- United States

- /

- Interactive Media and Services

- /

- NYSE:SNAP

Snap Inc.'s (NYSE: SNAP) Decline: The Writing Was on the Insiders Wall

Snap Inc. (NYSE: SNAP) was one of the companies that became multi-baggers after the Covid-19 crash. Social distancing prompted the population to look for it online, giving a tailwind to the sector.

Yet, even through the best of times, the company perpetually danced on the edge of profitability. Now, after the optimism has subsided and realism is setting in – the market is swinging to the other side of the ship.

Check out our latest analysis for Snap

An Unusual Warning

Snapchat shares are plunging today after the company announced that its Q2 revenue and EBITDA would be below the low-end of its previous guidance. This announcement, which came out just a month after the last published earnings, is alarming because we have just passed half of the second quarter.

As of today, the stock trades around US$13, which is over 80% below the peak achieved in September 2021.

Reflecting on the development, KeyBanc Capital Markets analyst Justin Patterson lowered the price target to US$27 (from US$45). Yet, that still presents over 100% upside from the current levels. Meanwhile, Benchmark analyst Mark Zgutowicz lowered the target from US$40 to US$20, noting the end of the company's fingerprint benefits on iOS.

Following the Money

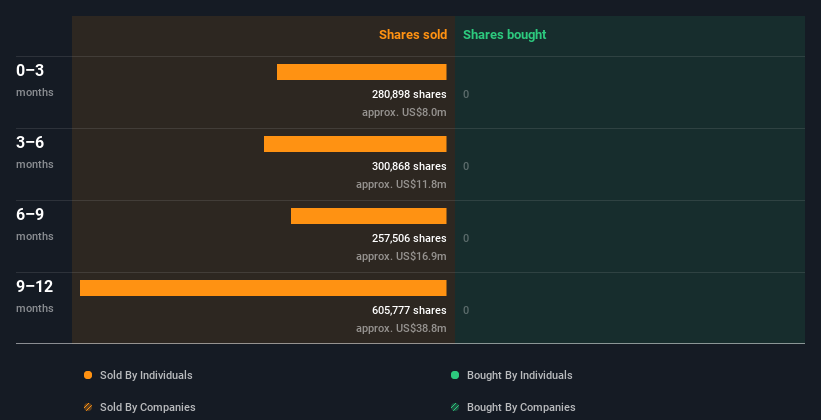

About a month ago, we published an article titled "Insider Selling at Snap Shows no Signs of Slowing Down," in which we took a look into insider transactions. They showed significant sellings over the last 12 months and a total lack of insider buying – a possible red flag for the investors.

Here is the latest data from our platform, where we can see insider selling as fresh as last week.

NYSE: SNAP Insider Trading Volume May 24th, 2022

If you're looking for a possible opportunity, check out this free list of growing companies with considerable, recent, insider buying.

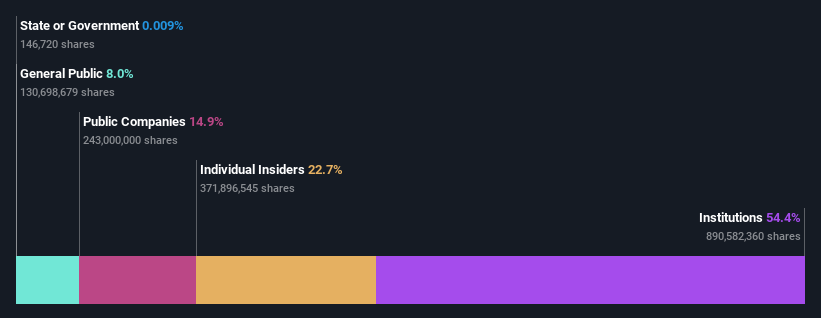

Over the last months, insiders have been steadily selling, taking their stake down to 22.7%, as seen from the following data.

NYSE: SNAP Ownership Breakdown May 24th, 2022

A notable standout is general public which owns only 8% of the company. This is an interesting observation since we can conclude that the decline isn't retail-driven. In turn, that creates a lower chance of the sell-off based on the sentiment shift but rather a fundamental concern from institutional investors.

Conclusion

Overall, Snap shareholders are down 71% year to date. Unfortunately, that's worse than the broader market decline of 11%. Having said that, it's inevitable that some stocks will be oversold in a falling market, but Snapchat's decline looks to be structural, not impulsive.

At present, that seems to be the stocks that are poorly adjusted to the ongoing inflation, those that experienced a growth slowdown, and those that have concerns about profitability in the incoming period – such as stocks that heavily rely on advertising revenues.

So while it's helpful to know what insiders are doing in terms of buying or selling, it's also beneficial to understand the risks that a particular company is facing. You'd be interested to know that we found 3 warning signs for Snap, and we suggest you have a look.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:SNAP

Snap

Operates as a technology company in North America, Europe, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives