Key Takeaways

- Expansion in digital publishing, AI licensing, and data analytics partnerships is diversifying revenue streams and accelerating high-margin, recurring growth.

- Operational restructuring and increased digital adoption are improving margins, boosting free cash flow, and enhancing resilience against funding volatility.

- Uncertainty in AI revenue, open access shifts, digital disruption, intensifying competition, and funding volatility all pose significant risks to Wiley's revenue growth and margin stability.

Catalysts

About John Wiley & Sons- Operates as a research and learning company worldwide.

- Strong growth in Open Access and digital research publishing, reinforced by multiyear renewal agreements and expanding global submissions (up 19%), positions Wiley to capture increasing demand for scalable, reputable research content-supporting sustained revenue growth and high-margin recurring revenues.

- Rapid expansion into AI licensing and data analytics partnerships with major corporate clients is unlocking new, high-margin revenue streams outside of Wiley's traditional academic markets, increasing earnings diversity and accelerating top-line growth.

- The continued shift towards digital learning platforms, inclusive access models, and subscription-based academic content is driving margin improvement and stable, recurring revenue, evidenced by robust adoption of courseware and digital offerings across educational institutions.

- Margin expansion and operational efficiency initiatives-including ongoing restructuring, technology cost rationalization, and portfolio simplification-are expected to deliver significant improvements in net margins and free cash flow through FY26 and beyond.

- Wiley's global and diverse customer base, combined with increasing investments in R&D by national governments and institutions, reduces revenue concentration risk and provides resilience in the face of regional funding volatility, supporting long-term revenue stability and cash generation.

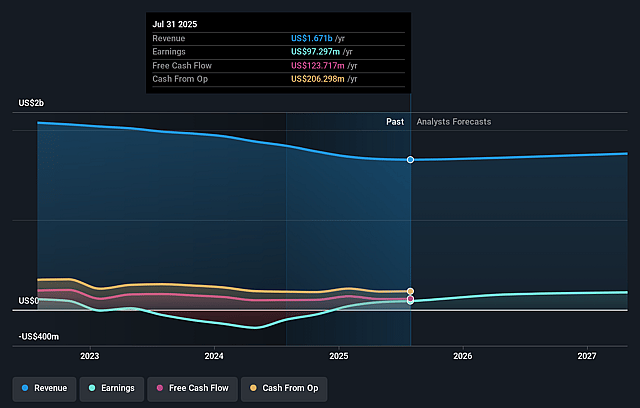

John Wiley & Sons Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming John Wiley & Sons's revenue will grow by 1.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.0% today to 15.1% in 3 years time.

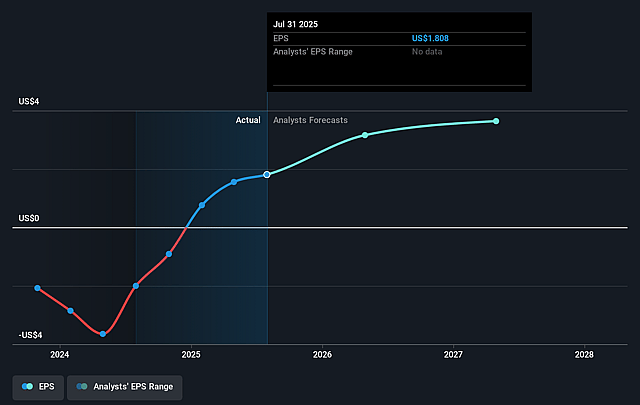

- Analysts expect earnings to reach $266.1 million (and earnings per share of $5.02) by about September 2028, up from $84.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.0x on those 2028 earnings, down from 25.2x today. This future PE is lower than the current PE for the US Media industry at 20.8x.

- Analysts expect the number of shares outstanding to decline by 1.63% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.42%, as per the Simply Wall St company report.

John Wiley & Sons Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rapid evolution and unpredictability in the AI content licensing market means Wiley cannot reliably forecast or count on continued high levels of AI revenue, potentially leading to volatility or declines in revenue and earnings as seen in the lapping of the $40 million AI licensing in FY25, posing risk to sustained top-line growth.

- Increasing global pressure for open access and alternative publishing models, including discounted or subsidized regional programs and growing Open Access share, threaten Wiley's traditional higher-margin subscription revenues and could compress net margins over time as pricing power erodes.

- Ongoing softness and structural decline in print and legacy professional publishing channels-exacerbated by digital-first and Open Educational Resource (OER) adoption-present a long-term headwind to revenue growth and risk further margin pressure as Wiley continues to transition.

- Growing industry competition from larger, more diversified academic publishers, digital-native EdTech firms, and alternative research dissemination platforms (like pre-print servers and AI review tools) threatens Wiley's market share, which could depress both revenue and future earnings growth.

- High exposure to volatile academic and research funding cycles-especially in key developed markets like the U.S.-plus policy risks and macro/geopolitical uncertainty, may result in flat or declining institutional spending on Wiley's products and services, pressuring recurring revenue and overall financial stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $60.0 for John Wiley & Sons based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.8 billion, earnings will come to $266.1 million, and it would be trading on a PE ratio of 14.0x, assuming you use a discount rate of 7.4%.

- Given the current share price of $39.77, the analyst price target of $60.0 is 33.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.