- United States

- /

- Media

- /

- NYSE:WLY

Did Wiley’s (WLY) AI Gateway Launch Just Shift Its Digital Transformation Investment Narrative?

Reviewed by Sasha Jovanovic

- Earlier this month, John Wiley & Sons announced the launch of Wiley AI Gateway, an AI-native research intelligence platform integrating content from leading publishers with major AI platforms like Anthropic's Claude and AWS, while Nanalysis Scientific Corp. revealed new Wiley file support in its KnowItAll 2026 analytics software for NMR data.

- This dual push into AI-driven research tools and expanded scientific data access signals Wiley's broader transformation toward interoperable digital solutions for academic and corporate research.

- We'll explore how the introduction of Wiley AI Gateway, emphasizing AI-powered interoperability, could impact the company's investment narrative moving forward.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

John Wiley & Sons Investment Narrative Recap

To be a shareholder in John Wiley & Sons today, you need to believe the company's move toward AI-powered, interoperable research solutions can set a foundation for renewed growth, despite ongoing pressure on its legacy publishing revenues. While the Wiley AI Gateway launch strengthens Wiley's digital credentials and could support earnings diversity, most near-term investor focus remains on management's ability to stabilize core subscription income as key contracts roll off, short-term impact from this platform launch may not yet be material to results, but it helps shape sentiment around future resilience.

Among Wiley's recent product announcements, the integration of its vast NMR data collections into Nanalysis Scientific Corp.'s KnowItAll 2026 stands out, reinforcing the company's expanding role in enabling accessible scientific data for academic and corporate researchers. These initiatives illustrate how Wiley is pushing digital content and analytics partnerships as key future growth drivers, but they must scale meaningfully to outweigh the risk of shrinking traditional margins.

By contrast, investors should be aware of the rising risk tied to rapid change in the AI content licensing market and what happens if large, one-time deals...

Read the full narrative on John Wiley & Sons (it's free!)

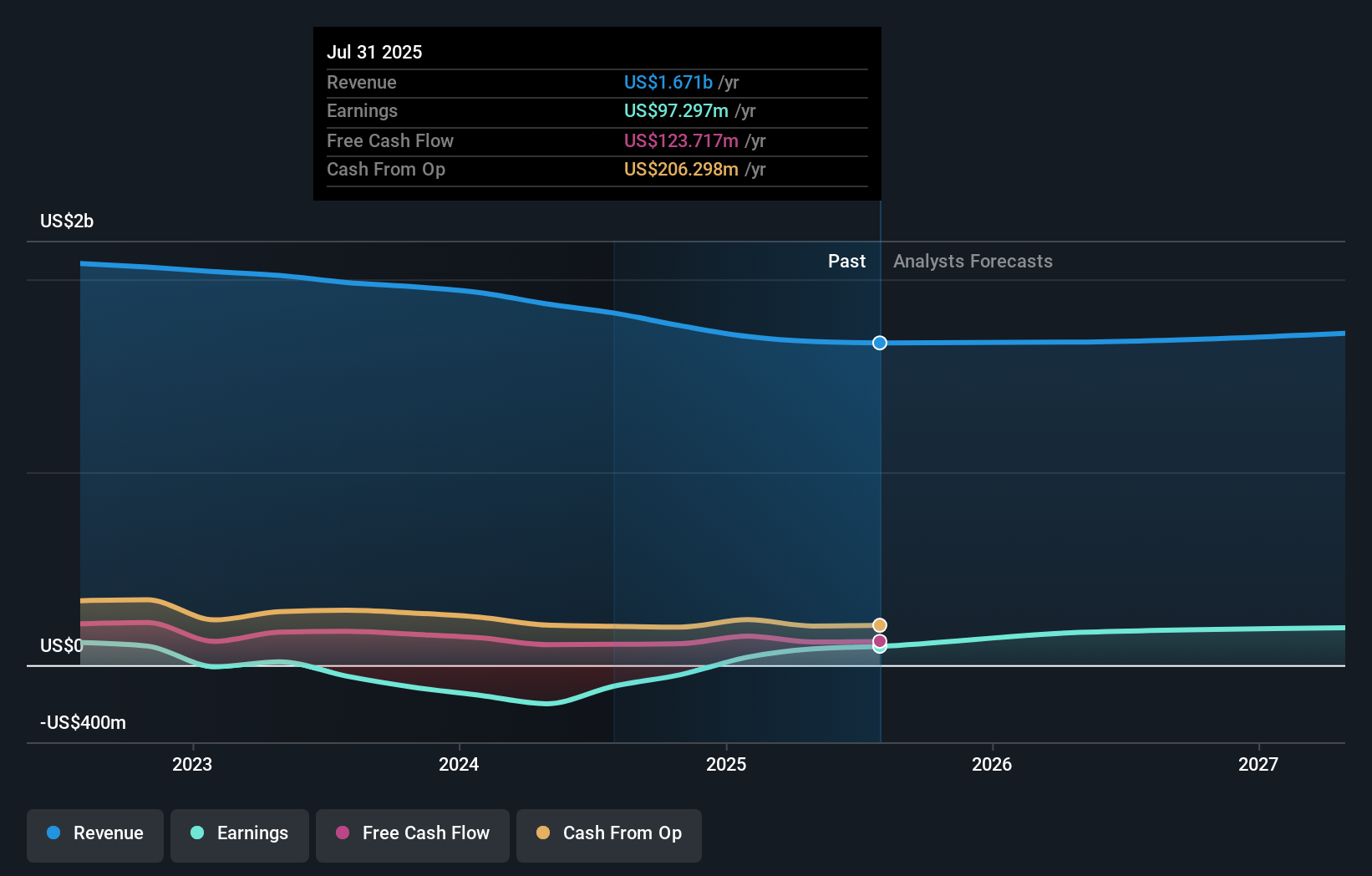

John Wiley & Sons' narrative projects $1.8 billion revenue and $266.1 million earnings by 2028. This requires 1.5% yearly revenue growth and an increase of $181.9 million in earnings from $84.2 million today.

Uncover how John Wiley & Sons' forecasts yield a $60.00 fair value, a 62% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Wiley range from US$30.28 to US$60, capturing three distinct outlooks. With the company's future shaped by both digital transformation and risks in the AI licensing arena, take this opportunity to consider several alternative perspectives.

Explore 3 other fair value estimates on John Wiley & Sons - why the stock might be worth as much as 62% more than the current price!

Build Your Own John Wiley & Sons Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- Our free John Wiley & Sons research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate John Wiley & Sons' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WLY

John Wiley & Sons

A publisher, provides authoritative content, data-driven insights, and knowledge services for the advancement of science, innovation, and learning in the United States, China, the United Kingdom, Japan, Australia, and internationally.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)