- United States

- /

- Software

- /

- NasdaqCM:BTDR

Exploring Three High Growth Tech Stocks in the United States

Reviewed by Simply Wall St

The United States market has remained flat over the past week but is up 29% over the past year, with earnings forecasted to grow by 15% annually. In this context of robust growth potential, identifying high-growth tech stocks involves assessing factors such as innovation, scalability, and financial health to capitalize on future opportunities.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 23.83% | 24.32% | ★★★★★★ |

| Ardelyx | 25.47% | 69.63% | ★★★★★★ |

| Sarepta Therapeutics | 23.98% | 42.48% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.38% | 70.33% | ★★★★★★ |

| Clene | 77.61% | 59.19% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.94% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 242 stocks from our US High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Bitdeer Technologies Group (NasdaqCM:BTDR)

Simply Wall St Growth Rating: ★★★★★★

Overview: Bitdeer Technologies Group is a technology company specializing in blockchain and computing, with a market cap of approximately $2.78 billion.

Operations: The company generates revenue primarily from its data processing segment, amounting to $395.61 million.

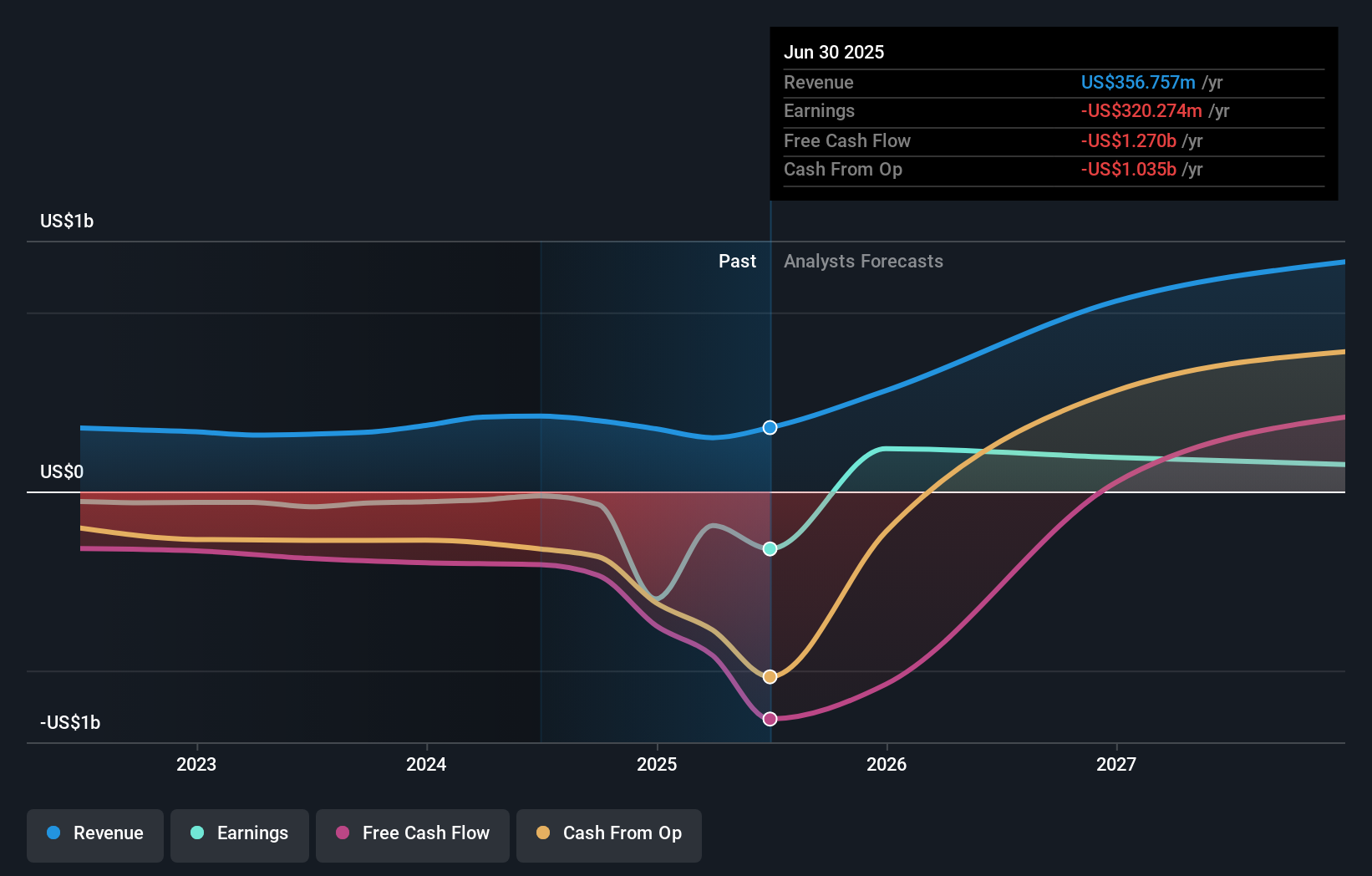

Bitdeer Technologies Group, amidst a challenging landscape, has demonstrated resilience with strategic maneuvers like the recent $1 billion shelf registration and a robust presentation lineup at the Roth Annual Conference. Despite reporting a significant reduction in Bitcoin mined and facing a net loss of $50.1 million in Q3 2024, Bitdeer's forward-looking activities signal an aggressive approach to market challenges. Notably, its revenue is projected to surge by 43.8% annually, outpacing the US market's growth rate of 9.1%. This growth trajectory is underpinned by an anticipated earnings increase of 122.35% per year over the next three years, positioning Bitdeer as a potential turnaround story in the high-tech arena despite current profitability hurdles.

Ascendis Pharma (NasdaqGS:ASND)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ascendis Pharma A/S is a biopharmaceutical company dedicated to developing therapies for unmet medical needs, with a market capitalization of approximately $7.75 billion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to €327.43 million.

Ascendis Pharma, despite its current unprofitability, is poised for significant growth with revenue expected to increase by 41.9% annually, outstripping the US market's 9.1% average. This growth is underpinned by a robust pipeline including a promising partnership with Novo Nordisk on metabolic diseases leveraging its TransCon technology, which could see up to $285 million in milestone payments. Additionally, recent earnings reflect a narrowing net loss from EUR 162.22 million to EUR 99.2 million year-over-year for Q3, alongside an increase in sales from EUR 48.03 million to EUR 57.83 million in the same period, indicating effective cost management and potential for future profitability as forecasted earnings are set to surge by an impressive 71.4% per year.

- Take a closer look at Ascendis Pharma's potential here in our health report.

Evaluate Ascendis Pharma's historical performance by accessing our past performance report.

Phreesia (NYSE:PHR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Phreesia, Inc. offers an integrated SaaS-based software and payment platform tailored for the healthcare industry in the United States and Canada, with a market capitalization of $1.40 billion.

Operations: The company generates revenue primarily from its healthcare software segment, amounting to $405.14 million.

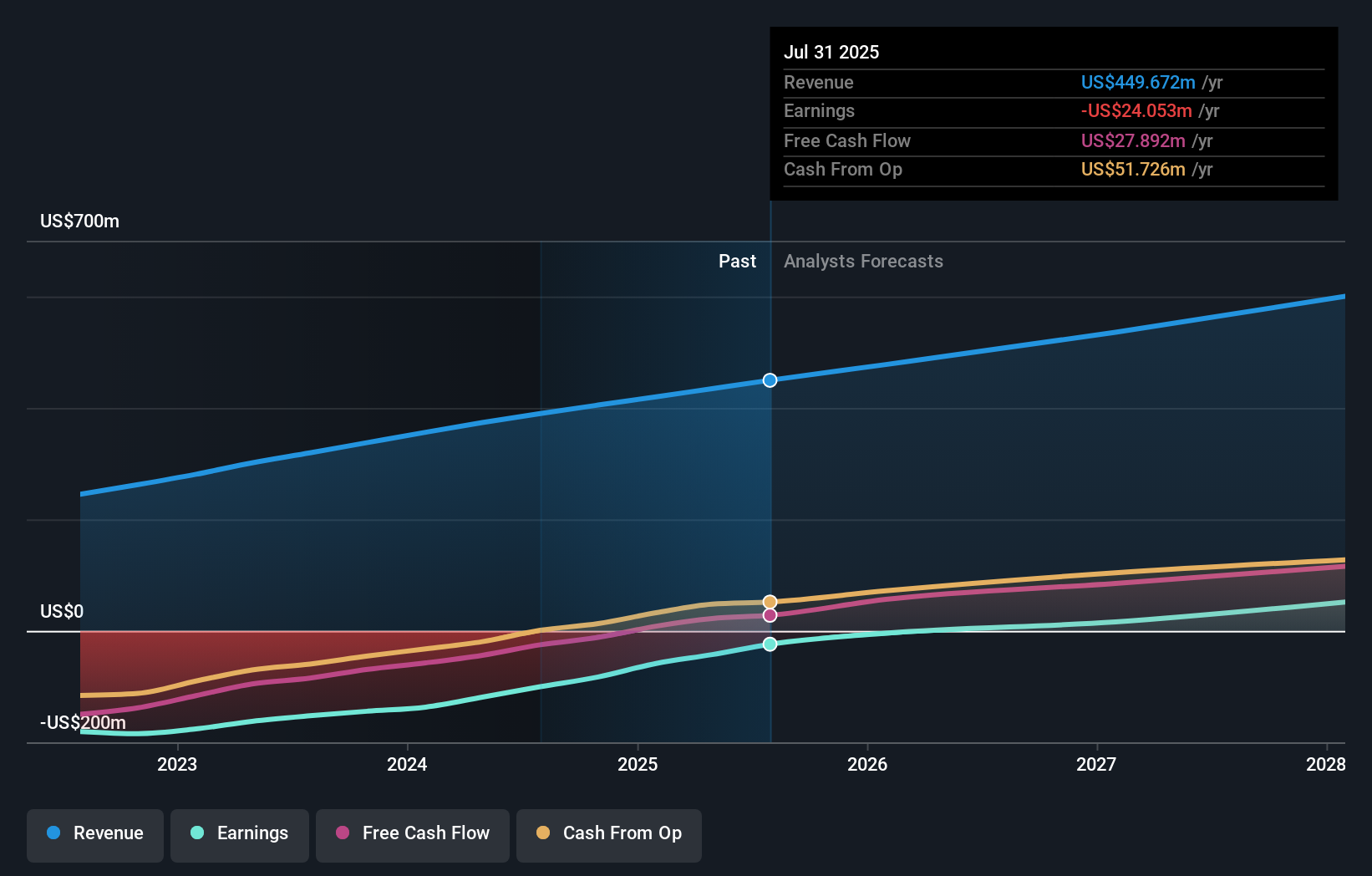

Phreesia, amidst a challenging fiscal landscape, showcased a notable reduction in net loss to $14.4 million from $31.94 million year-over-year in Q3 2024, signaling effective cost management and operational resilience. This improvement accompanies a robust revenue uptick to $106.8 million from $91.62 million, reflecting an 11% growth trajectory that surpasses the US market average of 9.1%. Moreover, Phreesia's strategic integration with Oracle Health EHR underscores its commitment to enhancing healthcare efficiency and patient experience through innovative technology solutions, further evidenced by their projected revenue surge to between $472 million and $482 million by fiscal 2026. These developments highlight Phreesia's potential in not just navigating but thriving within the competitive tech-driven healthcare landscape.

- Get an in-depth perspective on Phreesia's performance by reading our health report here.

Examine Phreesia's past performance report to understand how it has performed in the past.

Make It Happen

- Unlock more gems! Our US High Growth Tech and AI Stocks screener has unearthed 239 more companies for you to explore.Click here to unveil our expertly curated list of 242 US High Growth Tech and AI Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bitdeer Technologies Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BTDR

Bitdeer Technologies Group

Operates as a technology company for blockchain and computing.

Exceptional growth potential low.