- United States

- /

- Software

- /

- NasdaqGS:INTU

3 US Stocks Estimated To Be 24.7% To 47.4% Below Their Intrinsic Value

Reviewed by Simply Wall St

As the Nasdaq Composite reaches new record highs and investors eagerly anticipate earnings reports from major tech companies, the U.S. stock market is experiencing a period of heightened activity and optimism. Amidst this buoyant environment, identifying stocks that are currently undervalued can offer potential opportunities for investors looking to capitalize on discrepancies between market prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Bank of Marin Bancorp (NasdaqCM:BMRC) | $22.90 | $44.35 | 48.4% |

| California Resources (NYSE:CRC) | $52.09 | $104.09 | 50% |

| Atlanticus Holdings (NasdaqGS:ATLC) | $37.65 | $72.49 | 48.1% |

| Vita Coco Company (NasdaqGS:COCO) | $30.78 | $60.61 | 49.2% |

| Range Resources (NYSE:RRC) | $31.00 | $60.06 | 48.4% |

| WEX (NYSE:WEX) | $173.16 | $346.09 | 50% |

| Vitesse Energy (NYSE:VTS) | $24.94 | $49.27 | 49.4% |

| ChromaDex (NasdaqCM:CDXC) | $3.62 | $7.15 | 49.4% |

| Reddit (NYSE:RDDT) | $81.74 | $161.24 | 49.3% |

| Rapid7 (NasdaqGM:RPD) | $41.60 | $81.38 | 48.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Advanced Micro Devices (NasdaqGS:AMD)

Overview: Advanced Micro Devices, Inc. is a global semiconductor company with a market capitalization of approximately $258.83 billion.

Operations: The company generates revenue from four main segments: Client ($5.77 billion), Gaming ($4.44 billion), Embedded ($4.01 billion), and Data Center ($9.05 billion).

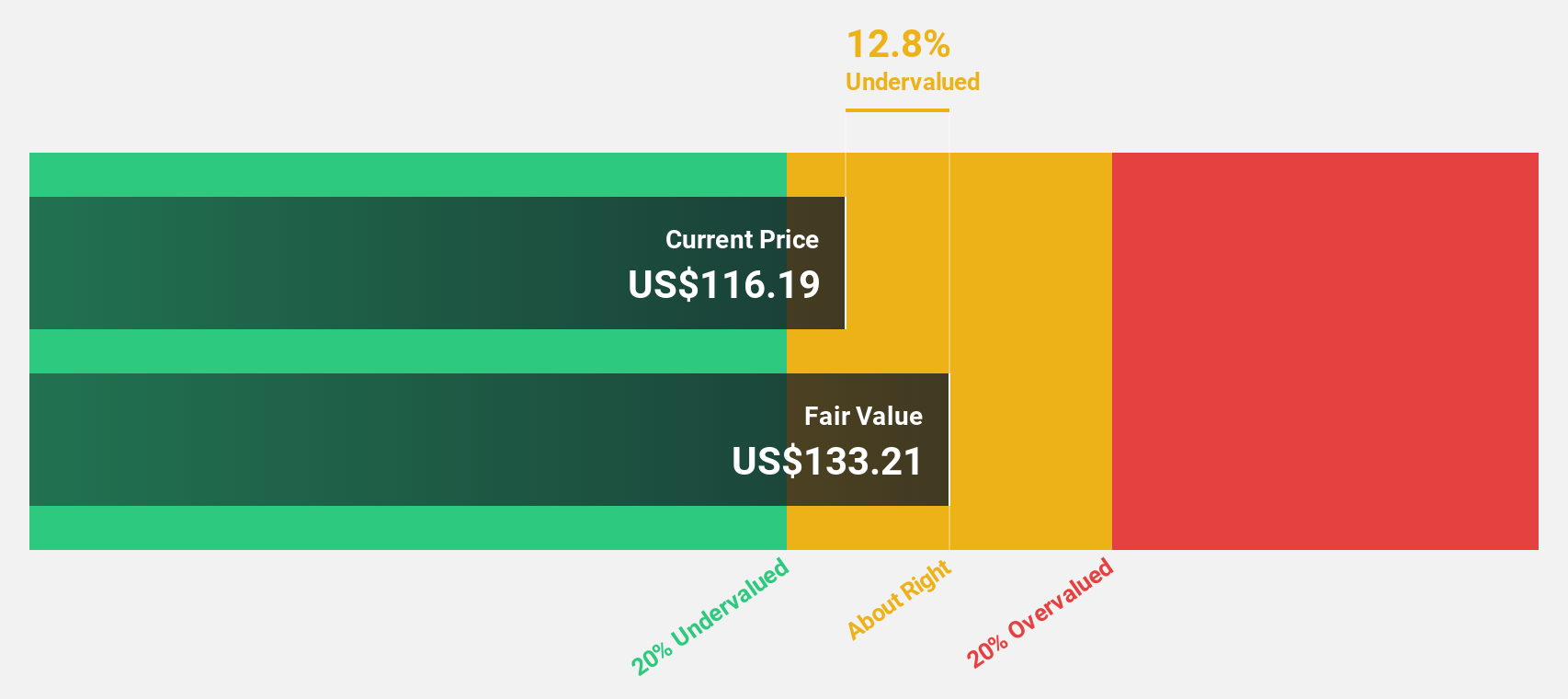

Estimated Discount To Fair Value: 24.7%

Advanced Micro Devices appears undervalued based on cash flows, trading at US$166.25, below its estimated fair value of US$220.89. Recent earnings reports show significant growth; Q3 sales rose to US$6.82 billion from US$5.8 billion last year, with net income increasing to US$771 million from US$299 million. The company expects Q4 revenue of approximately $7.5 billion, indicating strong ongoing performance and potential for continued profitability improvements in the near term.

- Insights from our recent growth report point to a promising forecast for Advanced Micro Devices' business outlook.

- Dive into the specifics of Advanced Micro Devices here with our thorough financial health report.

Intuit (NasdaqGS:INTU)

Overview: Intuit Inc. is a company that offers financial management, compliance, and marketing products and services in the United States, with a market cap of $171.56 billion.

Operations: The company's revenue is primarily derived from its Small Business and Self-Employed segment at $9.53 billion, followed by the Consumer segment at $4.45 billion, Credit Karma at $1.71 billion, and Pro-Tax at $599 million.

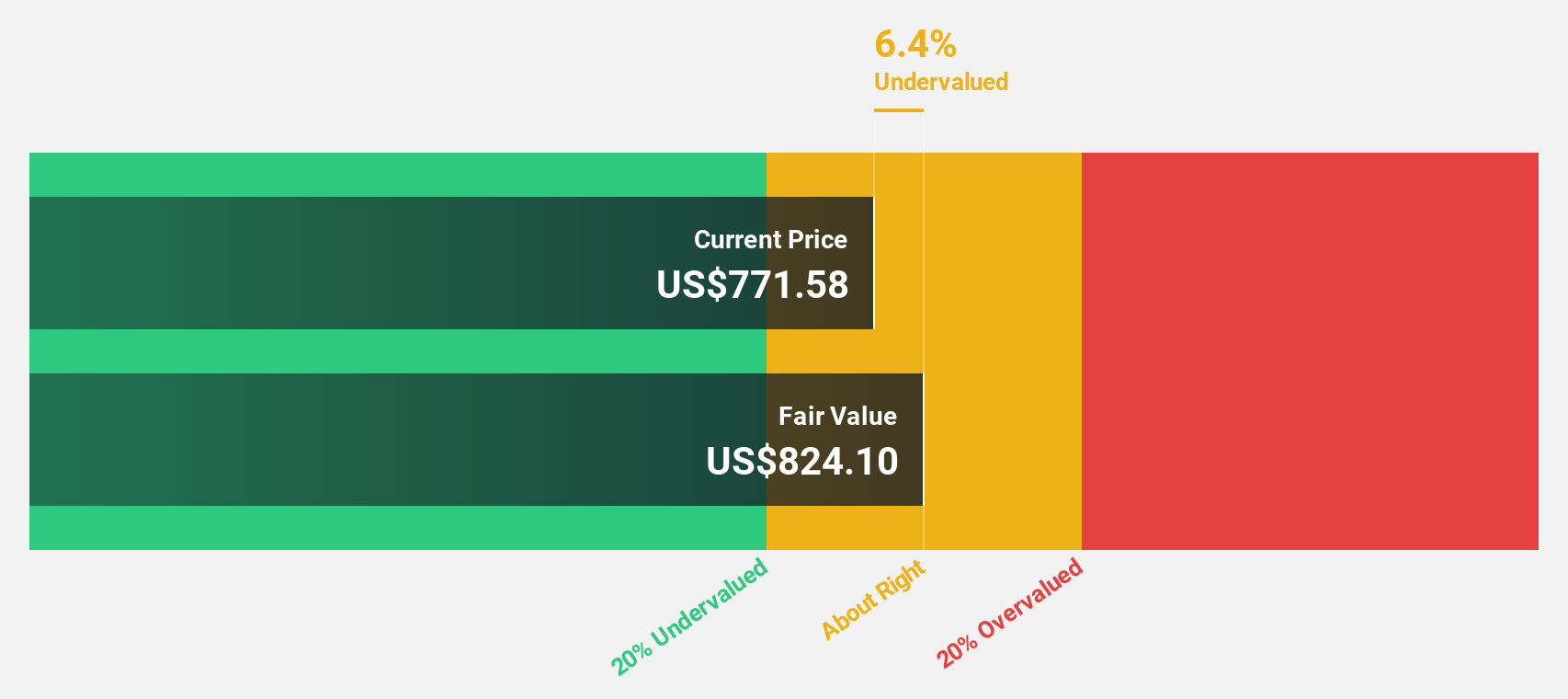

Estimated Discount To Fair Value: 35.5%

Intuit is trading at US$623.7, significantly below its estimated fair value of US$967.09, highlighting potential undervaluation based on cash flows. Revenue growth is expected to outpace the broader U.S. market, with earnings projected to grow 16.5% annually, surpassing market averages. However, recent insider selling may raise concerns for some investors. Intuit's focus on AI-driven innovations and enterprise solutions aims to enhance productivity and profitability for mid-market businesses and accounting professionals alike.

- Our comprehensive growth report raises the possibility that Intuit is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Intuit.

Snap (NYSE:SNAP)

Overview: Snap Inc. is a technology company that operates in North America, Europe, and internationally with a market cap of approximately $17.77 billion.

Operations: The company's revenue is primarily derived from its Software & Programming segment, which generated approximately $4.98 billion.

Estimated Discount To Fair Value: 47.4%

Snap is trading at US$10.89, considerably below its fair value estimate of US$20.72, suggesting undervaluation based on cash flows. Revenue growth is forecasted to exceed the U.S. market average at 11.9% annually, with profitability expected within three years. Despite significant insider selling recently, Snap's share repurchase program worth up to $500 million reflects management's confidence in its financial health and future prospects amidst improving sales and narrowing net losses.

- In light of our recent growth report, it seems possible that Snap's financial performance will exceed current levels.

- Take a closer look at Snap's balance sheet health here in our report.

Taking Advantage

- Investigate our full lineup of 195 Undervalued US Stocks Based On Cash Flows right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTU

Intuit

Provides financial management, compliance, and marketing products and services in the United States.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives