- United States

- /

- Software

- /

- NasdaqGS:CCCS

Exploring 3 High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

As the U.S. stock market experiences a rally, with the S&P 500 and Nasdaq Composite showing gains amid easing trade tensions and favorable inflation data, investors are keenly observing high-growth sectors like technology that have been leading these upward trends. In such an environment, identifying tech stocks with strong growth potential can be crucial for investors looking to capitalize on market momentum while navigating the complexities of economic indicators and broader sentiment shifts.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 27.17% | 38.44% | ★★★★★★ |

| Ardelyx | 20.57% | 59.97% | ★★★★★★ |

| Travere Therapeutics | 25.39% | 64.80% | ★★★★★★ |

| AVITA Medical | 27.21% | 60.66% | ★★★★★★ |

| TG Therapeutics | 25.99% | 38.42% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.67% | 61.11% | ★★★★★★ |

| Alkami Technology | 20.54% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.16% | 60.26% | ★★★★★★ |

| Lumentum Holdings | 21.59% | 110.32% | ★★★★★★ |

| CoreWeave | 35.99% | 69.86% | ★★★★★★ |

Click here to see the full list of 235 stocks from our US High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

CCC Intelligent Solutions Holdings (NasdaqGS:CCCS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CCC Intelligent Solutions Holdings Inc. is a software as a service (SaaS) company that provides solutions for the property and casualty insurance economy in the United States and China, with a market capitalization of approximately $5.99 billion.

Operations: CCC Intelligent Solutions Holdings focuses on delivering SaaS solutions to the property and casualty insurance sectors in the U.S. and China, generating revenue primarily from its Software & Programming segment, which totals approximately $969.13 million.

CCC Intelligent Solutions Holdings Inc., a trailblazer in AI-driven solutions for the P&C insurance sector, is demonstrating robust growth and strategic foresight. Recently, CCC forecasted its Q2 2025 revenue to range between $255.5 million and $257.5 million, reflecting its ongoing expansion. The company's engagement with the AI Governance Alliance underscores its commitment to shaping AI development responsibly across industries. Despite a net loss of $18.7 million in Q1 2025, CCC continues to innovate with initiatives like the CCC Intelligent Experience (IX) Cloud™, enhancing its offerings in vehicle damage assessment and repair processes which could drive future profitability and industry leadership.

ImmunityBio (NasdaqGS:IBRX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ImmunityBio, Inc. is a commercial-stage biotechnology company focused on developing next-generation therapies to enhance natural immune systems for combating cancers and infectious diseases, with a market cap of $2.08 billion.

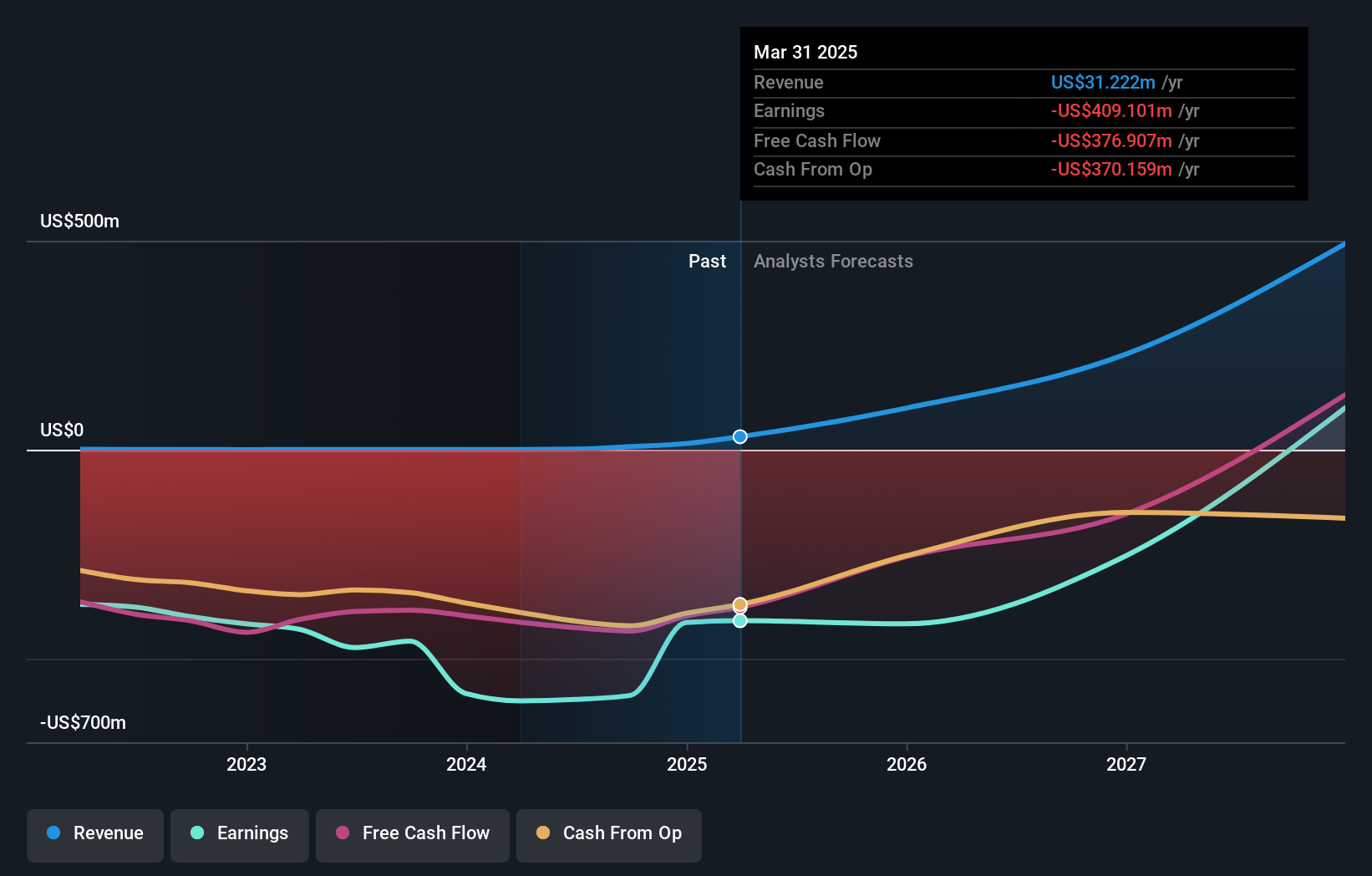

Operations: The company generates revenue primarily from its biotechnology segment, amounting to $31.22 million.

ImmunityBio, despite a challenging Q1 with a net loss of $129.65 million, showcased significant revenue growth from $0.04 million to $16.52 million year-over-year, reflecting a robust 49.3% increase in annualized revenue growth. This surge is underpinned by promising developments in its biologics sector, particularly the ANKTIVA® treatment for bladder cancer which demonstrated compelling long-term efficacy at the AUA 2025 meeting. However, recent setbacks such as the FDA's Refusal to File letter highlight regulatory hurdles that could impact future prospects despite ongoing innovations and an expected annual profit growth of 69.2%.

Reddit (NYSE:RDDT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Reddit, Inc. operates as a digital community platform both in the United States and internationally with a market capitalization of approximately $20.52 billion.

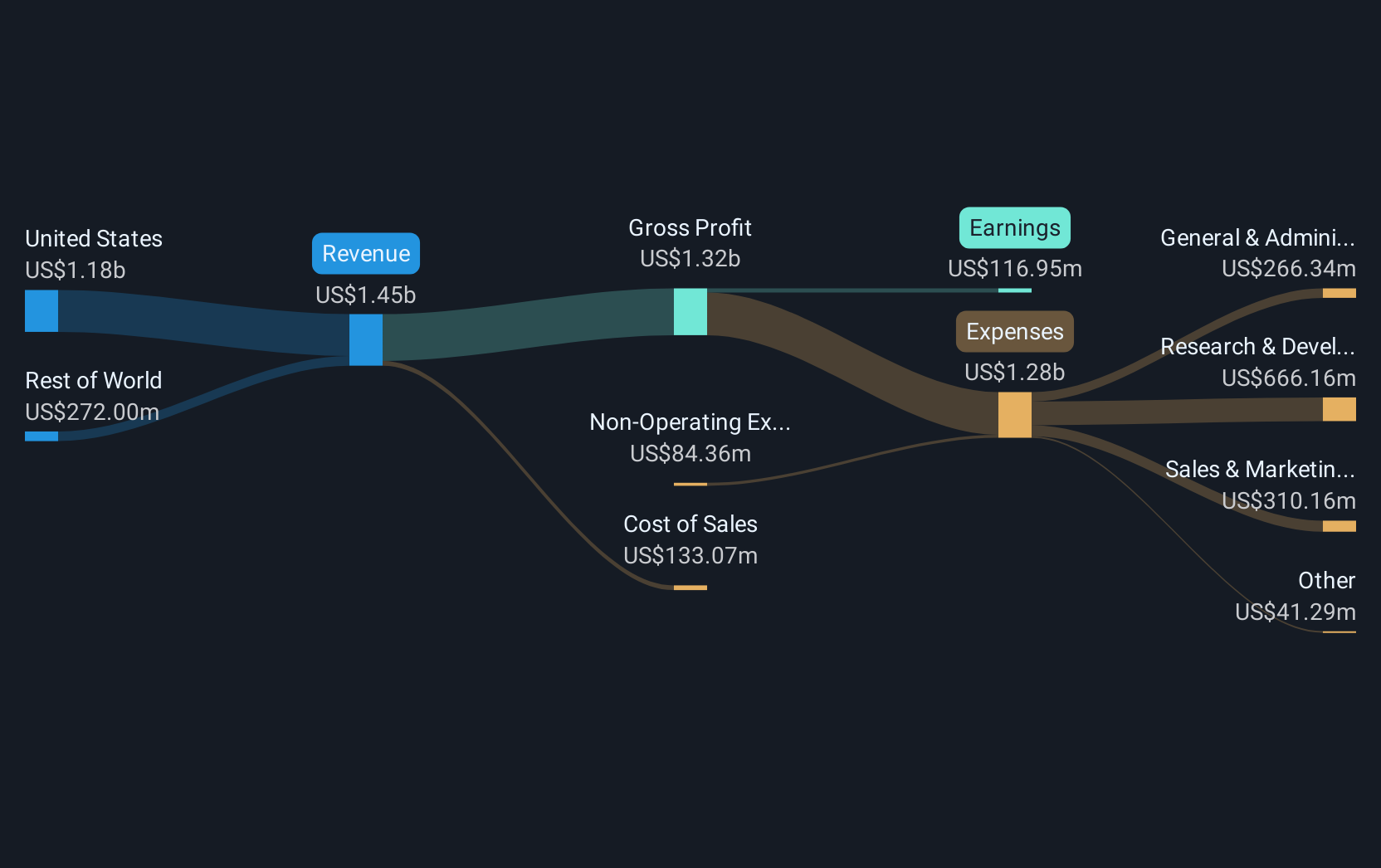

Operations: The company generates revenue primarily from its Internet Information Providers segment, amounting to $1.45 billion.

Reddit's recent surge in profitability, recording a net income of $26.16 million from a previous year's loss, highlights its robust recovery and strategic agility. With a significant 21.5% annual revenue growth and an impressive 37.8% forecast in earnings growth, the company is outpacing industry averages substantially. Strategic partnerships like the one with Samdesk utilizing Reddit’s Data API underscore its pivotal role in real-time data solutions, enhancing its appeal to global advertisers and tech innovators alike. This adaptability and forward-thinking approach suggest promising prospects for sustained growth within the tech sector.

- Take a closer look at Reddit's potential here in our health report.

Understand Reddit's track record by examining our Past report.

Key Takeaways

- Take a closer look at our US High Growth Tech and AI Stocks list of 235 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade CCC Intelligent Solutions Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCCS

CCC Intelligent Solutions Holdings

Operates as a software as a service (SaaS) company for the property and casualty insurance economy in the United States and China.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives