- United States

- /

- Entertainment

- /

- NYSE:SPOT

How Spotify's (SPOT) Co-CEO Transition Could Shape Its Long-Term Investment Narrative

Reviewed by Sasha Jovanovic

- Spotify Technology S.A. recently announced that founder and CEO Daniel Ek will transition to Executive Chairman in January 2026, with Gustav Söderström and Alex Norström named incoming co-CEOs, pending board approval.

- This formalizes an operating structure in place since 2023, underscoring a shift toward dual operational leadership while Ek focuses on long-term vision, capital allocation, and board guidance.

- We'll examine how this executive transition, which places greater emphasis on operational leadership by the co-CEOs, could affect Spotify's investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Spotify Technology Investment Narrative Recap

To own Spotify as a shareholder, you need to believe its expanding ecosystem of music, podcasts, and audiobooks will translate long-term user growth, higher monetization, and sustained margin improvement, even amid competitive and regulatory threats. While the promotion of Daniel Ek to Executive Chairman brings continuity in vision, it does not materially affect the near-term focus on accelerating advertising revenue, which remains the stock’s biggest catalyst and a continuing risk given recent underperformance versus peers.

Among recent developments, Spotify’s multiyear US publishing agreement with BMG draws attention for how the platform is evolving relationships with content providers. This type of direct licensing could play into both content cost management and the broader push to improve gross margins, factors that remain key as new operational leadership takes the reins.

But in contrast, investors should pay special attention to the ongoing challenges in advertising growth, as...

Read the full narrative on Spotify Technology (it's free!)

Spotify Technology's narrative projects €23.8 billion in revenue and €3.4 billion in earnings by 2028. This requires a 12.8% yearly revenue growth and a €2.6 billion earnings increase from €806.0 million today.

Uncover how Spotify Technology's forecasts yield a $747.78 fair value, a 9% upside to its current price.

Exploring Other Perspectives

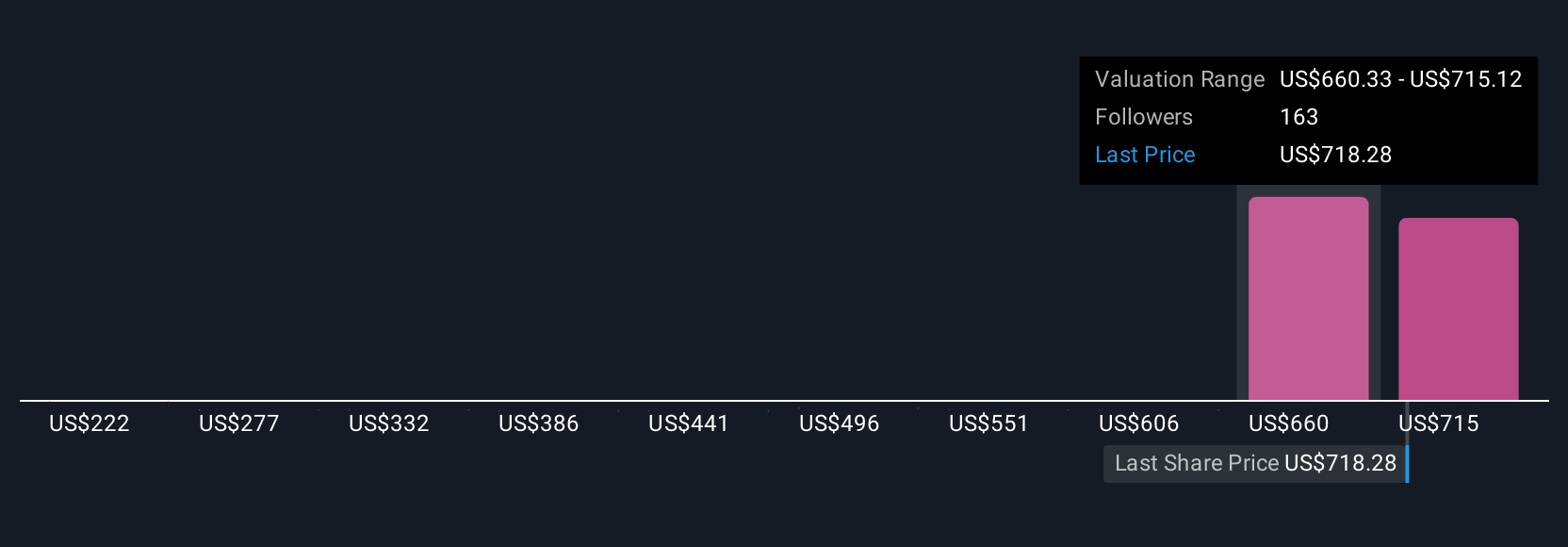

Simply Wall St Community members have set 24 fair value estimates for Spotify, spanning from €222 to €769.91. With advertising revenue growth still lagging, you might want to compare these many viewpoints to get a fuller sense of potential risks and rewards.

Explore 24 other fair value estimates on Spotify Technology - why the stock might be worth less than half the current price!

Build Your Own Spotify Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Spotify Technology research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Spotify Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Spotify Technology's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPOT

Spotify Technology

Provides audio streaming subscription services worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives