- United States

- /

- Interactive Media and Services

- /

- NYSE:SNAP

Snap (SNAP) Valuation Check as Board Expansion Brings in Veteran Executive Matthew McRae

Reviewed by Simply Wall St

Snap (SNAP) just expanded its board to twelve directors and added Matthew McRae, a veteran operator from Arlo, NETGEAR, and Vizio, a move that hints at a more execution focused chapter for the company.

See our latest analysis for Snap.

Even with McRae coming in to sharpen execution, Snap’s 30 day share price return of minus 15.29 percent and year to date slide of 35.41 percent suggest momentum has been fading. The 1 year total shareholder return of minus 35.06 percent reflects investors still reassessing its long term earnings power.

If this board refresh has you rethinking your tech exposure, it might be a good moment to explore other high growth opportunities across high growth tech and AI stocks.

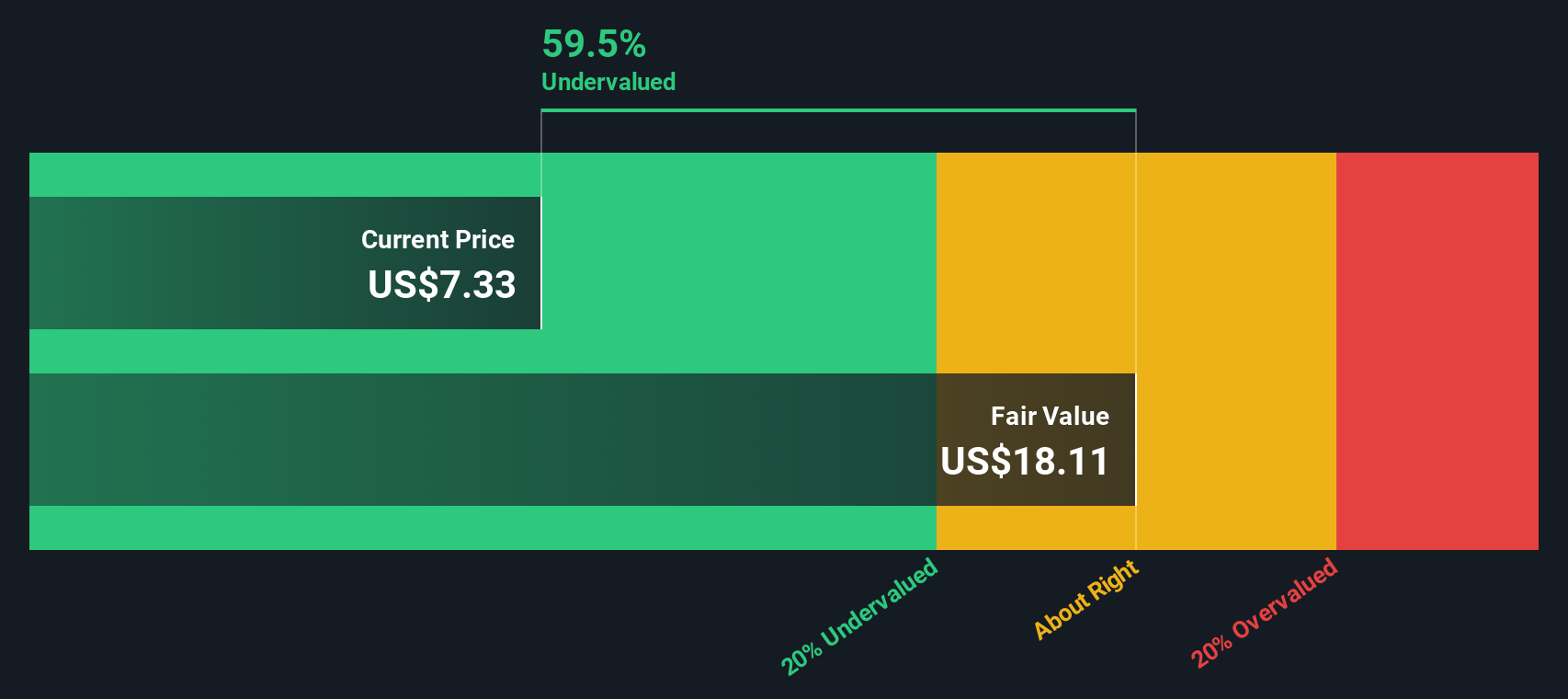

With shares down sharply despite double digit revenue growth and a hefty discount to analyst targets, is Snap being punished too harshly for its losses, or is the market already baking in all the future upside?

Most Popular Narrative Narrative: 26.5% Undervalued

With Snap closing at $7.26 versus a narrative fair value near $9.87, the story hinges on whether future margins and growth can close that gap.

Monetization progress in subscription products such as Snapchat+ and Lens+, alongside growing engagement with Spotlight and creator driven content, is diversifying Snap's revenue base and improving net margin potential by capturing higher margin direct to consumer and content revenue streams.

Curious how steady double digit growth, rising margins, and a richer ad mix might justify a re rating from here? The narrative lays out specific revenue, margin, and valuation assumptions that could redefine what “full value” looks like for Snap, but the exact thresholds may surprise you.

Result: Fair Value of $9.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, advertisers shifting spend to larger platforms and mounting regulatory pressures on youth safety could easily derail Snap’s path to higher margin, AI-driven growth.

Find out about the key risks to this Snap narrative.

Another View: Cash Flows Tell a Different Story

While the narrative fair value puts Snap at $9.87, our DCF model is more optimistic, pointing to a fair value near $13, around 44 percent above today’s price. If the cash flow path plays out, are investors mispricing a long runway of improvement?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Snap Narrative

If you prefer digging into the numbers yourself and challenging these assumptions, you can craft a personalized Snap thesis in just a few minutes: Do it your way.

A great starting point for your Snap research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, give yourself an edge by using the Simply Wall Street Screener to uncover fresh, data driven stock ideas you might otherwise overlook.

- Capture early stage potential by scanning these 3627 penny stocks with strong financials that pair tiny price tags with surprisingly resilient fundamentals and real business traction.

- Ride the next wave of innovation by zeroing in on these 25 AI penny stocks positioned at the intersection of machine learning breakthroughs and accelerating enterprise adoption.

- Focus on income and stability by targeting these 13 dividend stocks with yields > 3% that may strengthen your portfolio with cash returns and disciplined capital allocation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNAP

Snap

Operates as a technology company in North America, Europe, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)