- United States

- /

- Software

- /

- NYSE:RNG

High Growth Tech Stocks In The US For May 2025

Reviewed by Simply Wall St

As the U.S. market experiences a notable upswing, with the S&P 500 and Nasdaq Composite marking gains amid strong earnings reports from major tech companies like Microsoft and Meta, investors are keenly observing how these developments impact high-growth tech stocks. In this environment of robust AI spending and positive sentiment, identifying companies with solid financials and innovative strategies becomes crucial for those looking to tap into the potential of high-growth sectors.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.35% | 33.99% | ★★★★★★ |

| Travere Therapeutics | 28.65% | 66.06% | ★★★★★★ |

| TG Therapeutics | 26.06% | 37.39% | ★★★★★★ |

| Arcutis Biotherapeutics | 26.11% | 58.46% | ★★★★★★ |

| Clene | 62.08% | 64.01% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.08% | 58.85% | ★★★★★★ |

| AVITA Medical | 27.81% | 55.17% | ★★★★★★ |

| Alkami Technology | 20.71% | 92.32% | ★★★★★★ |

| Ascendis Pharma | 32.75% | 59.64% | ★★★★★★ |

| Lumentum Holdings | 21.34% | 120.49% | ★★★★★★ |

Click here to see the full list of 236 stocks from our US High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Ardelyx (NasdaqGM:ARDX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ardelyx, Inc. focuses on discovering, developing, and commercializing medicines for unmet medical needs globally, with a market cap of $1.30 billion.

Operations: Ardelyx generates revenue primarily through the development and commercialization of biopharmaceutical products, totaling $333.62 million.

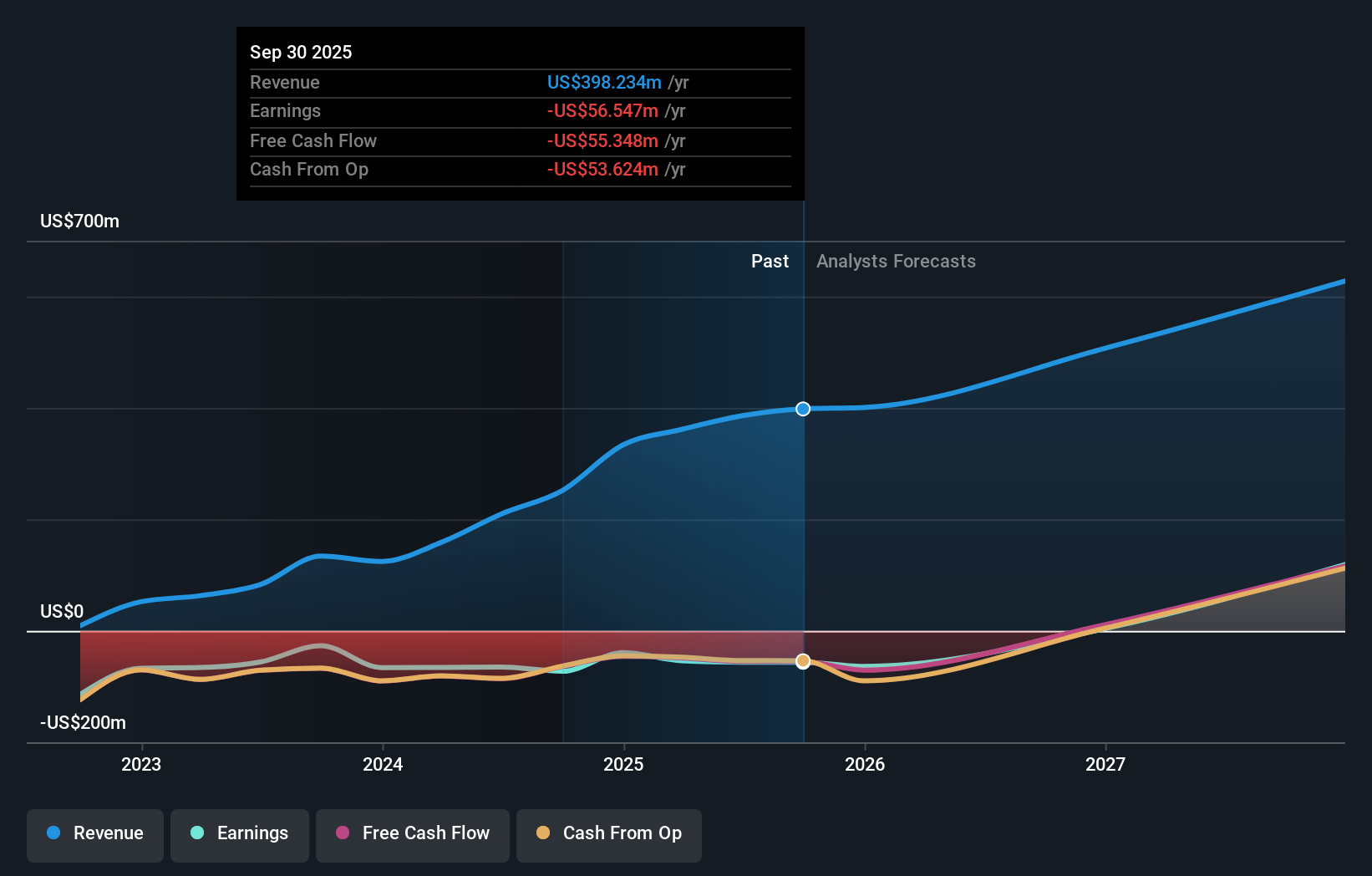

Ardelyx's recent appointment of Dr. Merdad Parsey to its Board underscores a strategic enhancement in governance, potentially enriching its leadership amidst crucial clinical advancements. The company's innovative focus is exemplified by XPHOZAH®, a pioneering treatment for hyperphosphatemia in CKD patients on dialysis, reflecting Ardelyx's commitment to addressing unmet medical needs through novel therapeutic approaches. Financially, Ardelyx has shown significant traction with a revenue jump to $333.62 million from the previous year’s $124.46 million, alongside an anticipated transition to profitability within three years, suggesting robust growth prospects driven by both clinical outcomes and market expansion strategies.

- Unlock comprehensive insights into our analysis of Ardelyx stock in this health report.

Review our historical performance report to gain insights into Ardelyx's's past performance.

Apellis Pharmaceuticals (NasdaqGS:APLS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Apellis Pharmaceuticals, Inc. is a commercial-stage biopharmaceutical company dedicated to discovering, developing, and commercializing innovative therapeutic compounds for diseases with significant unmet needs, with a market cap of approximately $2.41 billion.

Operations: Apellis Pharmaceuticals focuses on developing and commercializing proprietary therapeutics, generating revenue of $781.37 million.

Apellis Pharmaceuticals, set to become profitable within three years, is navigating a transformative phase with strategic board enhancements and significant FDA approvals. Recently, Craig Wheeler joined the board, bringing extensive biopharmaceutical leadership. This governance boost coincides with the FDA’s priority review of EMPAVELI for severe kidney diseases—a potential market expander given its $212.53 million Q4 revenue up from $146.38 million last year. With earnings expected to grow 61.29% annually and R&D focused on critical care areas, Apellis is poised for impactful industry contributions amidst forecasts of high return on equity (690.6%) in the near future.

- Click to explore a detailed breakdown of our findings in Apellis Pharmaceuticals' health report.

Gain insights into Apellis Pharmaceuticals' past trends and performance with our Past report.

RingCentral (NYSE:RNG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RingCentral, Inc. offers cloud-based business communications and contact center solutions globally, with a market capitalization of approximately $2.29 billion.

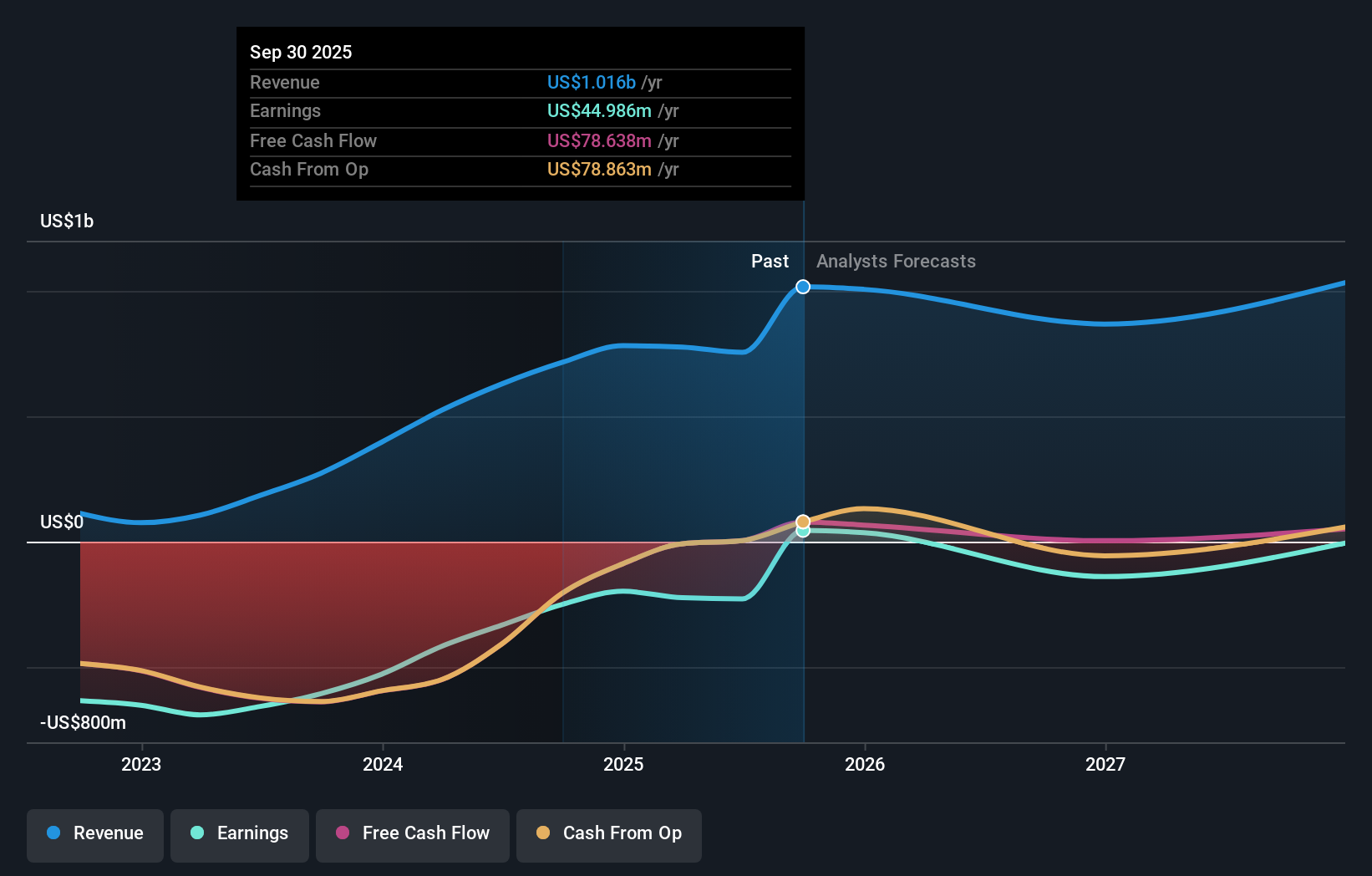

Operations: RingCentral generates revenue primarily from its Internet Software & Services segment, totaling approximately $2.40 billion. The company focuses on providing cloud-based communication and contact center solutions across North America and internationally.

RingCentral's strategic maneuvers in 2025, including the extension of its credit facilities and key partnerships with PCI-PAL and Cox Business, underscore its commitment to expanding its innovative cloud communication solutions. Notably, the company's recent integration with PCI-PAL enhances secure payment capabilities across North America and Europe, a critical feature for maintaining compliance and customer trust in digital transactions. Furthermore, the collaboration with Cox Business is set to transform work experiences by leveraging RingCentral’s AI-driven communication platform. These initiatives are pivotal as RingCentral navigates through a competitive landscape marked by a need for high security and seamless customer interactions in cloud communications.

- Click here and access our complete health analysis report to understand the dynamics of RingCentral.

Evaluate RingCentral's historical performance by accessing our past performance report.

Key Takeaways

- Unlock our comprehensive list of 236 US High Growth Tech and AI Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade RingCentral, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RNG

RingCentral

Provides cloud business communications, contact center, video, and hybrid event solutions in North America and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives