- United States

- /

- Software

- /

- NasdaqGS:CRWD

US Stocks That May Be Priced Below Intrinsic Value Estimates In October 2024

Reviewed by Simply Wall St

As of October 2024, the U.S. stock market is experiencing mixed performances amid a wave of earnings reports, with the Nasdaq Composite rising for its fifth consecutive session while the Dow Jones Industrial Average and S&P 500 see slight declines. In this environment, identifying stocks that may be priced below their intrinsic value can offer potential opportunities for investors seeking to navigate these fluctuating market conditions effectively.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Western Alliance Bancorporation (NYSE:WAL) | $82.34 | $162.91 | 49.5% |

| MidWestOne Financial Group (NasdaqGS:MOFG) | $29.11 | $57.14 | 49.1% |

| Associated Banc-Corp (NYSE:ASB) | $22.42 | $43.47 | 48.4% |

| Atlanticus Holdings (NasdaqGS:ATLC) | $36.92 | $72.49 | 49.1% |

| EQT (NYSE:EQT) | $35.97 | $69.67 | 48.4% |

| UFP Technologies (NasdaqCM:UFPT) | $276.41 | $537.49 | 48.6% |

| Vitesse Energy (NYSE:VTS) | $24.91 | $49.16 | 49.3% |

| Fiverr International (NYSE:FVRR) | $21.53 | $42.25 | 49% |

| Bowhead Specialty Holdings (NYSE:BOW) | $29.15 | $57.38 | 49.2% |

| Reddit (NYSE:RDDT) | $77.29 | $153.96 | 49.8% |

Let's take a closer look at a couple of our picks from the screened companies.

CrowdStrike Holdings (NasdaqGS:CRWD)

Overview: CrowdStrike Holdings, Inc. offers cybersecurity solutions globally and has a market cap of approximately $75.88 billion.

Operations: CrowdStrike Holdings generates revenue primarily from its Security Software & Services segment, amounting to $3.52 billion.

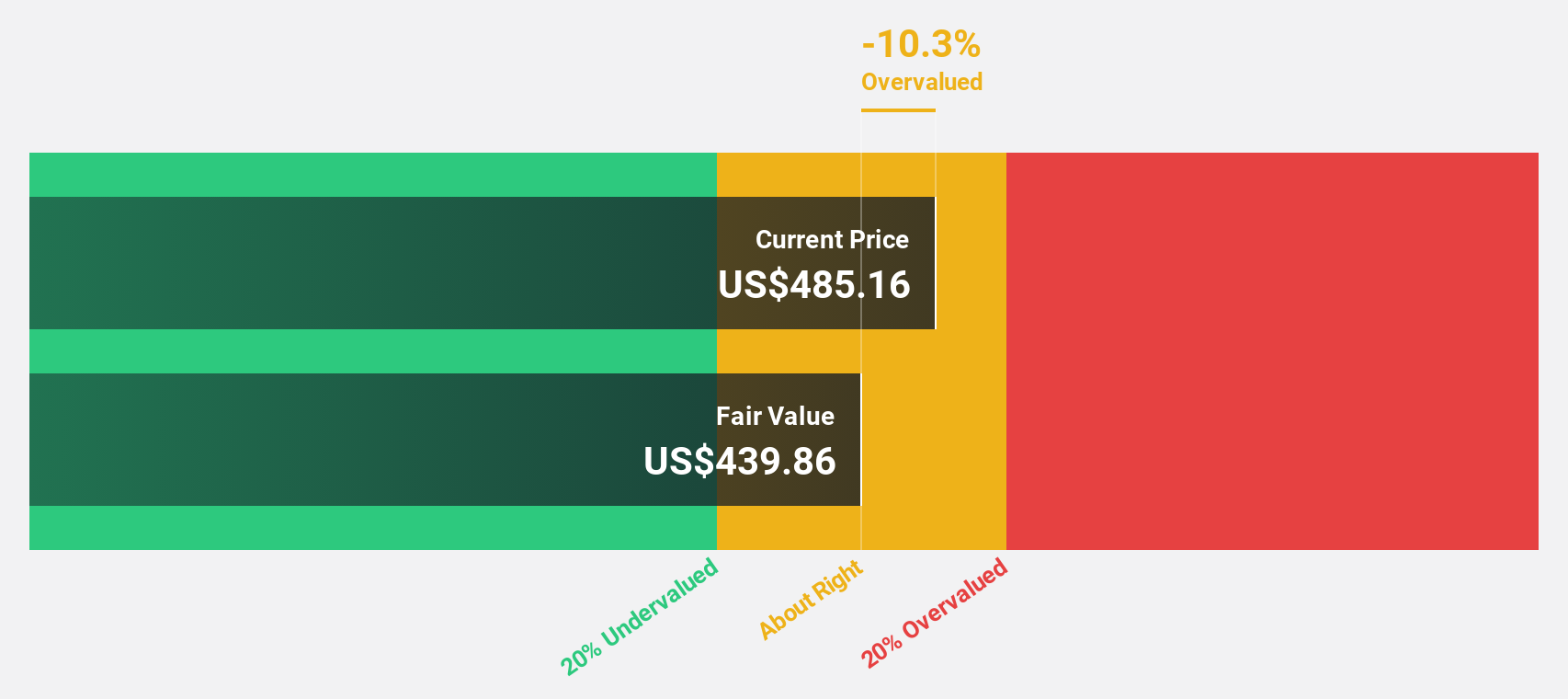

Estimated Discount To Fair Value: 26.6%

CrowdStrike Holdings is trading below its estimated fair value, presenting potential undervaluation based on cash flows. Despite recent legal challenges and insider selling, the company's earnings are forecasted to grow significantly faster than the US market. Recent strategic partnerships and innovations in cybersecurity enhance its competitive position. However, shareholder dilution over the past year could be a concern for investors evaluating long-term value creation.

- Insights from our recent growth report point to a promising forecast for CrowdStrike Holdings' business outlook.

- Click to explore a detailed breakdown of our findings in CrowdStrike Holdings' balance sheet health report.

DexCom (NasdaqGS:DXCM)

Overview: DexCom, Inc. is a medical device company that specializes in the design, development, and commercialization of continuous glucose monitoring systems both in the United States and internationally, with a market cap of approximately $29.10 billion.

Operations: The company generates revenue primarily from its patient monitoring equipment segment, amounting to $3.93 billion.

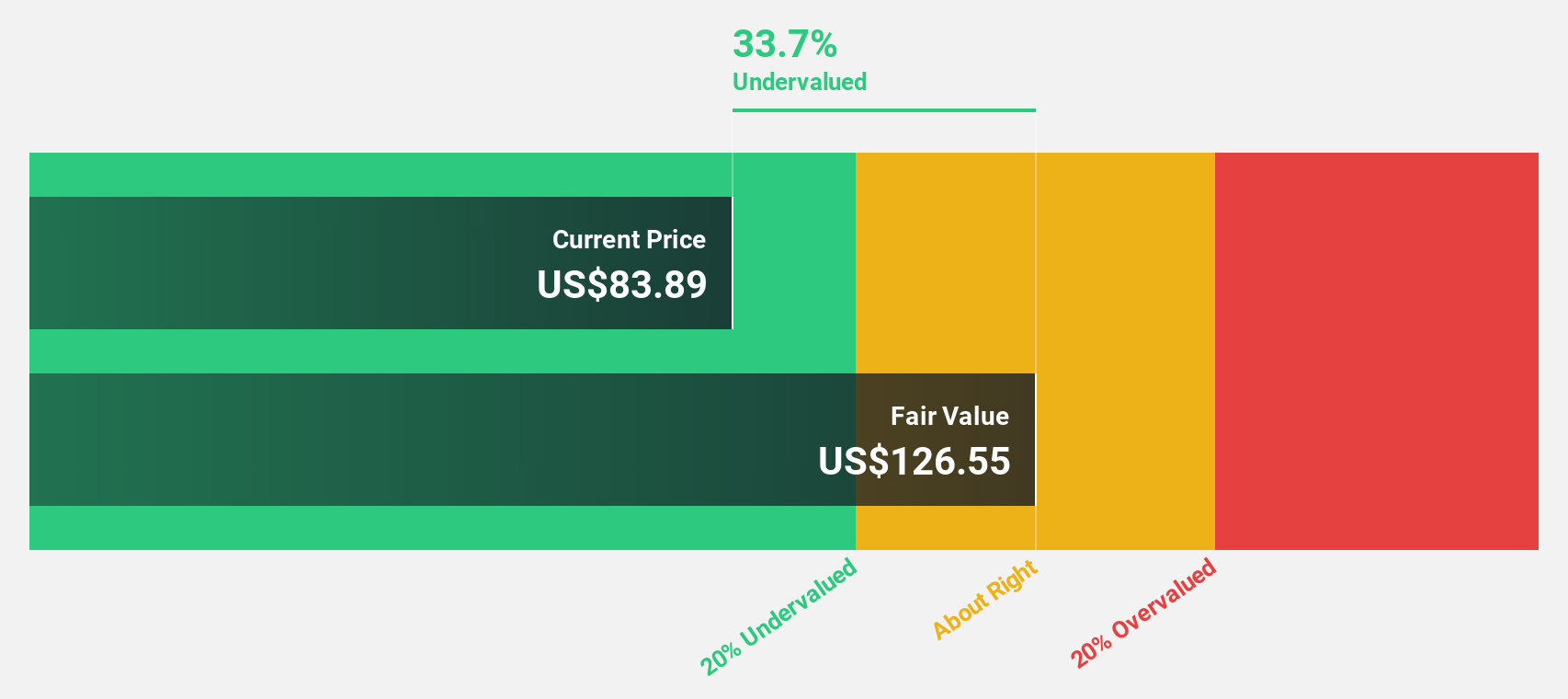

Estimated Discount To Fair Value: 41.1%

DexCom is trading significantly below its estimated fair value, highlighting potential undervaluation based on cash flows. Despite facing legal challenges and a volatile share price, the company's earnings are projected to grow faster than the US market. Recent product innovations, such as the Stelo glucose biosensor, strengthen its market position in diabetes management. However, issues with sales force strategy and distributor relationships pose risks to revenue growth and investor confidence.

- Our comprehensive growth report raises the possibility that DexCom is poised for substantial financial growth.

- Navigate through the intricacies of DexCom with our comprehensive financial health report here.

Sea (NYSE:SE)

Overview: Sea Limited operates in digital entertainment, e-commerce, and digital financial services across Southeast Asia, Latin America, and other international markets with a market cap of approximately $56.91 billion.

Operations: The company's revenue segments include digital entertainment, e-commerce, and digital financial services across various international markets.

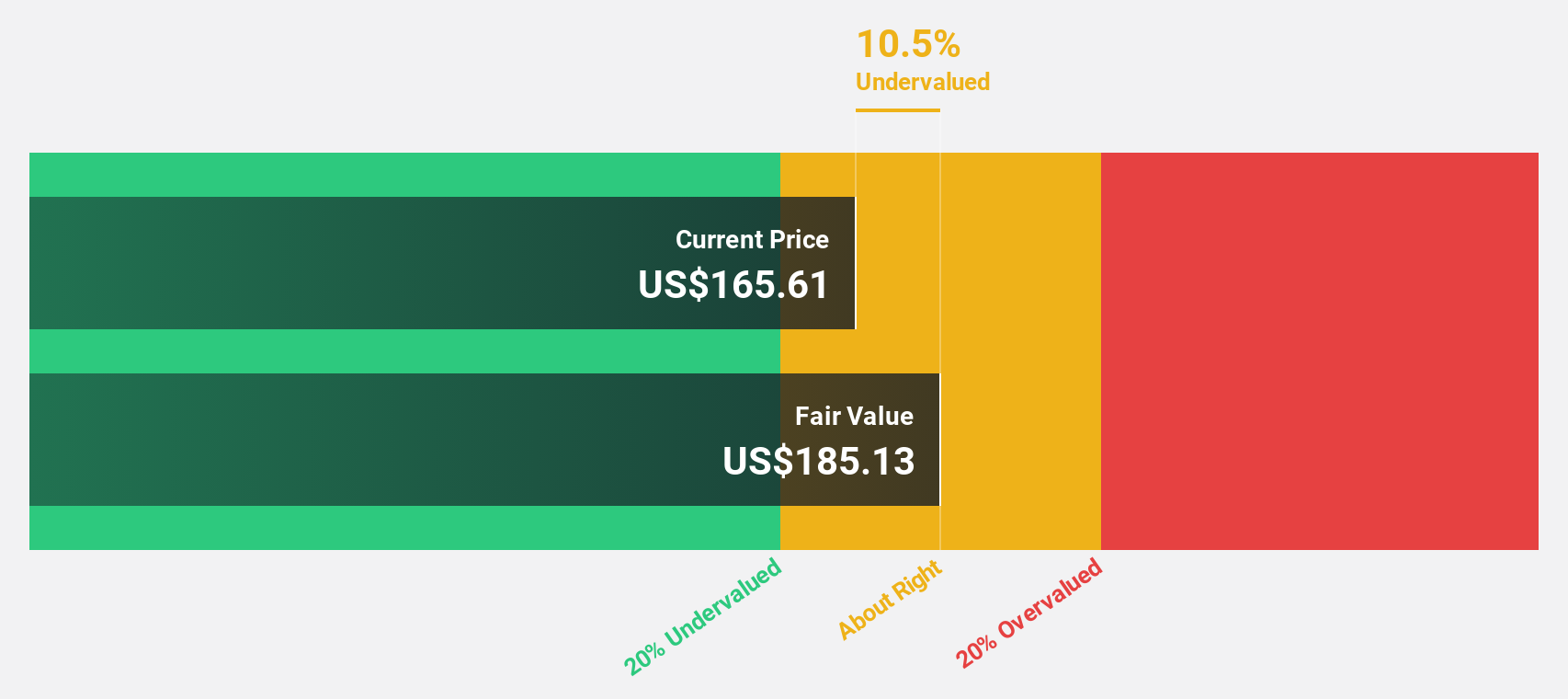

Estimated Discount To Fair Value: 32.5%

Sea Limited is trading at US$99.59, significantly below its estimated fair value of US$147.49, indicating potential undervaluation based on cash flows. Revenue growth is forecasted at 12.9% annually, outpacing the broader US market's growth rate and contributing to expected profitability within three years. However, recent earnings reports show a decline in net income compared to last year, which may impact investor sentiment despite the company's positive long-term outlook on revenue and profit growth.

- According our earnings growth report, there's an indication that Sea might be ready to expand.

- Take a closer look at Sea's balance sheet health here in our report.

Make It Happen

- Click here to access our complete index of 192 Undervalued US Stocks Based On Cash Flows.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWD

CrowdStrike Holdings

Provides cybersecurity solutions in the United States and internationally.

High growth potential with excellent balance sheet.