- United States

- /

- Software

- /

- NasdaqGS:ALLT

Exploring 3 High Growth Tech Stocks in the US Market

Reviewed by Simply Wall St

In a volatile trading session, major U.S. stock indexes ended mostly higher as robust bank earnings and strong performances in the tech sector helped lift market sentiment, despite ongoing concerns about U.S.-China trade tensions and a prolonged government shutdown. Amid these conditions, investors are keenly focused on high-growth tech stocks that can capitalize on trends like artificial intelligence and data center expansion, which are seen as pivotal drivers of future growth in the technology sector.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ADMA Biologics | 20.61% | 23.30% | ★★★★★☆ |

| Exelixis | 10.59% | 20.60% | ★★★★★☆ |

| Palantir Technologies | 25.11% | 31.65% | ★★★★★★ |

| Workday | 11.20% | 32.07% | ★★★★★☆ |

| RenovoRx | 65.52% | 68.63% | ★★★★★☆ |

| Aldeyra Therapeutics | 42.92% | 73.80% | ★★★★★☆ |

| OS Therapies | 56.64% | 68.61% | ★★★★★☆ |

| Vanda Pharmaceuticals | 22.66% | 59.11% | ★★★★★☆ |

| Zscaler | 15.74% | 40.36% | ★★★★★☆ |

| Gorilla Technology Group | 32.75% | 122.61% | ★★★★★☆ |

Click here to see the full list of 72 stocks from our US High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

ACADIA Pharmaceuticals (ACAD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ACADIA Pharmaceuticals Inc. is a biopharmaceutical company that develops and commercializes medicines for central nervous system disorders and rare diseases in the United States, with a market cap of approximately $3.43 billion.

Operations: ACADIA focuses on developing and commercializing innovative medicines, generating approximately $1.02 billion in revenue from its operations in the United States.

ACADIA Pharmaceuticals has demonstrated a remarkable surge in earnings growth, outpacing the biotech industry with a 626.8% increase over the past year compared to the industry's 65.2%. Despite this, its revenue growth projection of 9.6% annually trails behind the broader U.S. market expectation of 10%. The company is set to expand further, evidenced by its aggressive research and development efforts which are crucial for sustaining long-term innovation and competitiveness in neurology-focused therapies. Recent presentations at major conferences underscore ACADIA's commitment to advancing its pipeline, including significant findings on investigational drugs like ACP-711 for essential tumor treatments and ongoing improvements in Parkinson's disease psychosis management with NUPLAZID®—highlighting both current contributions and future potential within high-stakes medical sectors.

- Take a closer look at ACADIA Pharmaceuticals' potential here in our health report.

Explore historical data to track ACADIA Pharmaceuticals' performance over time in our Past section.

Allot (ALLT)

Simply Wall St Growth Rating: ★★★★☆☆

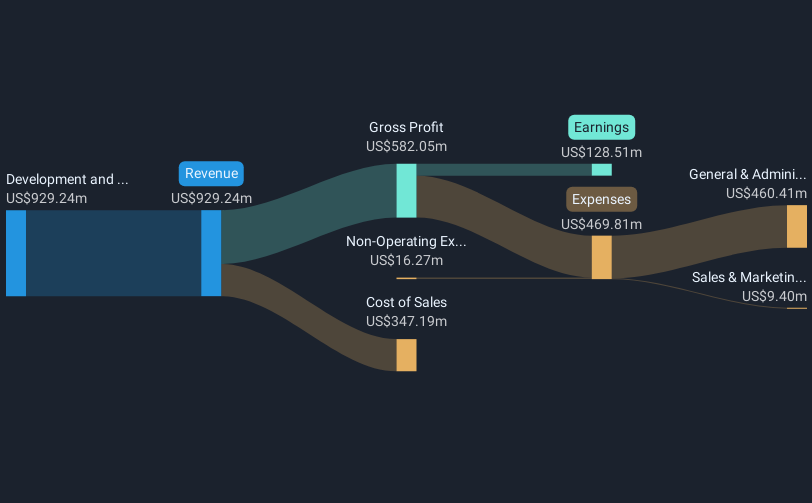

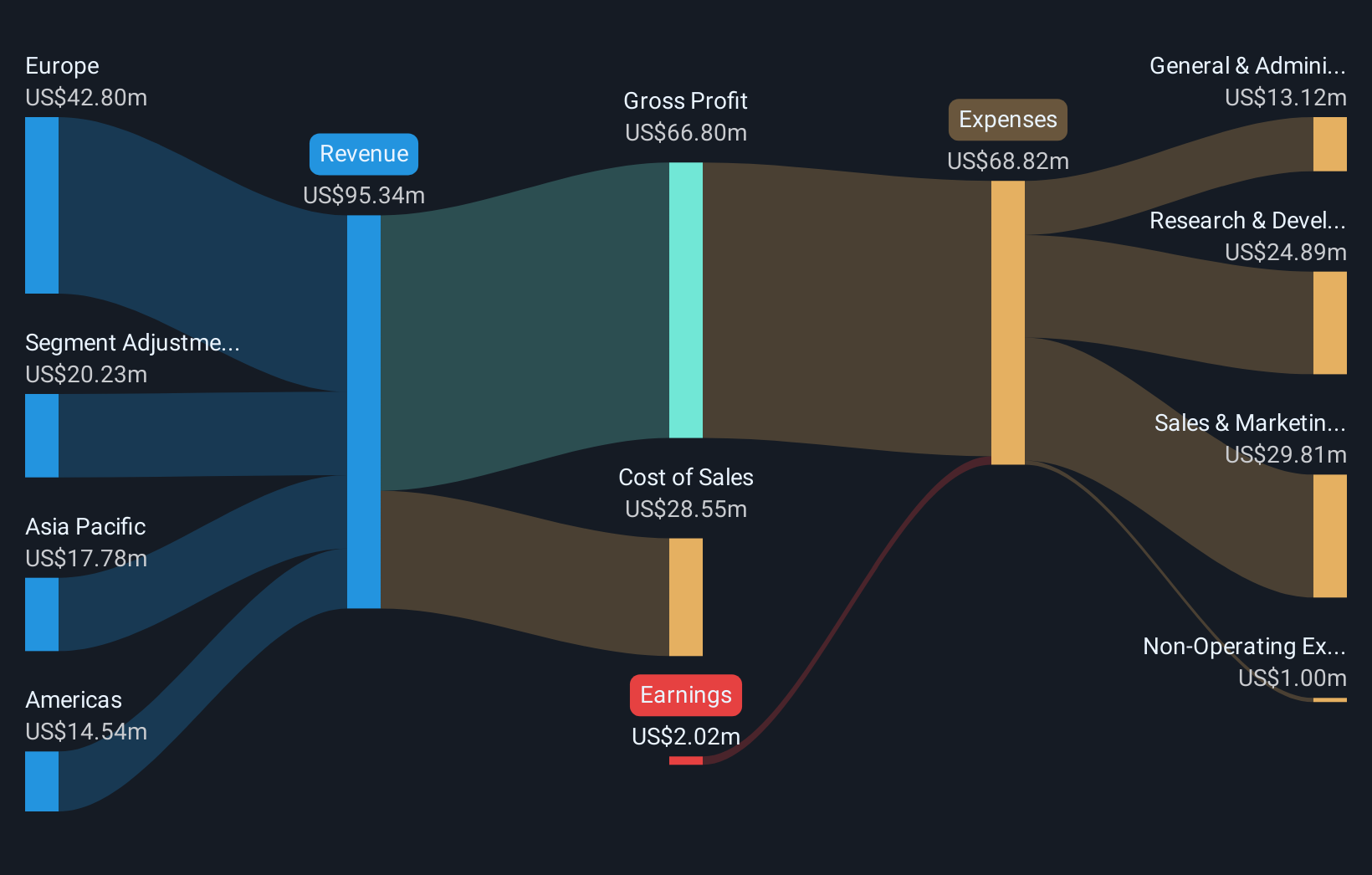

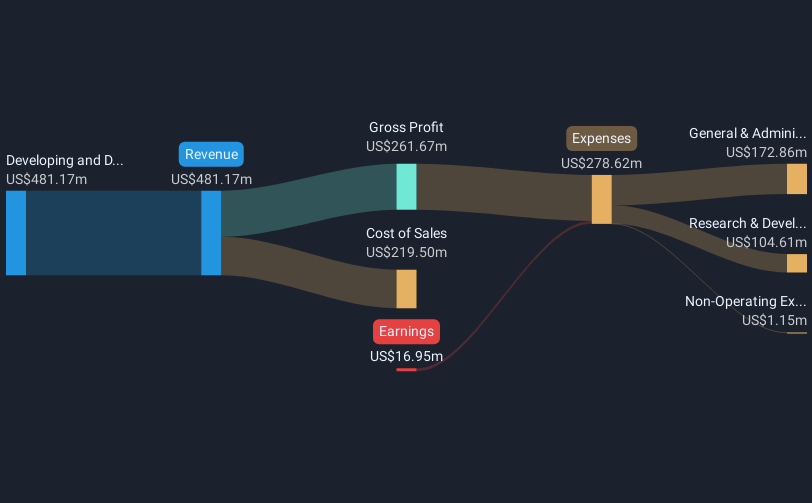

Overview: Allot Ltd. is a company that develops, sells, and markets network intelligence and security solutions across various regions including Israel, Europe, Asia, Oceania, the Americas, the Middle East, and Africa with a market capitalization of $484.52 million.

Operations: The company's primary revenue stream is from optical networking equipment, generating $95.34 million.

Allot has recently been added to the S&P Global BMI Index, reflecting a positive market recognition. Despite being currently unprofitable, Allot is expected to pivot to profitability within three years with an anticipated earnings growth of 56.82% annually. This transition is underscored by robust revenue projections set between $98 million and $102 million for 2025, signaling a potential shift towards sustainable financial health. Contributing significantly to this outlook is Allot's engagement with Mas Movil Panama and Play, integrating its advanced NetworkSecure and DNS Secure platforms respectively. These collaborations not only enhance Allot’s client base but also fortify its standing in cybersecurity solutions—a critical segment in today’s tech landscape dominated by escalating cyber threats.

- Click to explore a detailed breakdown of our findings in Allot's health report.

Gain insights into Allot's historical performance by reviewing our past performance report.

Kiniksa Pharmaceuticals International (KNSA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kiniksa Pharmaceuticals International, plc is a biopharmaceutical company that develops and commercializes novel therapies for diseases with unmet needs, focusing on cardiovascular indications globally, with a market cap of $2.81 billion.

Operations: Kiniksa Pharmaceuticals generates revenue primarily from developing and delivering therapeutic medicines, amounting to $529.33 million. The company focuses on addressing unmet needs in cardiovascular diseases globally.

Kiniksa Pharmaceuticals International has demonstrated a robust turnaround, transitioning from a net loss to reporting substantial net income of $17.83 million in Q2 2025, up from a loss the previous year. This growth is underscored by a significant increase in revenues, rising to $156.8 million from $108.63 million year-over-year for the same period. The company's commitment to innovation is evident in its R&D investments, aligning with its upward revision of 2025 revenue forecasts to between $625 million and $640 million. These financial improvements coincide with Kiniksa's active participation in major healthcare conferences, potentially enhancing its industry visibility and investor confidence.

- Delve into the full analysis health report here for a deeper understanding of Kiniksa Pharmaceuticals International.

Understand Kiniksa Pharmaceuticals International's track record by examining our Past report.

Next Steps

- Unlock more gems! Our US High Growth Tech and AI Stocks screener has unearthed 69 more companies for you to explore.Click here to unveil our expertly curated list of 72 US High Growth Tech and AI Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALLT

Allot

Develops, sells, and markets network intelligence and security solutions in Israel, Europe, Asia, Oceania, the Americas, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives