- United States

- /

- Interactive Media and Services

- /

- NYSE:RDDT

Is Reddit’s Valuation Justified After AI Licensing Deals and 2025 Post IPO Rally?

Reviewed by Bailey Pemberton

- If you are wondering whether Reddit's stock is still worth pursuing after its post IPO buzz, you are not alone. This breakdown will help you consider whether the current price makes sense or is getting ahead of itself.

- Despite some recent volatility, with the share price down 4.0% over the last week, it is still up 10.8% over 30 days and 35.5% year to date, which keeps it firmly on growth focused investors' radars.

- Recent headlines have centered on Reddit's licensing deals for its content and data partnerships with major AI players, which the market sees as opening up new monetization channels. At the same time, ongoing discussions about user growth, platform engagement and the competitive landscape are shaping how investors factor in its long term potential.

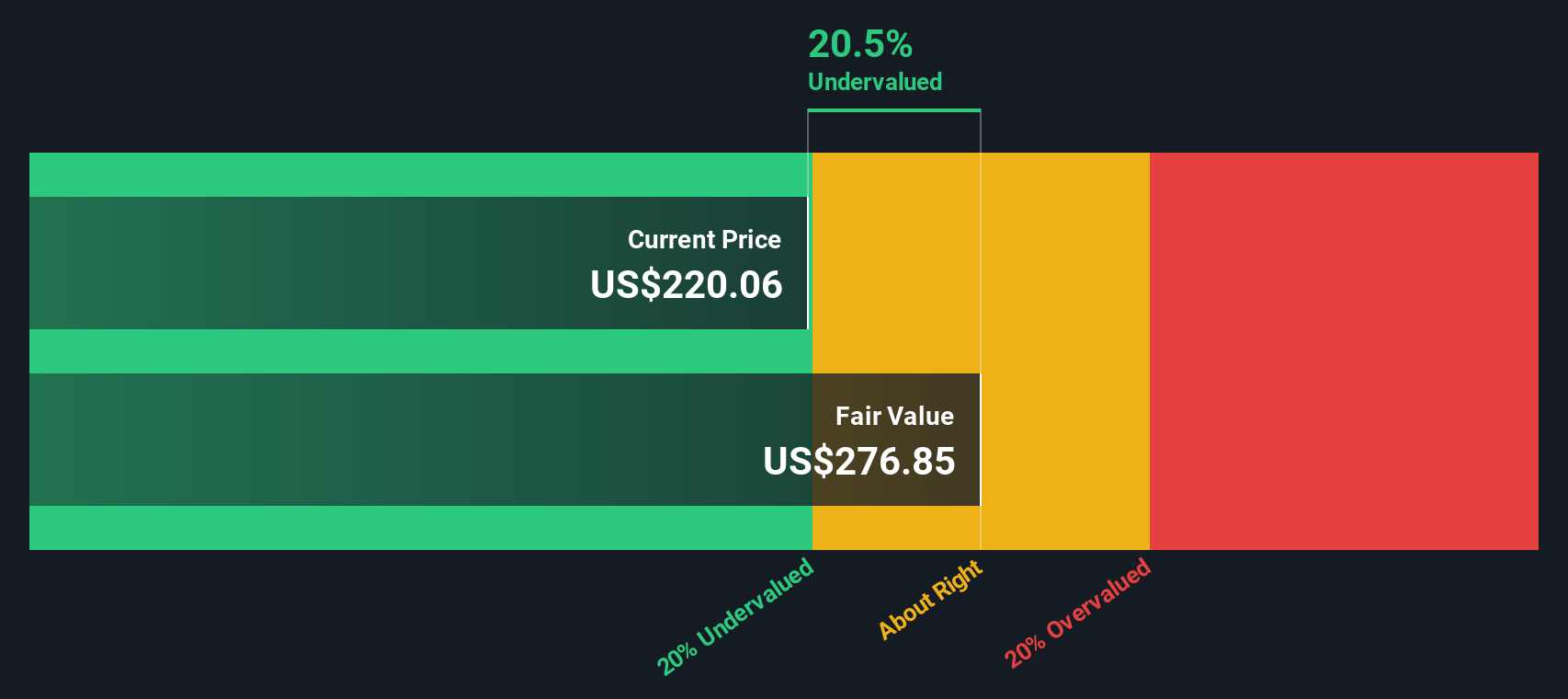

- Right now, Reddit scores just 2 out of 6 on our valuation checks. In what follows, we unpack what different valuation methods indicate about the stock, then finish with a more intuitive way to think about what Reddit might really be worth.

Reddit scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Reddit Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model projects Reddit's future cash flows, then discounts them back to arrive at what the business could be worth in today's dollars. For Reddit, the latest twelve month Free Cash Flow stands at about $503.6 Million, which serves as the starting point for these projections.

Some analysts expect Reddit's Free Cash Flow to rise over the next few years, with certain estimates and extrapolations pointing to roughly $4.75 Billion by 2035 as the platform scales and monetizes its community and data more effectively. Simply Wall St uses a 2 stage Free Cash Flow to Equity model, where near term analyst forecasts are blended with longer term, gradually slowing growth assumptions to avoid unrealistically aggressive projections.

When all these future cash flows are discounted back, the model arrives at an intrinsic value of about $338.19 per share. Compared with the current market price, this implies a 33.5% discount, indicating that, under this model, investors today would be paying less than what the projected cash flows suggest. In this view, the DCF analysis presents Reddit as materially undervalued at present.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Reddit is undervalued by 33.5%. Track this in your watchlist or portfolio, or discover 903 more undervalued stocks based on cash flows.

Approach 2: Reddit Price vs Earnings

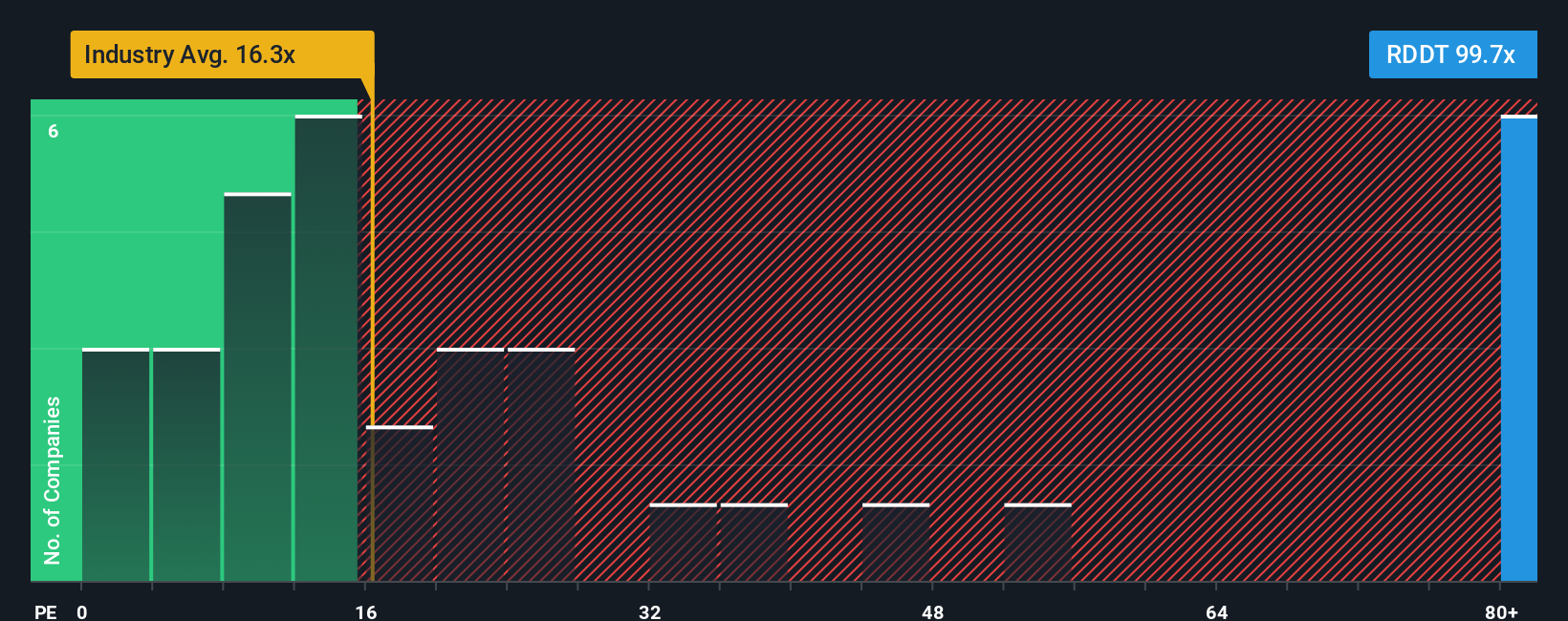

For companies that are already profitable, the Price to Earnings, or PE, ratio is a useful way to gauge how much investors are willing to pay for each dollar of current earnings, and how optimistic they are about future growth. Higher growth and lower risk typically justify a higher, or more expensive, PE ratio, while slower or more uncertain earnings prospects usually warrant a lower multiple.

Reddit currently trades on a PE of about 122x, which is well above both the Interactive Media and Services industry average of around 17x and the broader peer group average of roughly 38x. That premium suggests the market is assuming very strong growth expectations and is comfortable taking on the added risk that comes with a relatively young listed business.

Simply Wall St looks beyond simple comparisons and calculates a proprietary Fair Ratio. This is the PE you might reasonably expect once factors like Reddit's earnings growth outlook, industry dynamics, profit margins, market cap and specific risks are all considered together. For Reddit, this Fair Ratio comes out at about 37.9x, materially below the current 122x multiple, indicating that even after accounting for its growth potential and risk profile, the shares appear expensive on an earnings basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Reddit Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a simple way to connect your view of Reddit's story with a concrete forecast and fair value estimate instead of relying only on static multiples like PE. A Narrative on Simply Wall St is your explanation of what you think will happen to a company over time, tying together your assumptions about future revenue, earnings and margins with a resulting fair value, so you can clearly see how the story links to the numbers. Narratives live inside the Community page on Simply Wall St, where millions of investors can create, share and compare their views, then use them to decide whether to buy or sell by comparing each Narrative's Fair Value to Reddit's current share price. As new information like earnings results, product updates or news on AI data licensing comes in, Narratives are updated dynamically, helping you keep your thesis current instead of out of date. For example, some investors may see Reddit as worth around $240 per share given strong monetization and AI licensing potential, while more cautious investors might anchor closer to $75, reflecting bigger concerns about engagement and competition.

Do you think there's more to the story for Reddit? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDDT

Operates a digital community in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)