- United States

- /

- Beverage

- /

- NYSE:ZVIA

Atai Life Sciences And 2 Other Promising Penny Stocks On US Exchanges

Reviewed by Simply Wall St

As the U.S. stock market navigates a week of fluctuating earnings reports and economic indicators, investors are keenly observing opportunities across various sectors. Penny stocks, often associated with smaller or newer companies, continue to intrigue those looking for potential growth at lower price points. Despite their vintage label, these stocks can offer significant value when backed by strong financials and fundamentals, presenting an appealing option for investors seeking overlooked opportunities in the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $119.09M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.91 | $6.62M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.274193 | $10.24M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.46 | $48.51M | ★★★★★★ |

| North European Oil Royalty Trust (NYSE:NRT) | $4.54 | $41.73M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.88 | $83.72M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.12 | $53.61M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.92 | $80.14M | ★★★★★☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.30 | $22.88M | ★★★★★☆ |

Click here to see the full list of 706 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Atai Life Sciences (NasdaqGM:ATAI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Atai Life Sciences N.V. is a clinical-stage biopharmaceutical company focused on developing and investing in therapeutics for mental health disorders such as depression, anxiety, and addiction, with a market cap of $251.70 million.

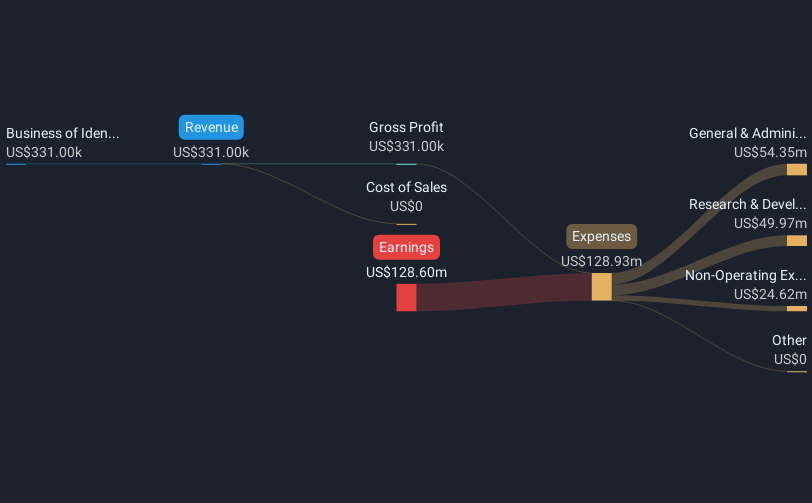

Operations: Atai Life Sciences generates revenue through its business of identifying and advancing innovations in mental health, amounting to $0.33 million.

Market Cap: $251.7M

Atai Life Sciences, a pre-revenue biopharmaceutical company with a market cap of US$251.70 million, recently announced promising results from its Phase 2a study on BPL-003 for alcohol use disorder. Despite generating minimal revenue (US$0.33 million), Atai's robust cash position exceeds its total debt, although it faces less than a year of cash runway if historical free cash flow reduction continues. The company's leadership changes aim to bolster its strategic direction in mental health therapeutics. While unprofitable and removed from the NASDAQ Biotechnology Index, Atai's short-term assets comfortably cover both short and long-term liabilities.

- Click to explore a detailed breakdown of our findings in Atai Life Sciences' financial health report.

- Evaluate Atai Life Sciences' prospects by accessing our earnings growth report.

RLX Technology (NYSE:RLX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RLX Technology Inc., along with its subsidiaries, manufactures and sells e-vapor products in China and internationally, with a market cap of approximately $2.71 billion.

Operations: The company generates revenue from its Personal Products segment, totaling CN¥2.16 billion.

Market Cap: $2.71B

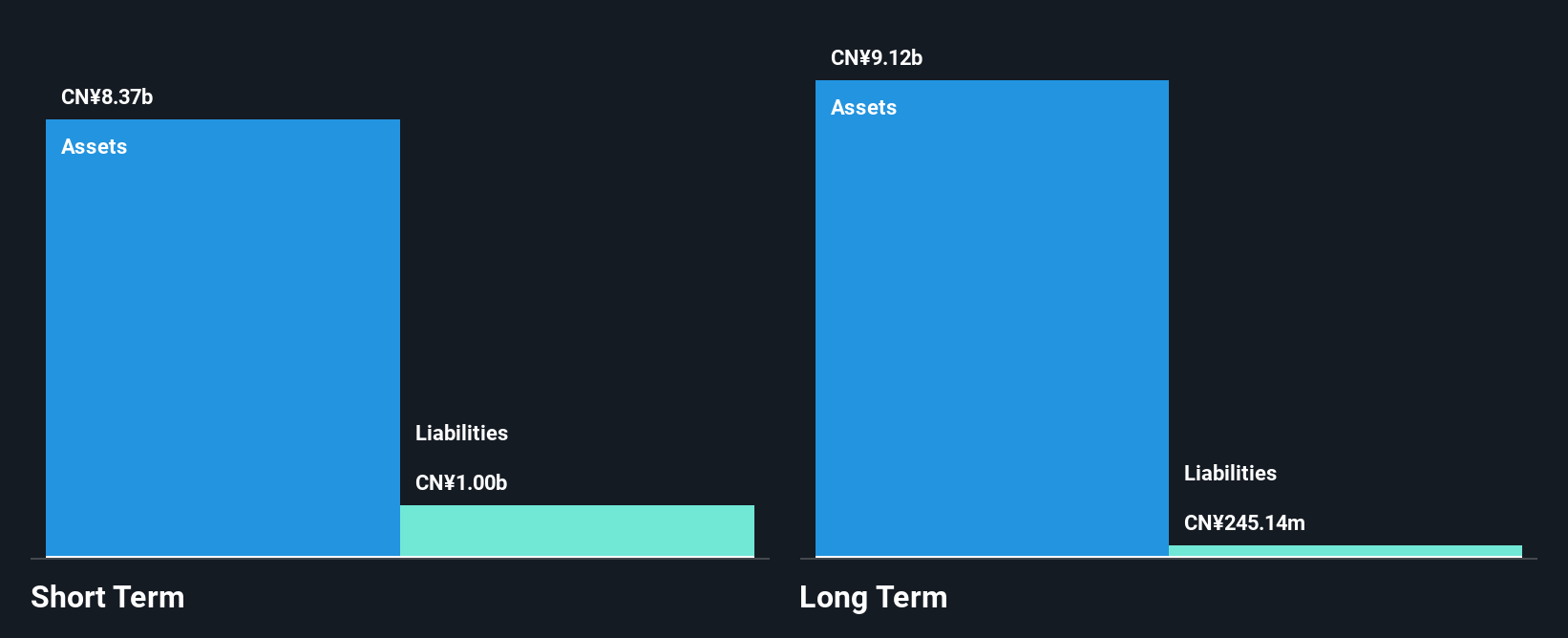

RLX Technology Inc., with a market cap of US$2.71 billion, offers potential in the penny stock space due to its strong financial health and growth metrics. The company reported third-quarter sales of CN¥756.29 million, up from CN¥498.93 million the previous year, indicating robust revenue growth alongside a net income of CN¥165.65 million. RLX is debt-free, with short-term assets significantly exceeding both short and long-term liabilities, reflecting solid liquidity management. Despite trading at 67.5% below estimated fair value and having stable weekly volatility, its return on equity remains low at 4.2%.

- Navigate through the intricacies of RLX Technology with our comprehensive balance sheet health report here.

- Assess RLX Technology's future earnings estimates with our detailed growth reports.

Zevia PBC (NYSE:ZVIA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zevia PBC is a beverage company that develops, markets, sells, and distributes various carbonated beverages in the United States and Canada, with a market cap of $313.23 million.

Operations: The company generates revenue of $153.39 million from its non-alcoholic beverage segment.

Market Cap: $313.23M

Zevia PBC, with a market cap of US$313.23 million, presents a mixed picture in the penny stock arena. The company is currently unprofitable and has seen increased losses over the past five years at 13.8% annually, impacting its return on equity negatively at -53.69%. However, it maintains strong liquidity with short-term assets of US$66.1 million exceeding both short and long-term liabilities, and it operates debt-free. Recent guidance suggests improved fourth-quarter sales expectations up to US$39.5 million, although insider selling raises caution about future prospects amidst high share price volatility over recent months.

- Jump into the full analysis health report here for a deeper understanding of Zevia PBC.

- Explore Zevia PBC's analyst forecasts in our growth report.

Next Steps

- Embark on your investment journey to our 706 US Penny Stocks selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zevia PBC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZVIA

Zevia PBC

A beverage company, develops, markets, sells, and distributes various carbonated beverages in the United States and Canada.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives