- United States

- /

- Software

- /

- NasdaqGS:WDAY

High Growth Tech Stocks In The US For May 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen 5.1%, contributing to an 11% increase over the past year, with earnings forecasted to grow by 14% annually. In such a dynamic environment, identifying high growth tech stocks requires focusing on companies that demonstrate strong innovation and adaptability in response to evolving market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 26.28% | 37.43% | ★★★★★★ |

| Ardelyx | 20.57% | 59.97% | ★★★★★★ |

| Legend Biotech | 26.73% | 59.51% | ★★★★★★ |

| Travere Therapeutics | 25.39% | 64.80% | ★★★★★★ |

| TG Therapeutics | 25.99% | 38.42% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.67% | 61.11% | ★★★★★★ |

| AVITA Medical | 27.28% | 60.66% | ★★★★★★ |

| Alkami Technology | 20.54% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.16% | 60.26% | ★★★★★★ |

| Lumentum Holdings | 21.59% | 110.32% | ★★★★★★ |

Click here to see the full list of 235 stocks from our US High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Palantir Technologies (NasdaqGS:PLTR)

Simply Wall St Growth Rating: ★★★★★★

Overview: Palantir Technologies Inc. develops software platforms for intelligence and counterterrorism operations globally, with a market cap of $302.30 billion.

Operations: The company generates revenue primarily from two segments: Commercial ($1.39 billion) and Government ($1.72 billion). Its software platforms support intelligence and counterterrorism efforts across multiple regions, including the U.S. and the U.K., contributing to its substantial market presence.

Palantir Technologies demonstrates robust growth and innovation, particularly in high-stakes environments where AI integration is critical. Recently, the company reported a 91.2% surge in earnings over the past year, significantly outpacing the software industry's growth rate of 23.8%. This performance is underpinned by strategic alliances that enhance operational capabilities across various sectors, including a notable partnership with Legion Intelligence to augment SOCOM's Mission Command System with advanced AI tools. Additionally, Palantir's commitment to R&D is evident as they continue to invest heavily in developing cutting-edge technologies that solidify their competitive edge and drive future growth prospects in an increasingly AI-dependent world.

- Take a closer look at Palantir Technologies' potential here in our health report.

Understand Palantir Technologies' track record by examining our Past report.

Workday (NasdaqGS:WDAY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Workday, Inc. offers enterprise cloud applications globally and has a market capitalization of $72.23 billion.

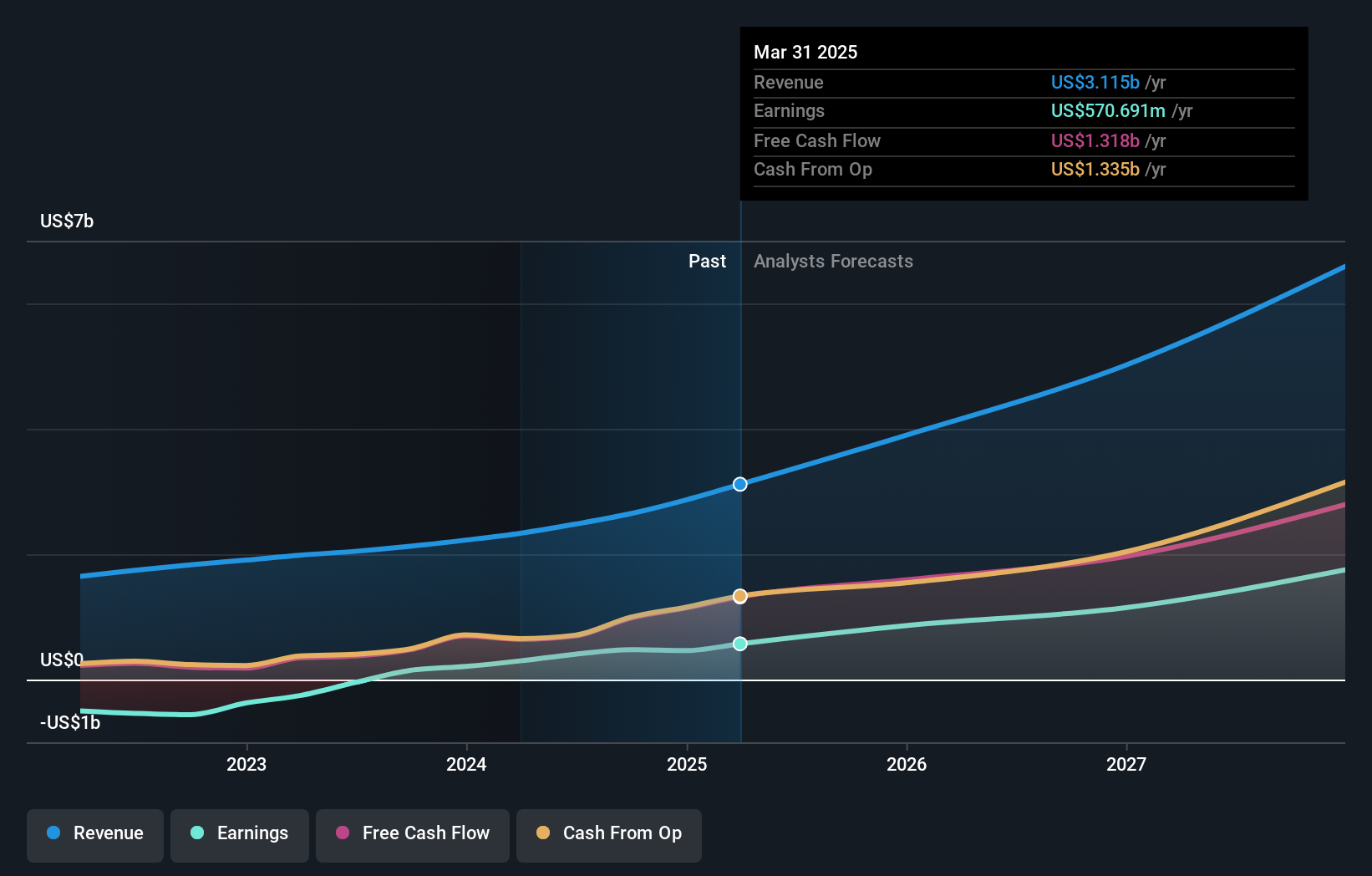

Operations: The company generates revenue primarily through its cloud applications segment, which brought in $8.45 billion.

Workday, Inc. is carving a niche in the high-growth tech sector with strategic expansions and partnerships that enhance its AI and software capabilities. At a recent virtual forum, Workday's Chief Responsible AI Officer highlighted initiatives for navigating AI regulations, reflecting its proactive stance in governance. The company also expanded its footprint at the Empire State Building, signaling growth and commitment to innovation hubs. Financially, Workday expects a 13% increase in subscription revenue for Q1 2026 to $2.05 billion, underpinning its robust business model amidst competitive markets. These moves are part of Workday's broader strategy to integrate advanced technologies across various platforms, ensuring sustained growth and industry relevance.

- Dive into the specifics of Workday here with our thorough health report.

Assess Workday's past performance with our detailed historical performance reports.

Sea (NYSE:SE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sea Limited operates as a consumer internet company with a focus on Southeast Asia, Latin America, and other international markets, and has a market capitalization of approximately $96.61 billion.

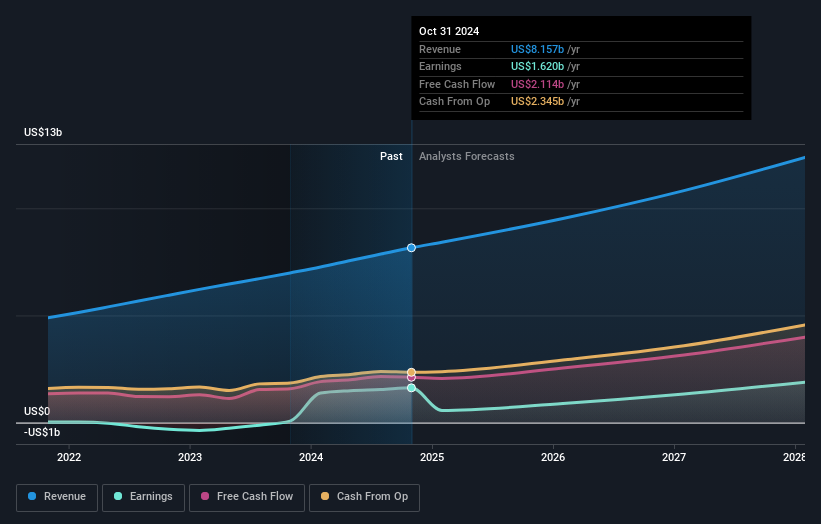

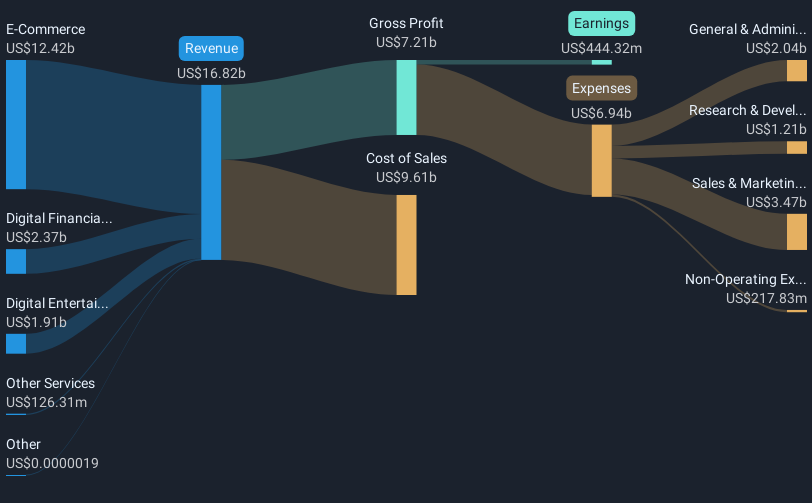

Operations: Sea Limited generates revenue primarily through its digital entertainment, e-commerce, and digital financial services segments. The company focuses on key regions including Southeast Asia and Latin America.

Sea Limited is distinguishing itself in the tech sector with a remarkable earnings growth of 2134.1% over the past year, significantly outpacing its industry's average of 13.6%. This surge is underpinned by a robust revenue increase to $4.84 billion in Q1 2025, up from $3.73 billion the previous year, reflecting a growth rate of 14.5% per annum which surpasses the US market average of 8.5%. Additionally, Sea's strategic focus on R&D has been pivotal; investing substantially to innovate and stay ahead in competitive markets has resulted in an impressive forecasted annual earnings growth rate of 29.7%. These financial metrics not only demonstrate Sea’s capacity for rapid expansion but also highlight its potential to maintain momentum amidst evolving market dynamics.

- Unlock comprehensive insights into our analysis of Sea stock in this health report.

Gain insights into Sea's past trends and performance with our Past report.

Seize The Opportunity

- Investigate our full lineup of 235 US High Growth Tech and AI Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Workday, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Workday might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WDAY

Workday

Provides enterprise cloud applications in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives