 million net income compared to a loss of $13.45 million year-over-year. This financial rebound is underpinned by strategic R&D investments which have enhanced its product offerings like voclosporin for lupus nephritis, recently approved in Japan, bolstering its international market presence. The firm's commitment to innovation is reflected in its R&D spending trends which align with its revenue growth at 17.3% annually, outpacing the US market average of 9.1%. Moreover, earnings are projected to surge by 52.43% annually, showcasing Aurinia’s potential as it navigates through executive transitions and reinforces its board with seasoned industry leaders for sustained expansion.

Neurocrine Biosciences (NasdaqGS:NBIX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Neurocrine Biosciences, Inc. is a company that focuses on discovering, developing, and marketing pharmaceuticals for neurological, neuroendocrine, and neuropsychiatric disorders globally with a market capitalization of approximately $13.07 billion.

Operations: Neurocrine Biosciences generates revenue primarily through the research, development, and commercialization of pharmaceuticals, amounting to $2.24 billion. The company's focus is on treatments for neurological, neuroendocrine, and neuropsychiatric disorders both in the U.S. and internationally.

Neurocrine Biosciences, leveraging its R&D prowess, has significantly advanced treatments in neurological disorders. In 2024, the company showcased robust earnings growth of 102% year-over-year, underpinned by strategic investments in research which accounted for a substantial portion of their revenue. Notably, their R&D expenses have been pivotal in developing INGREZZA®, enhancing treatment efficacy across various patient demographics. With a projected annual earnings growth of 29.6%, Neurocrine's commitment to innovation is evident as they continue to expand their market presence through key product-related announcements and strategic conference presentations.

Taking Advantage

- Take a closer look at our US High Growth Tech and AI Stocks list of 243 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:AUPH

Aurinia Pharmaceuticals

A commercial-stage biopharmaceutical company, focuses on developing and commercializing therapies to treat various diseases with unmet medical need in the United States.

Flawless balance sheet and good value.