- United States

- /

- Medical Equipment

- /

- NasdaqGS:VREX

Undervalued Small Caps With Insider Buying In The United States October 2024

Reviewed by Simply Wall St

The United States market has remained flat over the past week but has seen a substantial increase of 37% over the past year, with earnings projected to grow by 15% annually in the coming years. In this context, identifying small-cap stocks that are potentially undervalued and exhibit insider buying can be an intriguing strategy for investors seeking opportunities aligned with these market dynamics.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Columbus McKinnon | 20.7x | 0.9x | 43.21% | ★★★★★★ |

| Hanover Bancorp | 9.7x | 2.2x | 46.33% | ★★★★★☆ |

| Franklin Financial Services | 9.5x | 1.9x | 38.51% | ★★★★☆☆ |

| HighPeak Energy | 11.8x | 1.5x | 36.13% | ★★★★☆☆ |

| Citizens & Northern | 13.6x | 2.9x | 43.50% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Orion Group Holdings | NA | 0.3x | -108.23% | ★★★☆☆☆ |

| Sabre | NA | 0.5x | -46.70% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -55.41% | ★★★☆☆☆ |

| Industrial Logistics Properties Trust | NA | 0.6x | -193.52% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

SNDL (NasdaqCM:SNDL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: SNDL is a company involved in liquor retail, cannabis retail, and cannabis operations with a market capitalization of CA$1.02 billion.

Operations: The company generates revenue primarily from Liquor Retail, Cannabis Retail, and Cannabis Operations. Its gross profit margin has shown a positive trend recently, reaching 23.52% as of October 2024.

PE: -7.0x

SNDL, a small company in the U.S., has been making waves with recent leadership changes and strategic presentations. Despite facing a net loss of CAD 5.77 million in Q2 2024, down from CAD 32.52 million the previous year, they show potential for improvement. The appointment of J. Carlo to their board signals insider confidence and strategic shifts as they navigate challenges like high-risk funding sources without customer deposits. With no immediate profitability forecasted within three years, SNDL's focus remains on restructuring and leveraging industry expertise for future growth opportunities.

- Get an in-depth perspective on SNDL's performance by reading our valuation report here.

Examine SNDL's past performance report to understand how it has performed in the past.

Sabre (NasdaqGS:SABR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Sabre is a technology company that provides software and services primarily for the travel and hospitality industries, with a market cap of $1.86 billion.

Operations: Sabre generates revenue primarily from its Travel Solutions and Hospitality Solutions segments, with the former contributing significantly more to its total revenue. The company's cost of goods sold (COGS) has a substantial impact on gross profit, which has shown variability over time, reaching 59.47% in recent periods. Operating expenses are largely driven by research and development costs, along with general and administrative expenses.

PE: -3.1x

Sabre, a technology solutions provider for the travel industry, has been making strides with strategic partnerships and board changes. Recent agreements with Riyadh Air and Arajet highlight its innovative AI-driven offerings, enhancing airline retailing capabilities. Despite financial challenges like a net loss of US$69.76 million in Q2 2024, insider confidence is evident through recent share purchases by executives. With earnings projected to grow over 90% annually, Sabre's future holds potential amidst its competitive landscape.

- Click here and access our complete valuation analysis report to understand the dynamics of Sabre.

Assess Sabre's past performance with our detailed historical performance reports.

Varex Imaging (NasdaqGS:VREX)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Varex Imaging specializes in designing and manufacturing X-ray imaging components for medical and industrial applications, with a market capitalization of approximately $1.01 billion.

Operations: Varex Imaging derives its revenue primarily from the Medical segment, contributing $601 million, and the Industrial segment, adding $231.70 million. The company's gross profit margin has shown variability over the years, with a recent figure of 32.16%. Operating expenses have been significant, with R&D and General & Administrative costs being notable contributors.

PE: 15.0x

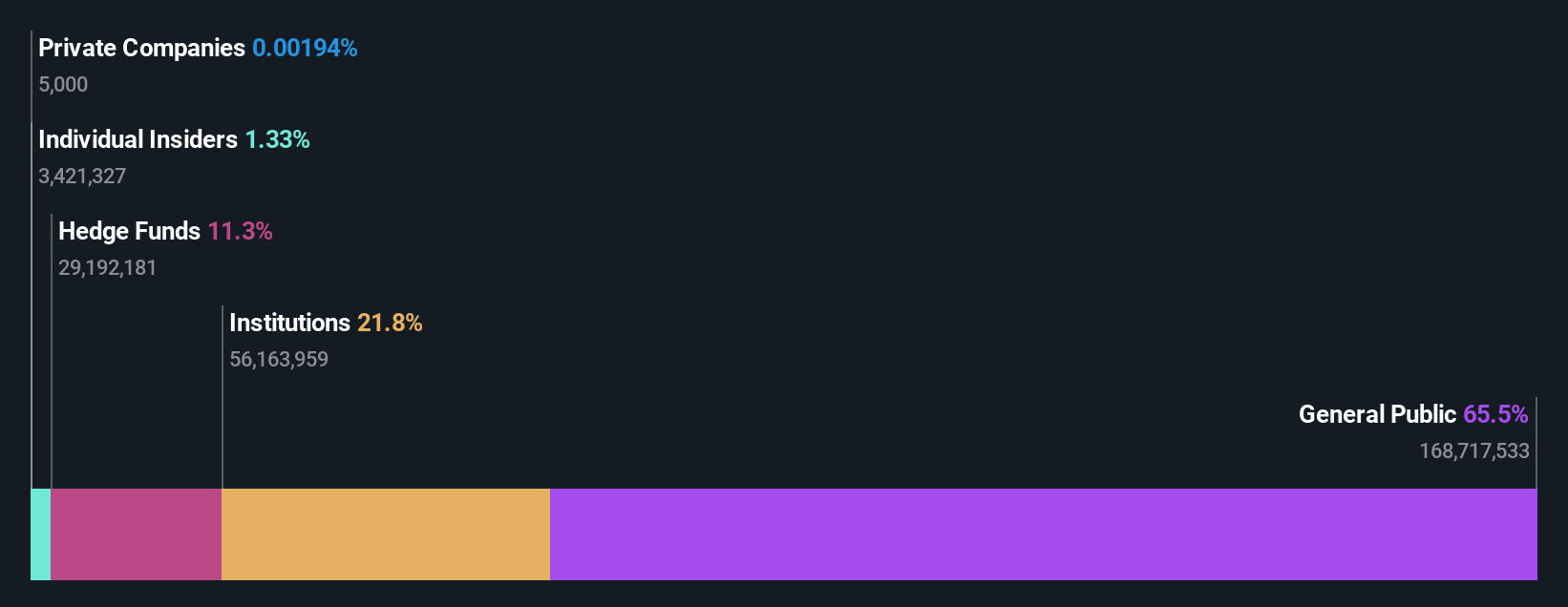

Varex Imaging's recent performance highlights its position as a smaller company with potential value. Despite being dropped from several S&P indices in September 2024, insider confidence is evident as their CFO and Principal Accounting Officer acquired 10,000 shares worth US$108,200. However, financial results show challenges; third-quarter sales fell to US$209 million from US$232 million the previous year. Earnings guidance for Q4 projects revenues between US$190 million and US$210 million, indicating cautious optimism amidst financial restructuring needs.

- Click here to discover the nuances of Varex Imaging with our detailed analytical valuation report.

Review our historical performance report to gain insights into Varex Imaging's's past performance.

Where To Now?

- Access the full spectrum of 51 Undervalued US Small Caps With Insider Buying by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VREX

Fair value with acceptable track record.