- United States

- /

- Software

- /

- NYSE:CRCL

High Growth Tech Stocks In The US Market September 2025

Reviewed by Simply Wall St

As of September 2025, the U.S. stock market has been reaching new heights, with major indices like the S&P 500, Dow Jones Industrial Average, and Nasdaq hitting record highs driven by a surge in technology stocks. This bullish momentum in tech underscores the importance of identifying high-growth opportunities within this sector, where innovative companies can capitalize on favorable market conditions and investor sentiment to potentially deliver strong returns.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ACADIA Pharmaceuticals | 10.94% | 26.66% | ★★★★★☆ |

| Palantir Technologies | 25.10% | 31.65% | ★★★★★★ |

| Workday | 11.32% | 31.06% | ★★★★★☆ |

| RenovoRx | 65.52% | 68.63% | ★★★★★☆ |

| OS Therapies | 56.64% | 68.61% | ★★★★★☆ |

| Vanda Pharmaceuticals | 22.66% | 59.11% | ★★★★★☆ |

| Gorilla Technology Group | 32.75% | 122.61% | ★★★★★☆ |

| Circle Internet Group | 28.59% | 82.71% | ★★★★★☆ |

| Aldeyra Therapeutics | 42.88% | 74.81% | ★★★★★☆ |

| Zscaler | 15.74% | 40.36% | ★★★★★☆ |

Click here to see the full list of 67 stocks from our US High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

CyberArk Software (CYBR)

Simply Wall St Growth Rating: ★★★★☆☆

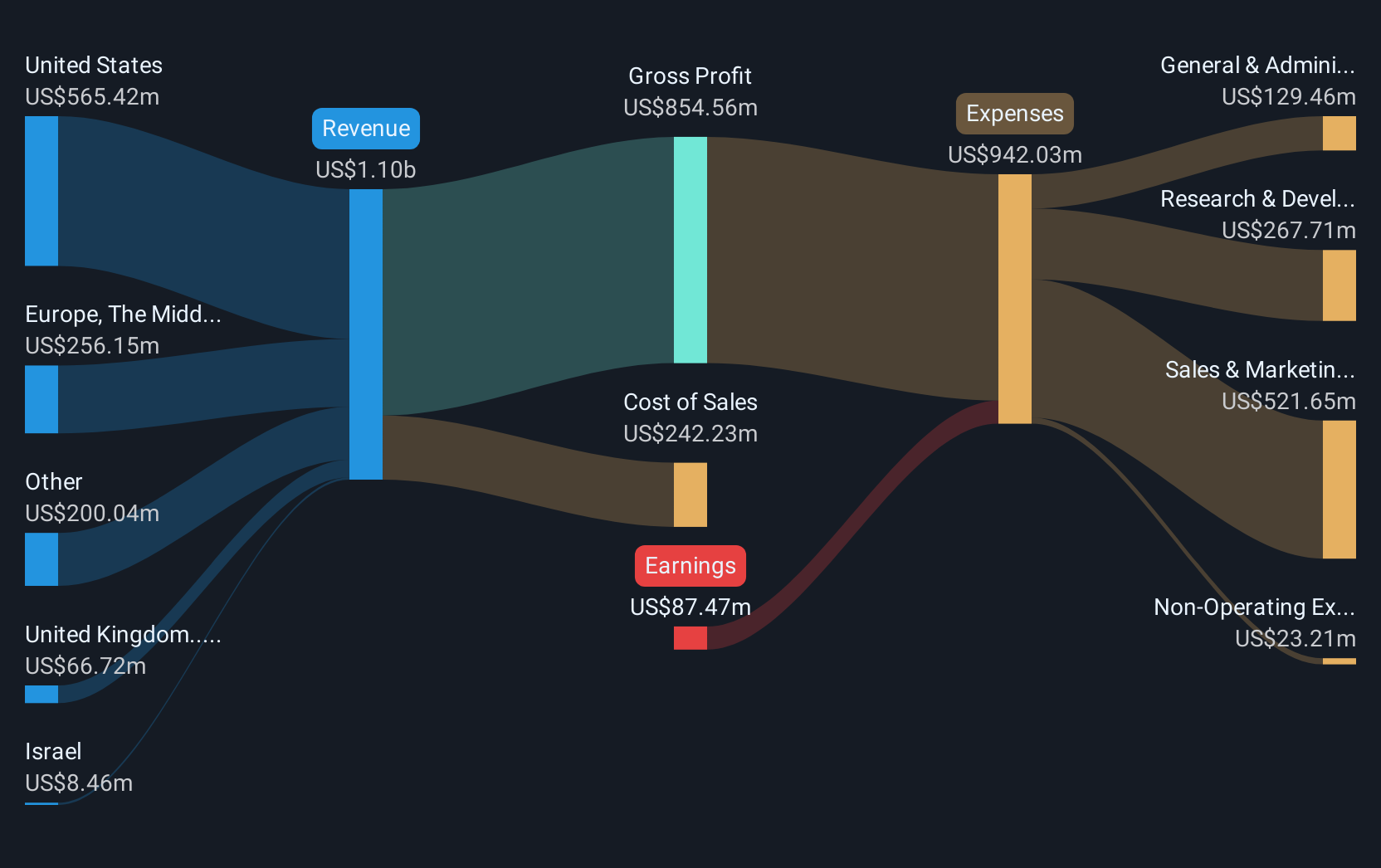

Overview: CyberArk Software Ltd. is a company that develops, markets, and sells software-based identity security solutions and services across various regions including the United States, Israel, the United Kingdom, Europe, the Middle East, Africa, and internationally with a market cap of $24.20 billion.

Operations: CyberArk generates revenue primarily from its security software and services segment, which amounts to $1.20 billion. The company operates in multiple regions including the United States, Israel, and Europe, providing identity security solutions globally.

CyberArk Software, amidst recent executive reshuffles and strategic alliances, is poised for transformative growth. With a 15.6% annual revenue increase outpacing the US market's 9.7%, and an expected earnings surge of 78.93% per year, CyberArk's aggressive investment in R&D aligns with its innovation trajectory—especially notable in its CYBR Unit focusing on identity security solutions. Recent leadership appointments aim to deepen trust across its ecosystem, crucial as CyberArk expands into new cybersecurity domains and strengthens collaborations like the NIST DevSecOps project to enhance software supply chain security.

- Click here and access our complete health analysis report to understand the dynamics of CyberArk Software.

Explore historical data to track CyberArk Software's performance over time in our Past section.

Circle Internet Group (CRCL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Circle Internet Group, Inc. operates as a platform, network, and market infrastructure for stablecoin and blockchain applications with a market cap of $30.33 billion.

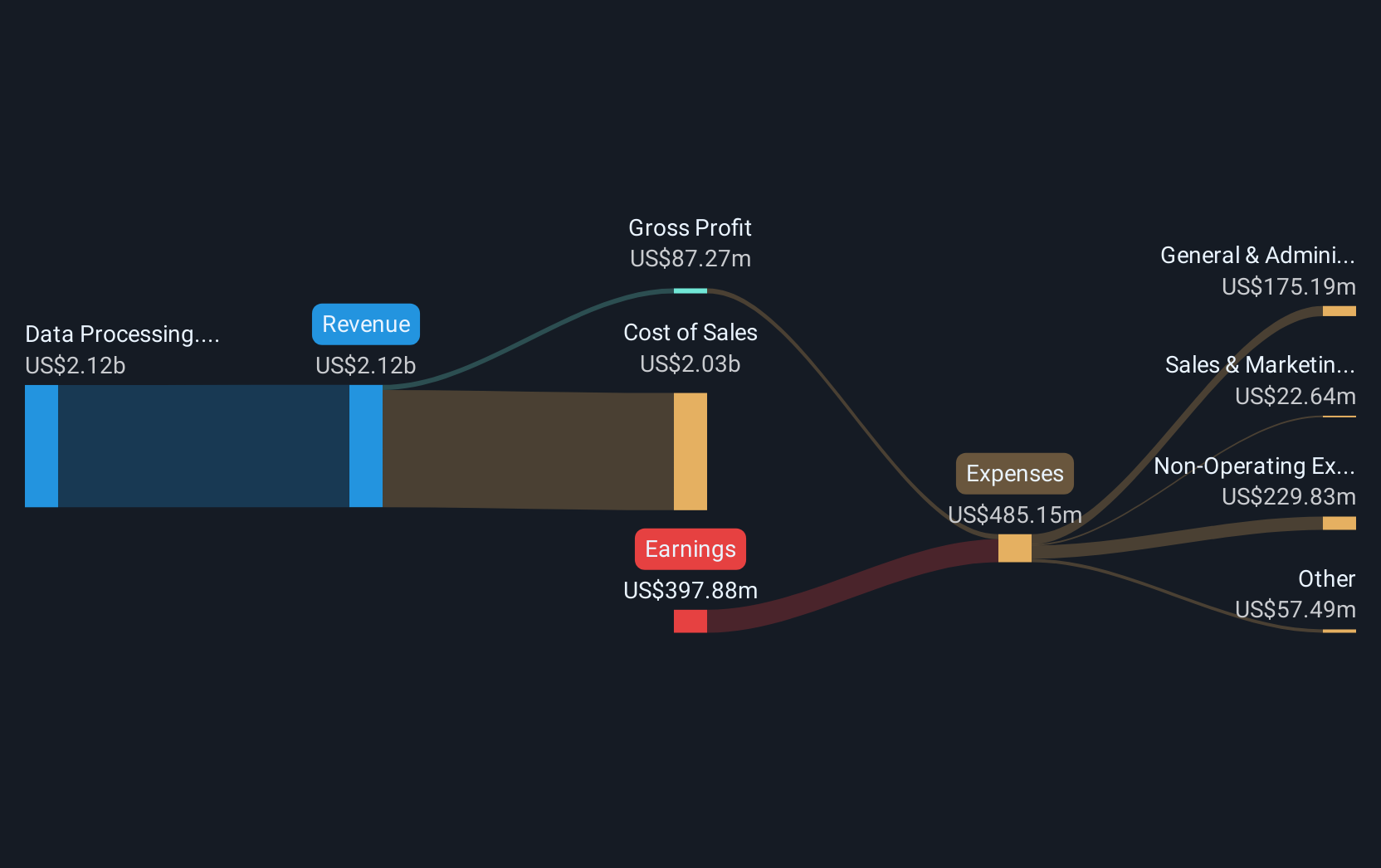

Operations: Circle Internet Group generates revenue primarily from data processing, amounting to $2.12 billion.

Circle Internet Group, Inc. has recently spotlighted its strategic prowess in the stablecoin arena through a series of partnerships aimed at expanding digital currency applications. Notably, the collaboration with Kraken enhances USDC's liquidity and utility, reflecting a broader industry trend towards blockchain-based financial solutions. This move coincides with Circle's $1.3 billion equity offering and strategic alliances like those with Fireblocks and Corpay, which collectively underscore its commitment to cementing stablecoins as foundational for digital finance infrastructure. These initiatives are set against a backdrop of rapid revenue growth at 28.6% annually, positioning Circle as an influential entity in shaping future financial ecosystems through innovative technology integration.

- Unlock comprehensive insights into our analysis of Circle Internet Group stock in this health report.

Evaluate Circle Internet Group's historical performance by accessing our past performance report.

Reddit (RDDT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Reddit, Inc. operates a digital community both in the United States and internationally, with a market capitalization of approximately $49.88 billion.

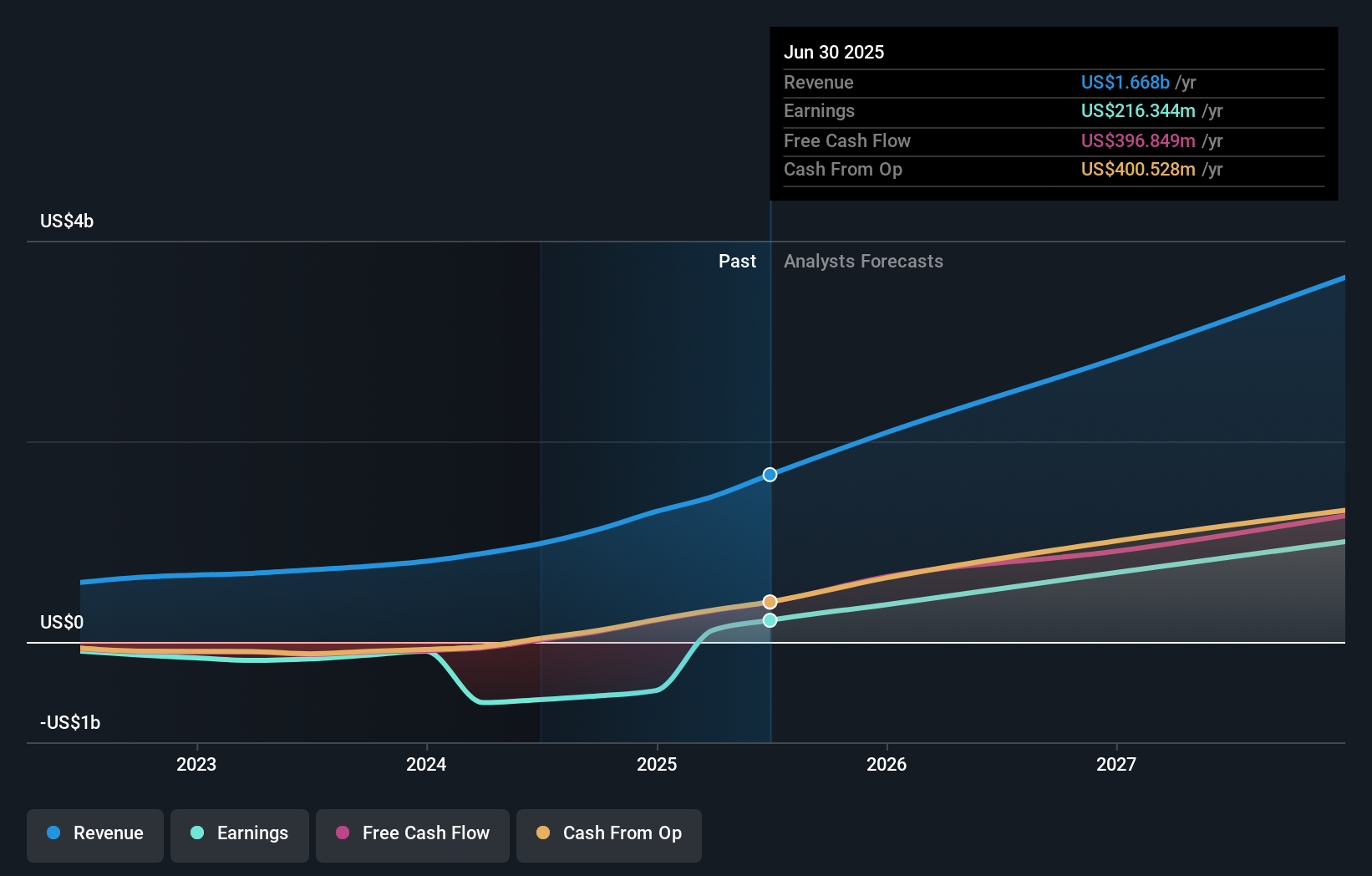

Operations: The company's primary revenue stream is from its Internet Information Providers segment, generating approximately $1.67 billion.

Amidst a challenging landscape marked by AI-driven changes in Google Search, Reddit has demonstrated resilience and strategic adaptability. The company's recent earnings report highlighted a significant revenue jump to $499.63 million in Q2 2025, up from $281.18 million the previous year, underscoring its robust growth trajectory with an impressive 24.1% annual revenue increase. Despite facing headwinds from algorithm adjustments that initially dampened user traffic, Reddit's innovative responses and adaptations have positioned it well for sustained growth, especially as it navigates through legal challenges and market shifts. This adaptability is crucial as the platform continues to evolve its revenue model in an increasingly competitive digital environment.

- Get an in-depth perspective on Reddit's performance by reading our health report here.

Gain insights into Reddit's historical performance by reviewing our past performance report.

Summing It All Up

- Explore the 67 names from our US High Growth Tech and AI Stocks screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRCL

Circle Internet Group

Operates as a platform, network, and market infrastructure for stablecoin and blockchain applications.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026