- United States

- /

- Hospitality

- /

- NasdaqGS:ABNB

3 US Stocks Estimated To Be Trading Below Intrinsic Value In November 2024

Reviewed by Simply Wall St

As of November 2024, the U.S. stock market is experiencing mixed movements with notable fluctuations in major indices, reflecting investor anticipation ahead of key earnings reports and record highs in cryptocurrency markets. Amidst this dynamic environment, identifying stocks trading below their intrinsic value can present opportunities for investors seeking potential long-term growth.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| First National (NasdaqCM:FXNC) | $22.94 | $45.25 | 49.3% |

| Business First Bancshares (NasdaqGS:BFST) | $27.67 | $55.07 | 49.8% |

| West Bancorporation (NasdaqGS:WTBA) | $23.72 | $46.83 | 49.4% |

| Five Star Bancorp (NasdaqGS:FSBC) | $32.23 | $63.89 | 49.6% |

| Better Choice (NYSEAM:BTTR) | $1.78 | $3.45 | 48.5% |

| Afya (NasdaqGS:AFYA) | $16.36 | $31.64 | 48.3% |

| Advanced Energy Industries (NasdaqGS:AEIS) | $110.77 | $219.27 | 49.5% |

| Air Industries Group (NYSEAM:AIRI) | $4.33 | $8.44 | 48.7% |

| Marcus & Millichap (NYSE:MMI) | $40.13 | $78.66 | 49% |

| AirSculpt Technologies (NasdaqGM:AIRS) | $6.35 | $12.46 | 49.1% |

We're going to check out a few of the best picks from our screener tool.

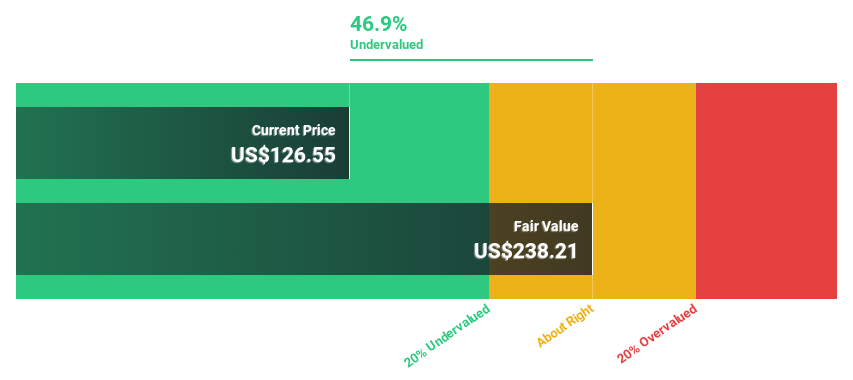

Airbnb (NasdaqGS:ABNB)

Overview: Airbnb, Inc., along with its subsidiaries, operates a global platform that allows hosts to offer accommodations and experiences to guests, with a market cap of approximately $82.12 billion.

Operations: The company generates revenue of $10.84 billion from its Internet Information Providers segment, which facilitates hosts in offering accommodations and experiences to a global audience.

Estimated Discount To Fair Value: 35.8%

Airbnb is trading at US$135.25, significantly below its estimated fair value of US$210.63, suggesting it may be undervalued based on cash flows. Despite a decline in profit margins from 56.9% to 17%, the company forecasts earnings growth of 18% per year, outpacing the US market's average. Recent earnings showed a drop in net income but an increase in sales to US$3.73 billion for Q3 2024, with continued share buybacks enhancing shareholder value perception.

- Insights from our recent growth report point to a promising forecast for Airbnb's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Airbnb.

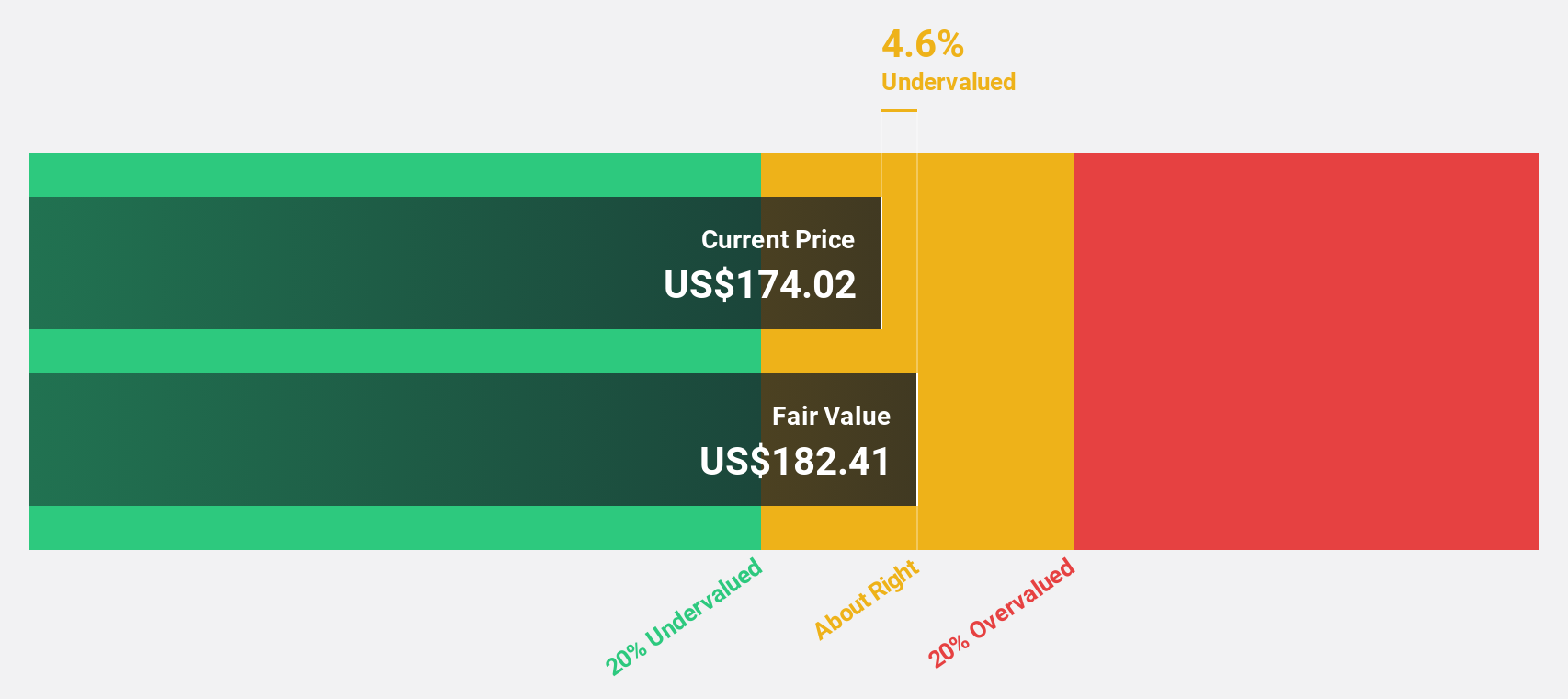

Oracle (NYSE:ORCL)

Overview: Oracle Corporation provides products and services for enterprise information technology environments globally, with a market cap of approximately $523.45 billion.

Operations: Oracle's revenue is primarily derived from three segments: Cloud and License at $45.50 billion, Services at $5.31 billion, and Hardware at $3.01 billion.

Estimated Discount To Fair Value: 26.9%

Oracle's current trading price of US$190.75 is below its estimated fair value of US$260.99, highlighting potential undervaluation based on cash flows. The company's revenue and earnings are projected to grow annually at 10.8% and 16.46%, respectively, surpassing the broader US market averages. Recent client announcements, such as partnerships with Vodafone for cloud migrations using Oracle Database@Azure, underscore Oracle's strategic expansion in cloud services, potentially enhancing future cash flow prospects despite its high debt levels.

- Upon reviewing our latest growth report, Oracle's projected financial performance appears quite optimistic.

- Take a closer look at Oracle's balance sheet health here in our report.

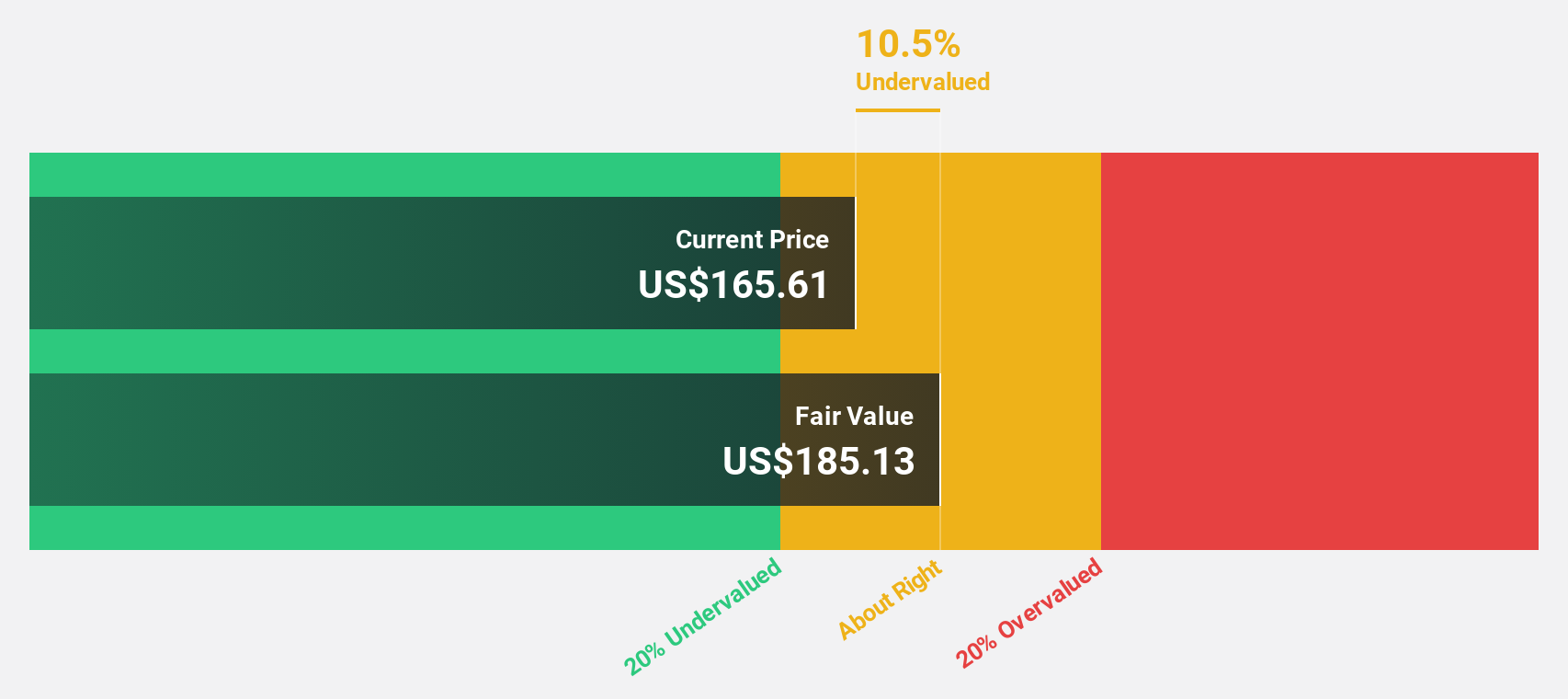

Sea (NYSE:SE)

Overview: Sea Limited operates in digital entertainment, e-commerce, and digital financial services across Southeast Asia, Latin America, the rest of Asia, and internationally with a market cap of approximately $65.29 billion.

Operations: The company's revenue is derived from its digital entertainment, e-commerce, and digital financial services segments across various regions including Southeast Asia and Latin America.

Estimated Discount To Fair Value: 34.2%

Sea Limited's recent earnings report showed a significant turnaround, with a net income of US$153.32 million for Q3 2024 compared to a loss in the same quarter last year. Despite lower profit margins compared to last year, the stock trades at US$114.46, well below its estimated fair value of US$173.9, suggesting it may be undervalued based on cash flows. Earnings are expected to grow significantly over the next three years, outpacing market averages.

- The analysis detailed in our Sea growth report hints at robust future financial performance.

- Dive into the specifics of Sea here with our thorough financial health report.

Seize The Opportunity

- Dive into all 196 of the Undervalued US Stocks Based On Cash Flows we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ABNB

Airbnb

Operates a platform that enables hosts to offer stays and experiences to guests worldwide.

Excellent balance sheet with reasonable growth potential.