- United States

- /

- Banks

- /

- NasdaqGS:PROV

Top US Dividend Stocks To Watch In October 2024

Reviewed by Simply Wall St

As the U.S. stock market navigates a mixed performance amid a wave of earnings reports, with the Nasdaq rising for its fifth consecutive session, investors are keenly observing economic indicators and Federal Reserve actions for insights into future market directions. In such an environment, dividend stocks can offer stability and income potential, making them an attractive option for those looking to balance growth with consistent returns in their investment portfolios.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| WesBanco (NasdaqGS:WSBC) | 4.67% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 5.32% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.23% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.49% | ★★★★★★ |

| Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.62% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.43% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.08% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.74% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.95% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.81% | ★★★★★★ |

Click here to see the full list of 172 stocks from our Top US Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Provident Financial Holdings (NasdaqGS:PROV)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Provident Financial Holdings, Inc., with a market cap of $100.47 million, operates as the holding company for Provident Savings Bank, F.S.B.

Operations: Provident Financial Holdings, Inc. generates its revenue primarily through its banking segment, which accounts for $38.93 million.

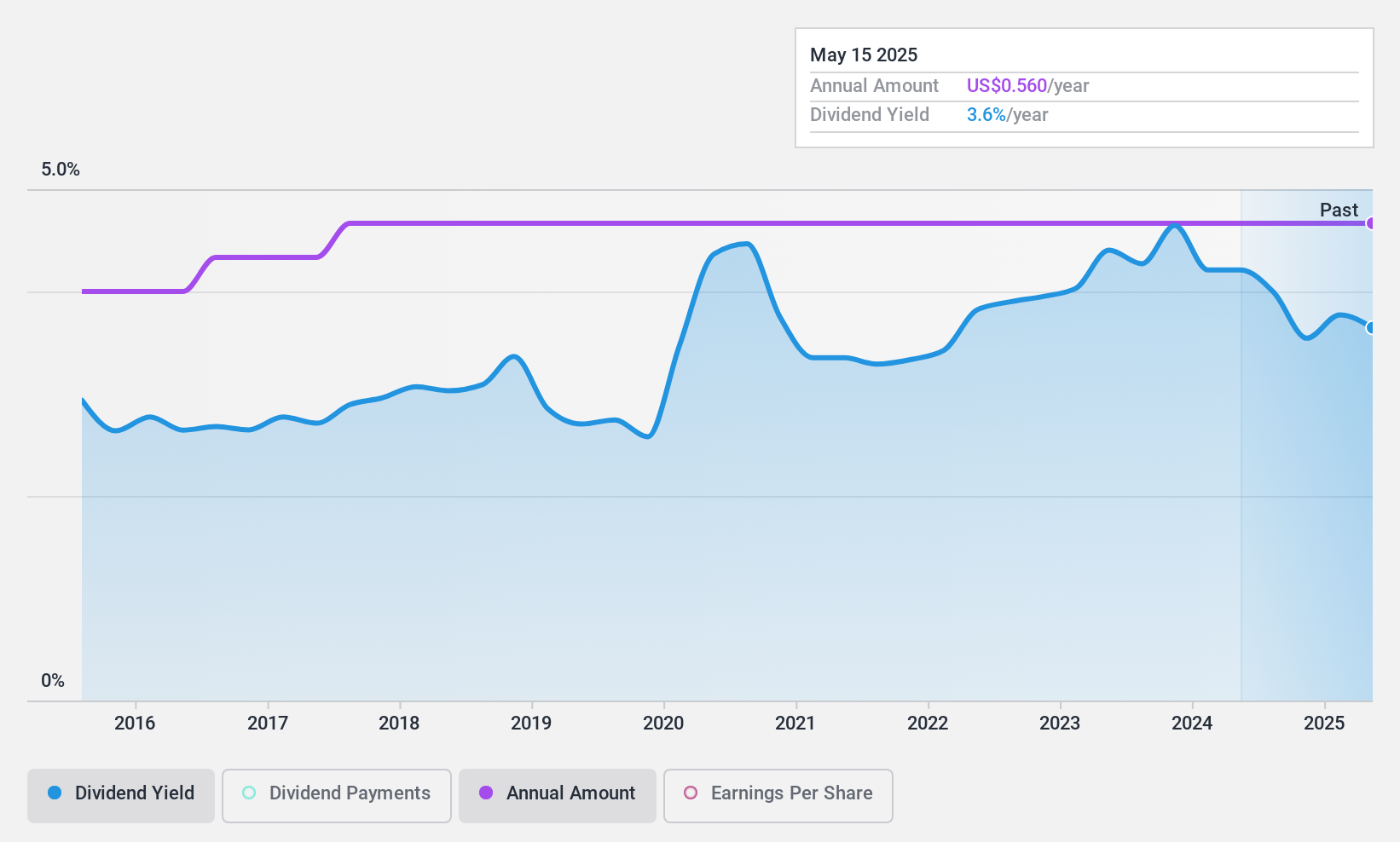

Dividend Yield: 3.7%

Provident Financial Holdings offers a stable dividend profile, with dividends consistently covered by earnings, currently at a 52.9% payout ratio and forecasted to improve to 41.5% in three years. The company has maintained reliable and growing dividends over the past decade, although its yield of 3.71% is below the top quartile in the US market. Recent buybacks and steady earnings growth contribute positively to its valuation attractiveness, trading below estimated fair value.

- Click here and access our complete dividend analysis report to understand the dynamics of Provident Financial Holdings.

- The analysis detailed in our Provident Financial Holdings valuation report hints at an inflated share price compared to its estimated value.

Zions Bancorporation National Association (NasdaqGS:ZION)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zions Bancorporation, National Association offers a range of banking products and services across several western U.S. states, with a market cap of approximately $7.30 billion.

Operations: Zions Bancorporation, National Association generates revenue through various banking products and services across its operational regions.

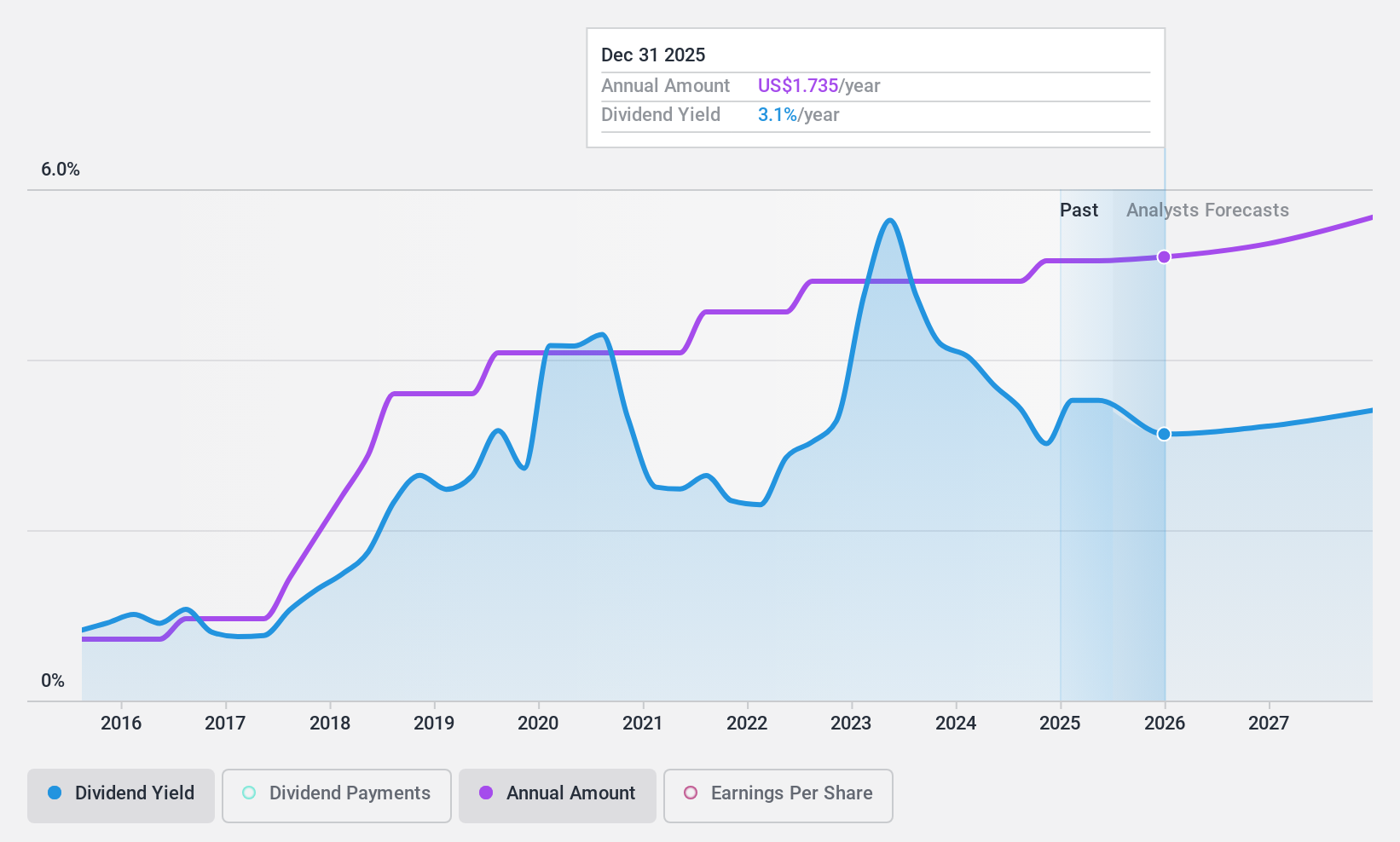

Dividend Yield: 3.1%

Zions Bancorporation's dividends have shown stability and growth over the past decade, with a current yield of 3.12%, lower than the top 25% in the US market. The payout ratio of 37.2% indicates dividends are well covered by earnings, with future coverage expected to improve to 31.8%. Recent earnings results show increased net income and interest income, supporting dividend sustainability despite recent net charge-offs of US$3 million for Q3 2024.

- Click here to discover the nuances of Zions Bancorporation National Association with our detailed analytical dividend report.

- Our valuation report here indicates Zions Bancorporation National Association may be undervalued.

Credicorp (NYSE:BAP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Credicorp Ltd. offers a range of financial, insurance, and health services primarily in Peru and internationally, with a market cap of approximately $14.92 billion.

Operations: Credicorp Ltd.'s revenue segments include financial services generating PEN 12.34 billion, insurance services contributing PEN 8.56 billion, and health services bringing in PEN 3.45 billion.

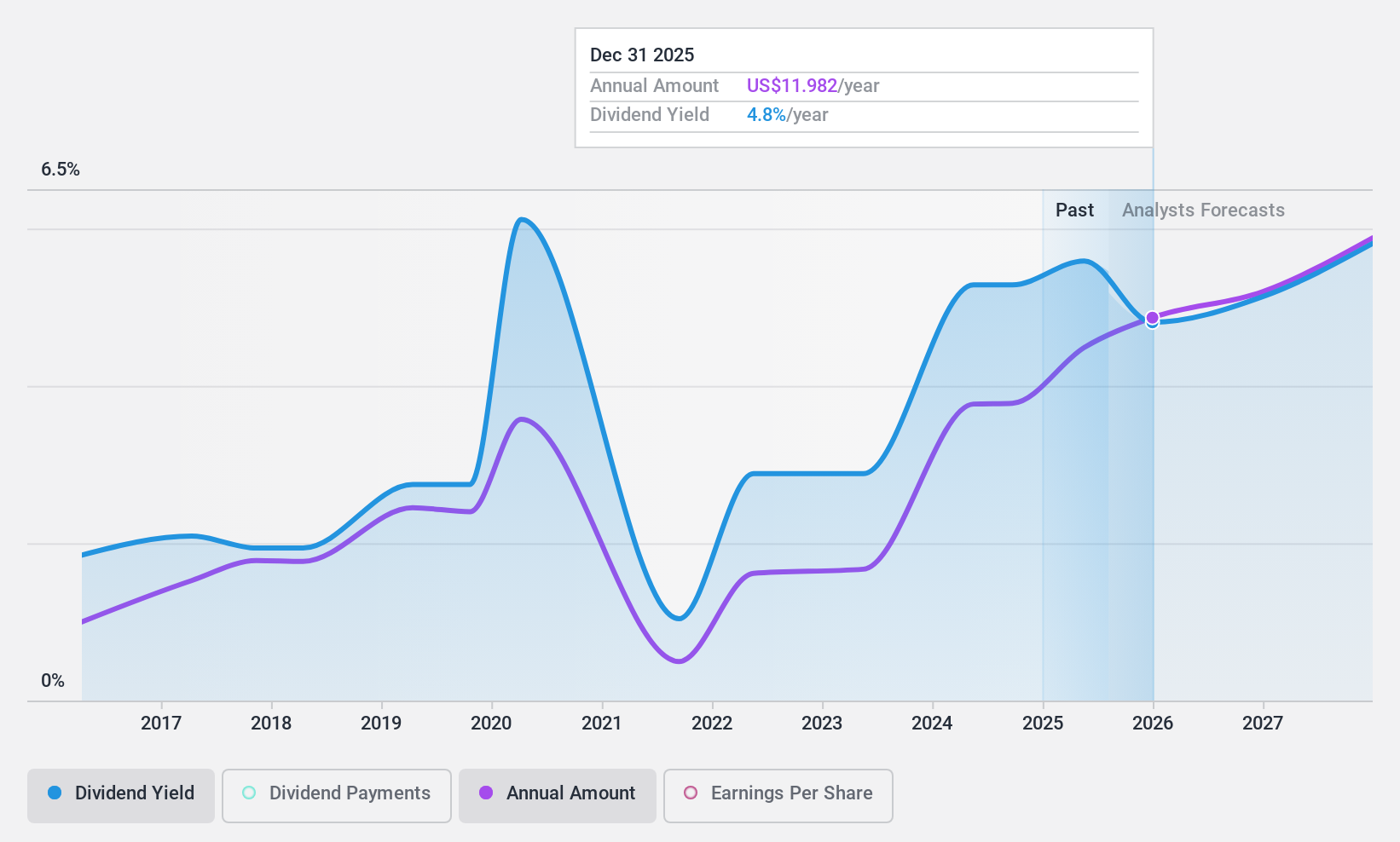

Dividend Yield: 5%

Credicorp's dividend yield is in the top 25% of US payers, though its dividends have been volatile over the past decade. The payout ratio stands at a reasonable 56.4%, indicating coverage by earnings, with future forecasts suggesting continued coverage at 46.2%. Despite trading below fair value and offering good relative value compared to peers, Credicorp faces challenges with high non-performing loans and low allowances for bad loans, impacting dividend reliability.

- Click to explore a detailed breakdown of our findings in Credicorp's dividend report.

- In light of our recent valuation report, it seems possible that Credicorp is trading behind its estimated value.

Key Takeaways

- Click here to access our complete index of 172 Top US Dividend Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PROV

Provident Financial Holdings

Operates as the holding company for Provident Savings Bank, F.S.B.

Flawless balance sheet established dividend payer.