- United States

- /

- Interactive Media and Services

- /

- NYSE:SNAP

Snap (NYSE:SNAP) Stock Falls 13% As Company Conducts US$1.5 Billion Senior Notes Offering

Reviewed by Simply Wall St

Snap (NYSE:SNAP) recently announced a strategic partnership with Later, aiming to optimize marketing activities on Snapchat by integrating key capabilities such as creator discovery and content scheduling. Meanwhile, the company also conducted a $1.5 billion senior notes offering to strategically manage its debt. Despite these potentially positive developments, shares declined 13% over the past week. This price movement occurred against a backdrop of a broader market rebound, with the S&P 500 and Nasdaq registering gains on Friday as tech stocks rallied. However, prior to that, both indexes had experienced significant losses, with the S&P 500 entering correction territory amid inflation fears and potential economic slowdown concerns. Snap's share price performance might also reflect broader investor sentiment affected by market volatility and economic uncertainties despite its efforts to strengthen its platform and financial position.

Take a closer look at Snap's potential here in our financial health report.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

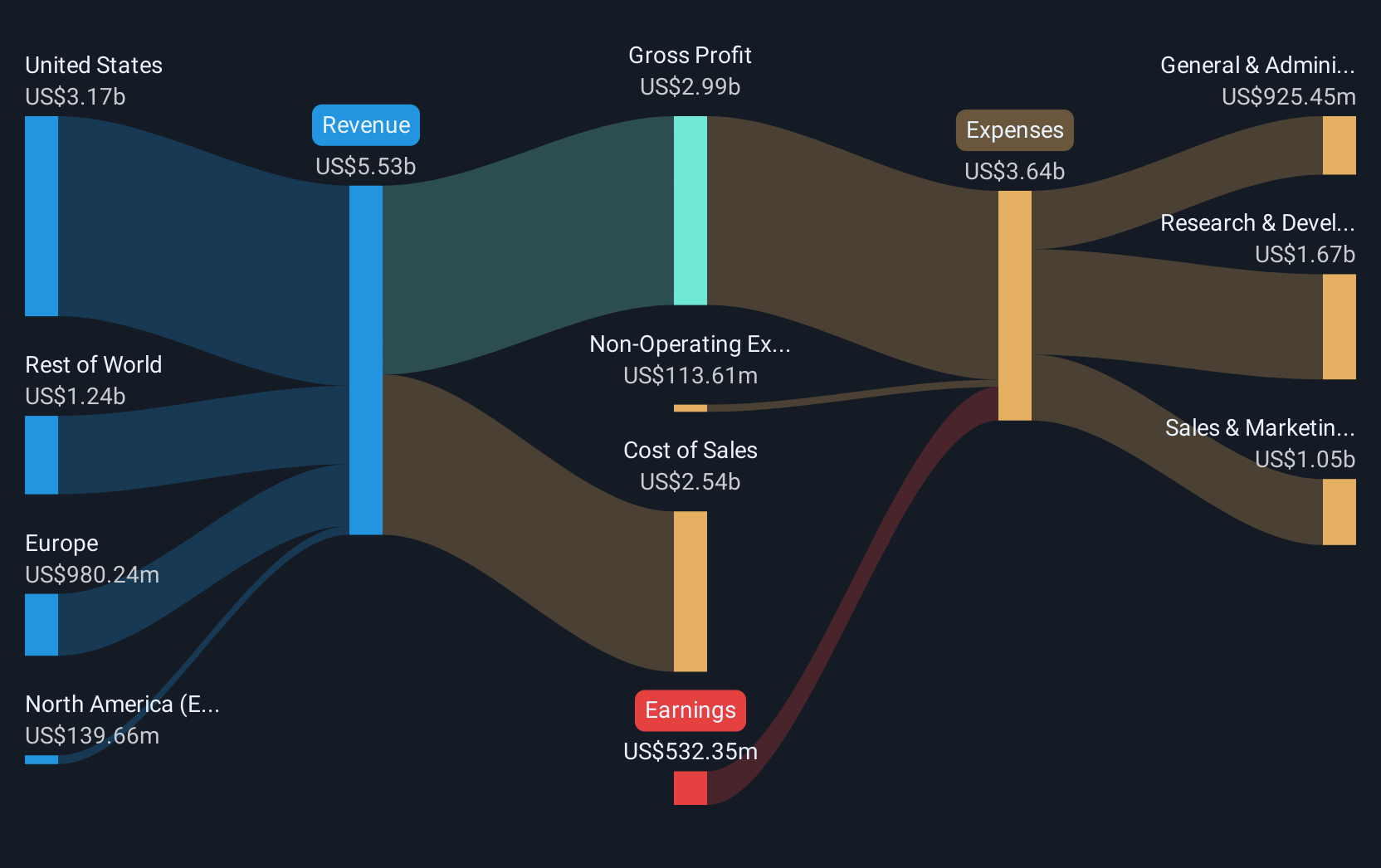

Over the last five years, Snap’s total shareholder return was a decline of 11.62%. This period has seen several significant developments at Snap, including the formation of a strategic partnership with Later and a recent earnings report showing a shift from previous losses to a small net income, signaling a potential turnaround. Despite these changes, Snap’s share performance underperformed both the broader market and the US Interactive Media and Services industry over the past year, which saw returns of 6.6% and 15% respectively.

The completion of a $1.5 billion senior notes offering in February 2025 highlights Snap’s focus on financial restructuring. However, despite these financial strategies, significant insider selling over the past quarter might have raised concerns among investors. Additionally, a class-action lawsuit filed in early 2025 adds to the challenges Snap faces, impacting investor sentiment. Interestingly, the company's Price-To-Sales Ratio suggests it trades below its estimated fair value, offering a potential opportunity for value investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNAP

Snap

Operates as a technology company in North America, Europe, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives