- United States

- /

- Construction

- /

- NYSE:AGX

Exploring Three Undiscovered Gems In The United States Market

Reviewed by Simply Wall St

In the last week, the United States market has remained flat, yet it has experienced a significant 29% rise over the past 12 months with earnings forecasted to grow by 15% annually. In this dynamic environment, identifying stocks that are not only poised for growth but also remain underappreciated can offer intriguing opportunities for investors seeking to navigate these promising conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

Bank7 (NasdaqGS:BSVN)

Simply Wall St Value Rating: ★★★★★★

Overview: Bank7 Corp. operates as a bank holding company for Bank7, offering banking and financial services to individual and corporate customers, with a market cap of $433.71 million.

Operations: Bank7 generates revenue primarily from its banking segment, which amounts to $85.88 million.

Bank7, a nimble player in the financial sector with total assets of US$1.7 billion and equity of US$204.2 million, stands out for its robust fundamentals. With a net interest margin of 5%, it showcases efficient operations while maintaining an appropriate level of bad loans at 0.5% and a substantial allowance for these loans at 231%. The bank's liabilities are primarily low-risk, sourced from customer deposits, which bolsters its stability. Trading significantly below fair value by over half, Bank7's strategic positioning in economically active regions supports steady loan growth without sacrificing portfolio quality.

Argan (NYSE:AGX)

Simply Wall St Value Rating: ★★★★★★

Overview: Argan, Inc. operates through its subsidiaries to offer a range of services including engineering, procurement, construction, commissioning, maintenance, project development, and technical consulting primarily for the power generation market with a market cap of $1.93 billion.

Operations: Argan's primary revenue stream comes from Power Services, generating $615.58 million, followed by Industrial Services at $175.98 million and Telecom Services at $14.70 million.

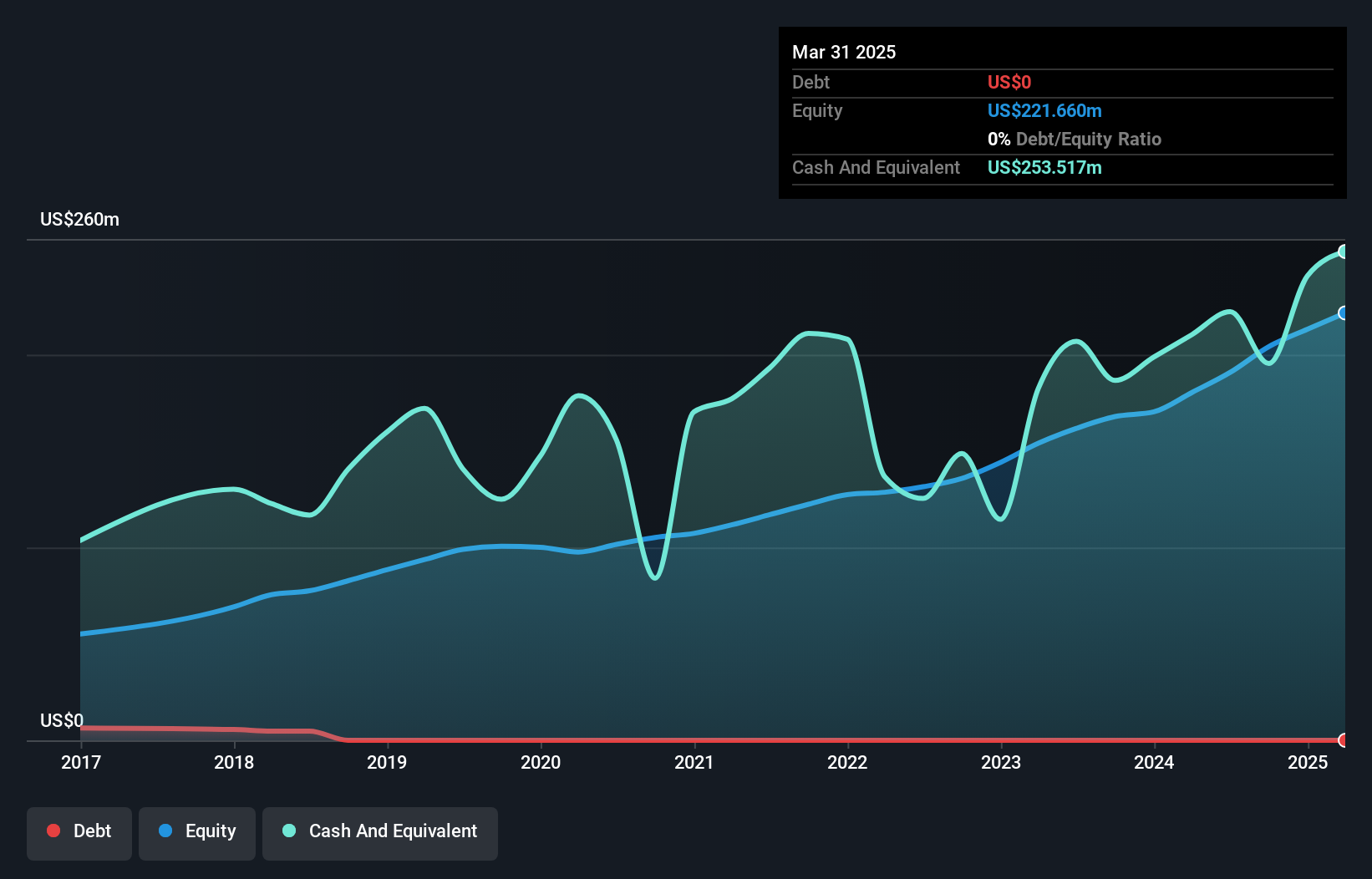

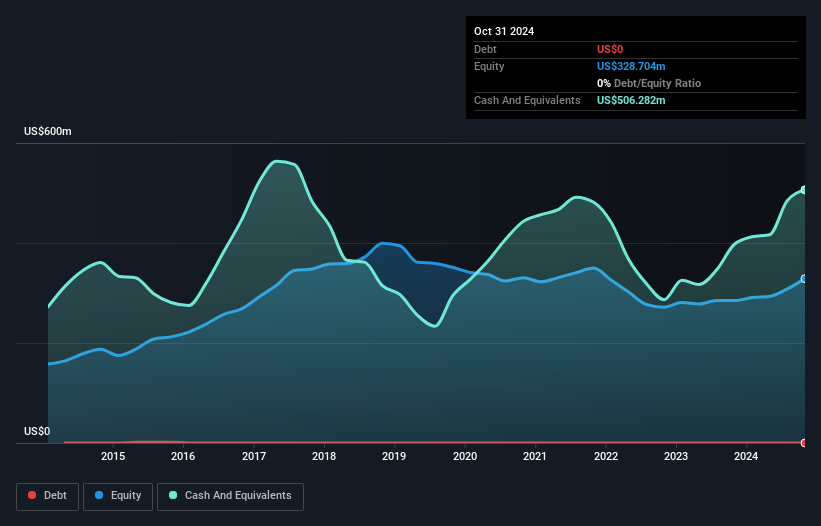

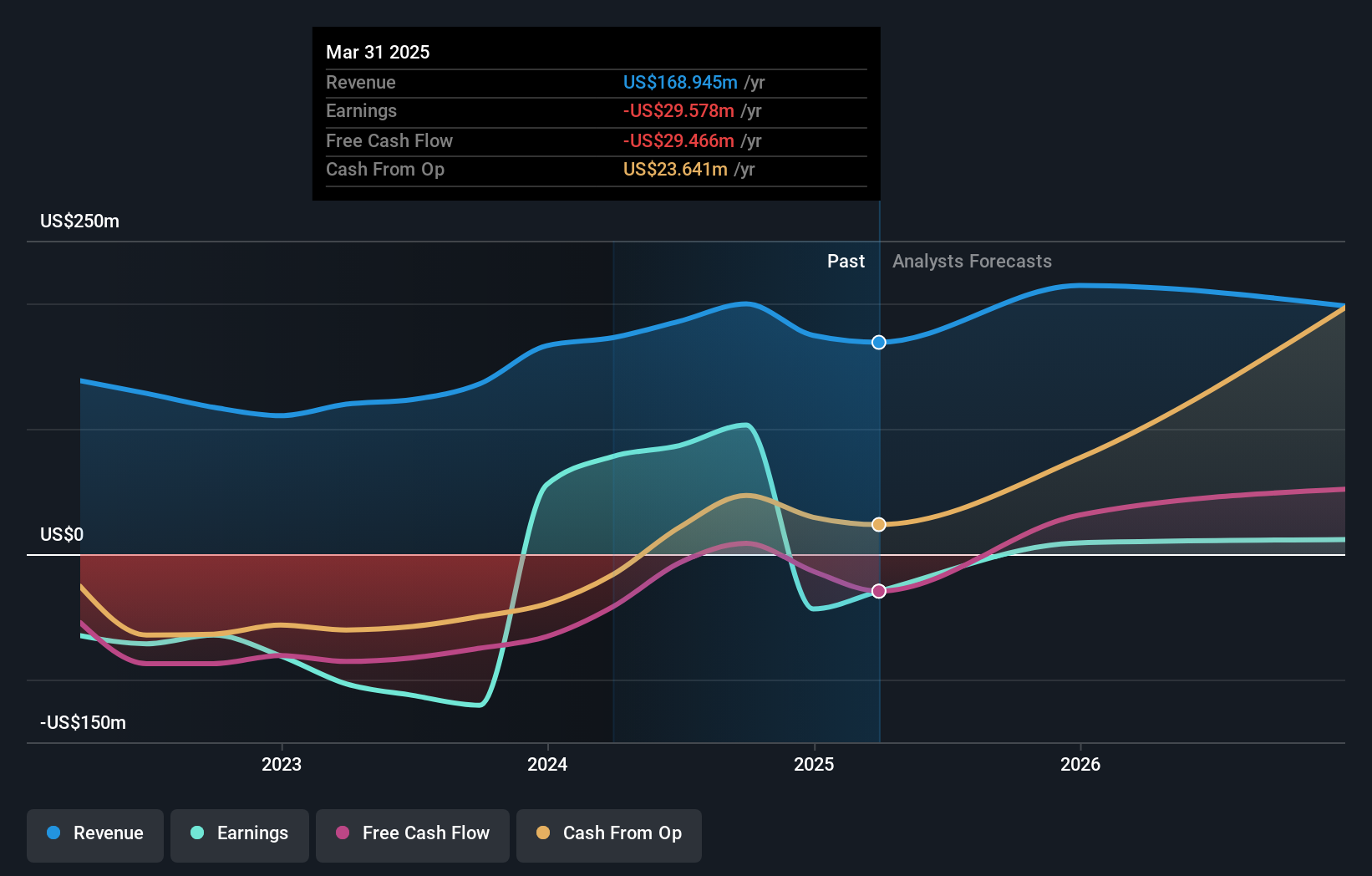

Argan, a player in the power generation market, has shown impressive growth with earnings surging 94.6% over the past year, outpacing the construction industry's 26.6%. Despite significant insider selling recently, Argan remains debt-free and offers high-quality earnings. The company repurchased 5,700 shares for $0.39 million between August and October 2024 as part of a broader buyback program totaling $101.65 million since June 2020. With its stock trading at a notable discount to estimated fair value and robust free cash flow of US$169 million as of July 2024, Argan presents an intriguing opportunity for investors mindful of potential risks like competition and backlog fluctuations.

McEwen Mining (NYSE:MUX)

Simply Wall St Value Rating: ★★★★☆☆

Overview: McEwen Mining Inc. is involved in the exploration, development, production, and sale of gold and silver deposits across the United States, Canada, Mexico, and Argentina with a market capitalization of $452.52 million.

Operations: McEwen Mining generates revenue primarily from its operations in the USA, Canada, and Mexico, with $126.10 million coming from the USA and $70.99 million from Canada.

McEwen Mining, a nimble player in the mining sector, has shown promising developments at its Grey Fox deposit within the Fox Complex in Ontario. Recent assays revealed high-grade gold intersections, notably 10.2 grams per tonne over 11 meters at Whiskey Jack. The company reported a net loss of US$2 million for Q3 2024, an improvement from US$18 million last year. Trading at about 39% below estimated fair value and with a satisfactory net debt to equity ratio of 1.9%, McEwen Mining's exploration efforts are set to continue with a US$9.7 million budget for upcoming drilling campaigns.

- Unlock comprehensive insights into our analysis of McEwen Mining stock in this health report.

Evaluate McEwen Mining's historical performance by accessing our past performance report.

Key Takeaways

- Explore the 235 names from our US Undiscovered Gems With Strong Fundamentals screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AGX

Argan

Through its subsidiaries, provides engineering, procurement, construction, commissioning, maintenance, project development, and technical consulting services to the power generation market.

Outstanding track record with flawless balance sheet and pays a dividend.