- United States

- /

- Semiconductors

- /

- NasdaqGS:ADI

Analog Devices, Inc.'s (NASDAQ:ADI) Price In Tune With Earnings

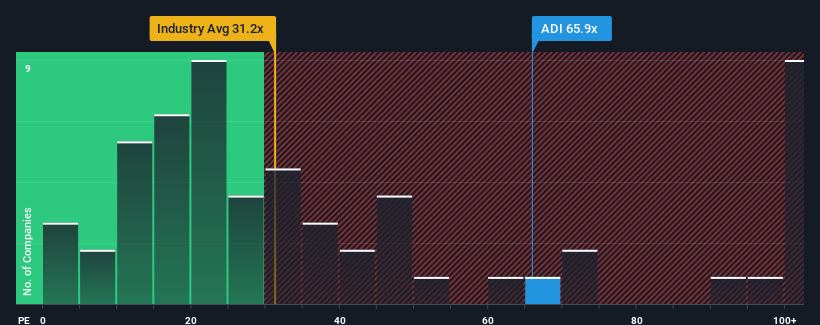

Analog Devices, Inc.'s (NASDAQ:ADI) price-to-earnings (or "P/E") ratio of 65.9x might make it look like a strong sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 19x and even P/E's below 11x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Analog Devices could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for Analog Devices

Is There Enough Growth For Analog Devices?

The only time you'd be truly comfortable seeing a P/E as steep as Analog Devices' is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 50%. This means it has also seen a slide in earnings over the longer-term as EPS is down 5.8% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 36% per year over the next three years. That's shaping up to be materially higher than the 11% per annum growth forecast for the broader market.

With this information, we can see why Analog Devices is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Analog Devices maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 2 warning signs for Analog Devices that we have uncovered.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ADI

Analog Devices

Engages in the design, manufacture, testing, and marketing of integrated circuits (ICs), software, and subsystems products in the United States, rest of North and South America, Europe, Japan, China, and rest of Asia.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion