- United States

- /

- Biotech

- /

- NasdaqGS:AMGN

A Look at Amgen’s (AMGN) Valuation Following FDA Nod Expanding Repatha’s Patient Reach

Reviewed by Simply Wall St

Amgen (AMGN) just received expanded FDA approval for its cholesterol-lowering drug, Repatha, allowing doctors to prescribe it to an even broader pool of adults at risk for heart disease. Unlike the prior label, which was restricted to people already diagnosed with cardiovascular conditions, the new approval means more patients than ever may now qualify. This is an important shift that could drive commercial uptake in the coming quarters. For investors, this regulatory win is a sizable development that has understandably shaken up the recent outlook for the stock.

Looking at the bigger picture, the FDA’s decision arrives as Amgen continues to roll out sizable investments in research, manufacturing, and innovation across the U.S. These moves point to a business scaling up for further growth. Still, Amgen’s shares have been on a rollercoaster over the year, gaining nearly 9% since January, but down about 10% over the past twelve months. In the past three months, the stock’s momentum has faded, yet the company’s three- and five-year returns highlight its longer-term appeal.

All of this raises an important question: has the market already priced in this new wave of Repatha-driven opportunity, or does Amgen’s current valuation offer a genuine chance to buy ahead of further upside?

Most Popular Narrative: 9.1% Undervalued

The prevailing perspective suggests Amgen’s current share price is about 9% below what leading analysts believe the company is worth. This hints at meaningful upside potential, especially for those who put stock in forward-looking growth assumptions.

*Advancements in personalized and targeted therapies, reflected in the robust late-stage pipeline (e.g., MariTide for obesity/type 2 diabetes, Repatha and olpasiran for cardiovascular, multiple bispecific T-cell engagers for oncology), position Amgen to launch high-margin, first-in-class products that drive both top-line growth and margin expansion in the coming years.*

Want to know the fundamental growth lever that could lift Amgen's valuation? This narrative hints at product launches and clinical breakthroughs, but the real story lies in the bold margin projections and profit expansion underlying their fair value. Ready to uncover exactly what future earnings targets and revenue assumptions are driving this premium? The full narrative breaks down the numbers and the “why” behind the valuation.

Result: Fair Value of $311.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent drug pricing pressure and intensifying biosimilar competition could still curb Amgen's revenue growth and reduce future profit expansion.

Find out about the key risks to this Amgen narrative.Another View: What Do the Numbers Suggest?

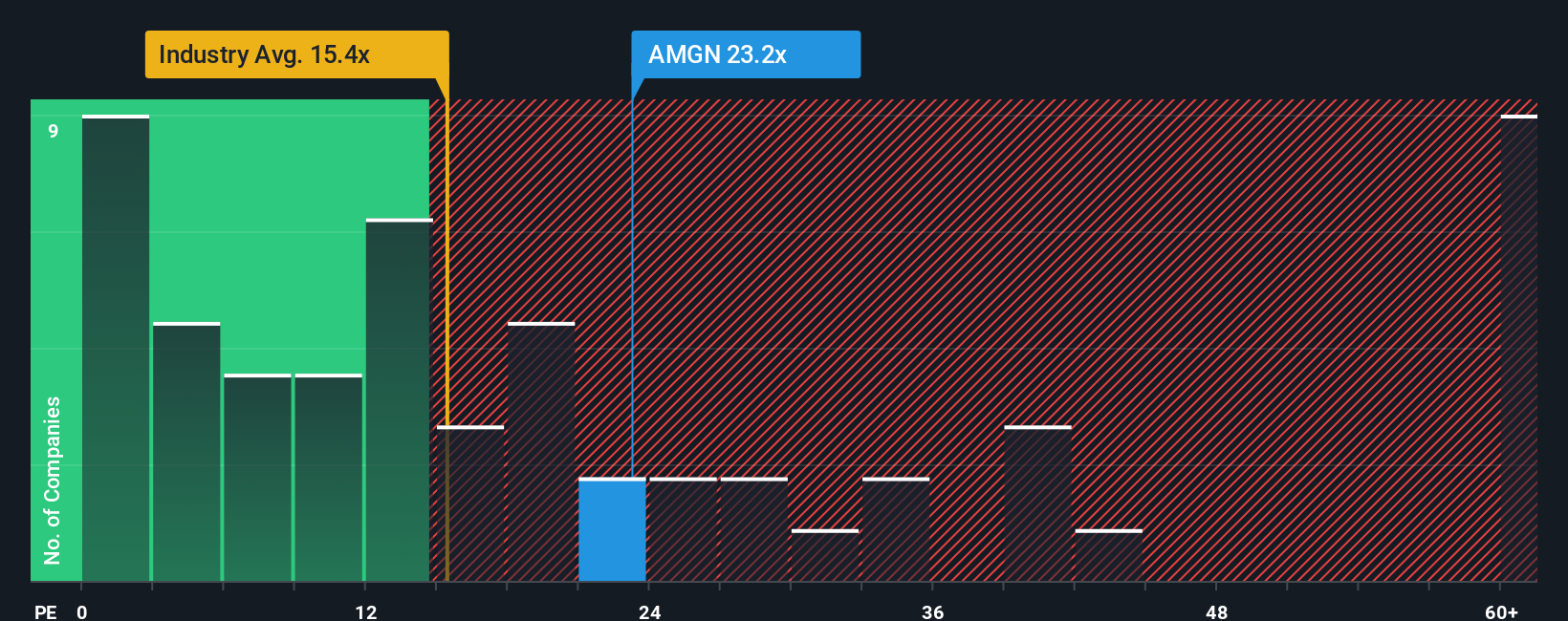

Taking a step back from analyst targets, a popular market yardstick points out that Amgen appears pricier than the industry average for similar companies. Does this alternate lens suggest the market sees strengths others miss, or is there lingering optimism that is outpacing reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amgen Narrative

If you see things differently or want to take a hands-on approach, it takes just a few minutes to craft your own view from the ground up. Do it your way

A great starting point for your Amgen research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Don’t miss out on fresh opportunities just ahead. The Simply Wall Street Screener uncovers ideas with standout potential, curated to help you build a truly informed portfolio.

- Spot rising tech pioneers by tapping into emerging breakthroughs. AI penny stocks can help you discover companies powering tomorrow’s game-changing artificial intelligence.

- Generate steady income and enhance your portfolio’s resilience by tracking companies that consistently offer dividend stocks with yields > 3% for reliable returns.

- Seize the chance for strong returns by screening for value gems trading below their true worth using our list of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:AMGN

Amgen

Amgen Inc. discovers, develops, manufactures, and delivers human therapeutics worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026