- United States

- /

- Software

- /

- NasdaqGS:CRWD

Exploring High Growth Tech Stocks in the United States

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it is up 21% over the past year with earnings forecast to grow by 14% annually. In this context, identifying high growth tech stocks involves looking for companies that are well-positioned to capitalize on technological advancements and demonstrate strong potential for sustained revenue increases.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 29.07% | 27.57% | ★★★★★★ |

| Ardelyx | 21.09% | 55.29% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.21% | 57.07% | ★★★★★★ |

| Travere Therapeutics | 30.33% | 61.73% | ★★★★★★ |

| Lumentum Holdings | 21.25% | 118.58% | ★★★★★★ |

| Ascendis Pharma | 33.38% | 57.92% | ★★★★★★ |

Click here to see the full list of 234 stocks from our US High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

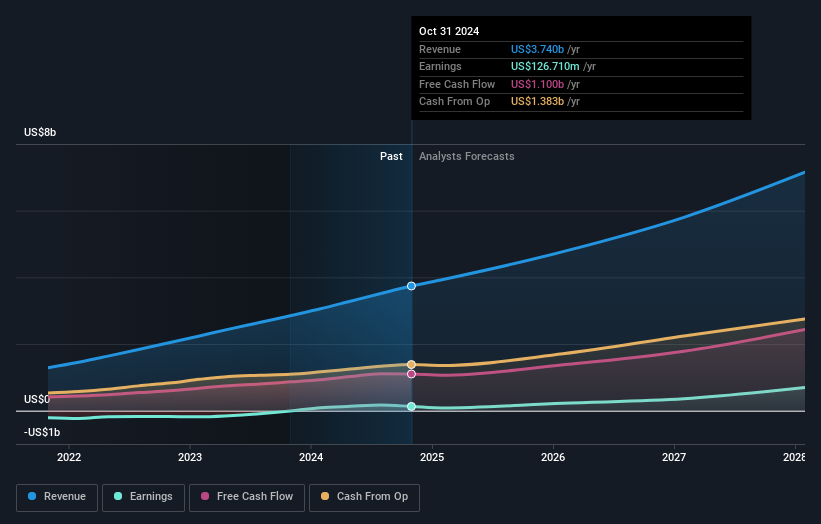

AppLovin (NasdaqGS:APP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: AppLovin Corporation develops a software-based platform aimed at improving content marketing and monetization for advertisers globally, with a market cap of approximately $129.32 billion.

Operations: The company generates revenue primarily through its Advertising segment, which accounts for $3.22 billion, and its Apps segment, contributing $1.49 billion.

AppLovin's recent performance showcases a robust trajectory in the tech sector, with a striking 344.3% increase in earnings over the past year and expectations for continued growth at 31% annually, outpacing the US market's 14.5%. This growth is underpinned by significant R&D investments, aligning with its revenue surge to $1.37 billion in Q4 2024 from $953 million the previous year. Additionally, AppLovin's strategic expansion through client partnerships, like with MiMedia for enhanced monetization on mobile platforms, underscores its innovative approach to capturing more of the digital advertising market. Despite a volatile share price and high debt levels, these aggressive growth strategies and solid financial outcomes position it intriguingly for future prospects in high-tech sectors.

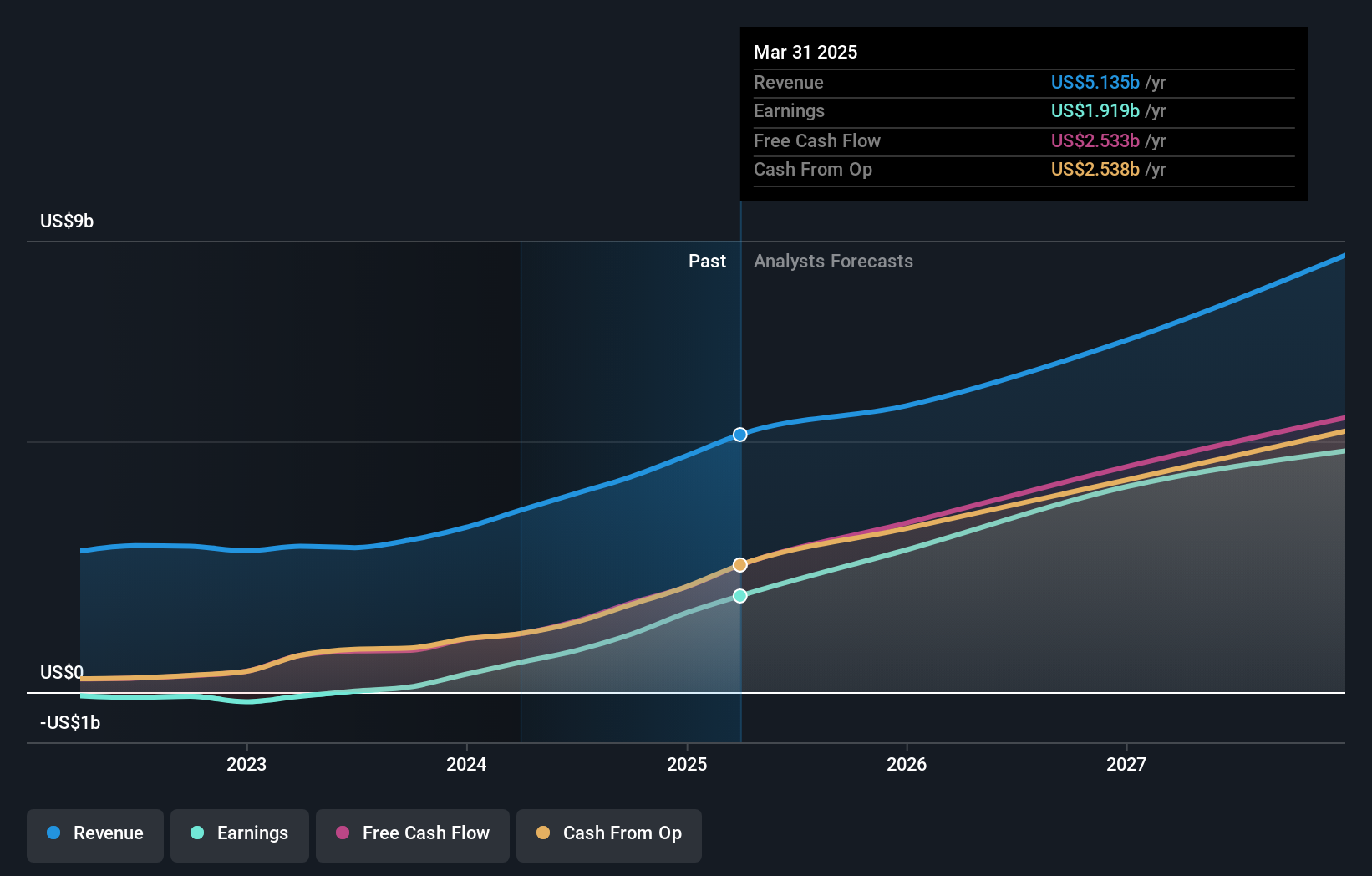

CrowdStrike Holdings (NasdaqGS:CRWD)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CrowdStrike Holdings, Inc. offers cybersecurity solutions both in the United States and internationally, with a market capitalization of $107.05 billion.

Operations: CrowdStrike Holdings generates revenue primarily from its Security Software & Services segment, which accounted for $3.74 billion. The company's business model focuses on providing comprehensive cybersecurity solutions to a global clientele.

CrowdStrike Holdings continues to redefine cybersecurity with its recent launch of Charlotte AI Detection Triage, demonstrating a significant leap in AI-driven security operations. This innovation not only enhances the efficiency of SOC teams by autonomously analyzing threats with over 98% accuracy but also integrates seamlessly into existing systems like the Falcon® platform, ensuring robust defense mechanisms against increasingly sophisticated cyber threats. The company's strategic collaborations, such as the recent integration with Commvault and Cognizant, leverage CrowdStrike's advanced threat intelligence to fortify cybersecurity measures across diverse IT environments. These partnerships underscore CrowdStrike's commitment to evolving enterprise security landscapes and maintaining high operational standards in response to dynamic cyber challenges.

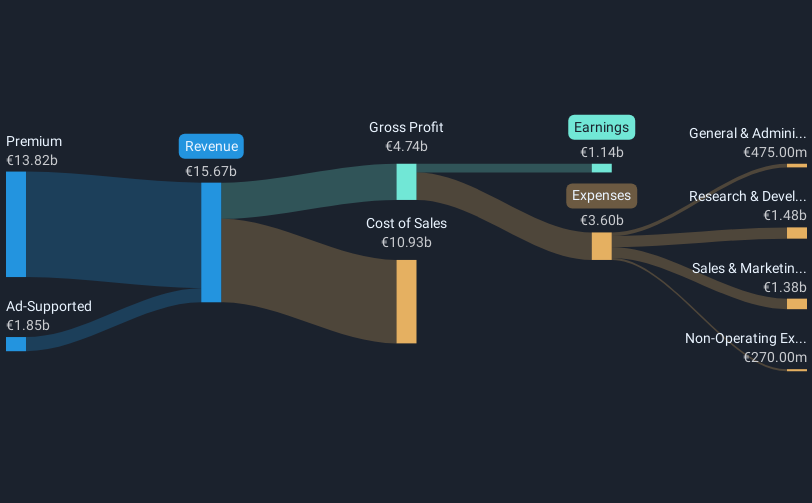

Spotify Technology (NYSE:SPOT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Spotify Technology S.A. operates as a global provider of audio streaming subscription services and has a market capitalization of approximately $130.58 billion.

Operations: Spotify generates revenue primarily through its Premium subscription service, which brought in €13.82 billion, and its Ad-Supported segment, contributing €1.85 billion. The company focuses on providing a diverse range of audio content to users worldwide.

Spotify Technology has demonstrated robust growth with a 12% annual revenue increase, outpacing the US market's 8.8% expansion. The company's earnings are expected to surge by 23.6% annually, reflecting its successful transition to profitability this year. A recent strategic alliance with Warner Music Group underscores Spotify’s commitment to enhancing artist and songwriter revenues through innovative royalty models and expanded music publishing rights in the U.S., promising sustained growth in a dynamic industry landscape. Moreover, Spotify's R&D focus is evident from its significant investment in new technologies and partnerships like the integration within Opera One’s browser, ensuring it remains at the forefront of digital music innovation.

- Navigate through the intricacies of Spotify Technology with our comprehensive health report here.

Assess Spotify Technology's past performance with our detailed historical performance reports.

Where To Now?

- Unlock our comprehensive list of 234 US High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWD

CrowdStrike Holdings

Provides cybersecurity solutions in the United States and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives