- United States

- /

- Entertainment

- /

- NYSE:SPOT

What Spotify (SPOT)'s Global Mental Health Campaign With Nike Could Mean for Its Social Impact Strategy

Reviewed by Simply Wall St

- Spotify and Nike recently announced the global launch of the Make Moves campaign to support teen girls' mental health by encouraging daily movement through music, expanding on a successful UK pilot from 2023.

- This collaboration not only promotes youth wellbeing worldwide but also demonstrates Spotify's increased emphasis on social impact and engagement initiatives through a partnership with Nike and a donation to Selena Gomez’s Rare Impact Fund.

- We'll look at how Spotify's focus on mental health and broad teen engagement could influence its investment narrative going forward.

Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

Spotify Technology Investment Narrative Recap

To be a Spotify shareholder, you need to believe that global user and subscriber growth, coupled with deepening engagement through differentiated content and partnerships, will help drive revenue and margin expansion over time. While the new Make Moves campaign with Nike highlights Spotify’s broader influence and focus on teen engagement and social impact, this initiative does not significantly shift the most important short term catalyst, advertising revenue progress, or address the biggest risk, which remains high music licensing costs limiting profitability.

Among the company’s recent announcements, Spotify’s expanded buyback authority, raised by $1 billion in July 2025, stands out, reflecting an ongoing commitment to shareholder value. Although relevant from a capital allocation standpoint, neither the buyback nor the Make Moves campaign materially alters near-term questions around ad monetization, which remains the central debate for both margin and diversification.

But despite initiatives like Make Moves with Nike, investors should not overlook the risk that...

Read the full narrative on Spotify Technology (it's free!)

Spotify Technology's outlook anticipates €23.8 billion in revenue and €3.4 billion in earnings by 2028. This scenario assumes annual revenue growth of 12.8% and an earnings increase of €2.6 billion from the current €806.0 million.

Uncover how Spotify Technology's forecasts yield a $739.83 fair value, a 5% upside to its current price.

Exploring Other Perspectives

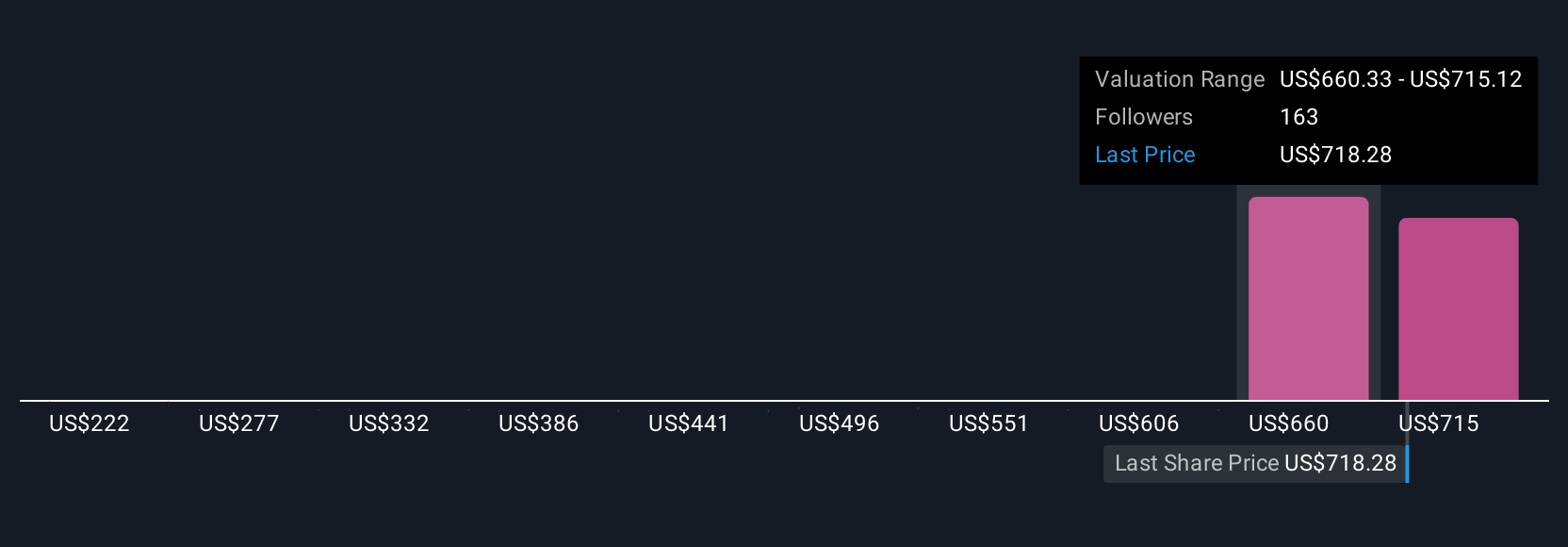

Twenty-four Simply Wall St Community fair value estimates for Spotify range from €222 to €769.91, with most clustering between €386,000 and €715,000. Amid this wide divergence, many are closely watching whether advertising revenue growth can accelerate and meaningfully impact future earnings and margins.

Explore 24 other fair value estimates on Spotify Technology - why the stock might be worth as much as 9% more than the current price!

Build Your Own Spotify Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Spotify Technology research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Spotify Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Spotify Technology's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPOT

Spotify Technology

Provides audio streaming subscription services worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives