- United States

- /

- Entertainment

- /

- NYSE:RBLX

3 Growth Companies With High Insider Ownership Growing Revenues Up To 21%

Reviewed by Simply Wall St

As the U.S. stock market grapples with renewed trade tensions with China, investors are closely watching for growth opportunities amidst a backdrop of uncertainty and fluctuating indices. In this environment, companies that demonstrate robust revenue growth and high insider ownership can offer a compelling proposition, as they often reflect strong internal confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 92.9% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| IREN (IREN) | 11.2% | 73.1% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 11.1% | 30.3% |

| Cloudflare (NET) | 10.5% | 46.1% |

| Celsius Holdings (CELH) | 10.8% | 32.1% |

| Atour Lifestyle Holdings (ATAT) | 18.2% | 23.7% |

| Astera Labs (ALAB) | 12.1% | 36.6% |

| Accelerant Holdings (ARX) | 24.9% | 66.5% |

We're going to check out a few of the best picks from our screener tool.

monday.com (MNDY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: monday.com Ltd., along with its subsidiaries, develops software applications globally, including in the United States, Europe, the Middle East, Africa, and the United Kingdom; it has a market cap of approximately $9.57 billion.

Operations: The company's revenue segment is primarily from Internet Software & Services, generating $1.10 billion.

Insider Ownership: 13.7%

Revenue Growth Forecast: 17.5% p.a.

monday.com is experiencing significant earnings growth, forecasted at 37.3% annually, outpacing the US market average. Despite trading 14.6% below its estimated fair value and anticipated stock price rise of 43.6%, its Return on Equity remains modestly low at 15.7%. Recent product innovations, particularly in AI capabilities like monday agents and monday campaigns, enhance operational efficiency and market competitiveness. The company announced a substantial $870 million share repurchase program, reflecting confidence in its long-term strategy.

- Dive into the specifics of monday.com here with our thorough growth forecast report.

- Our valuation report here indicates monday.com may be undervalued.

Atlassian (TEAM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Atlassian Corporation offers collaboration software designed to enhance productivity by connecting teams globally, with a market cap of approximately $39.19 billion.

Operations: The company generates its revenue primarily from its Software & Programming segment, amounting to $5.22 billion.

Insider Ownership: 37%

Revenue Growth Forecast: 14.6% p.a.

Atlassian's growth trajectory is marked by a forecasted 52.97% annual earnings increase, surpassing US market averages, though revenue growth at 14.6% annually lags behind the desired 20%. Despite substantial insider selling recently, the company maintains high insider ownership and trades at a significant discount to its estimated fair value. Recent strategic moves include a multi-year partnership with Google Cloud to enhance AI capabilities and expand cloud infrastructure, reflecting Atlassian's commitment to innovation.

- Get an in-depth perspective on Atlassian's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Atlassian's share price might be on the cheaper side.

Roblox (RBLX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Roblox Corporation operates an immersive platform for connection and communication both in the United States and internationally, with a market cap of approximately $88.90 billion.

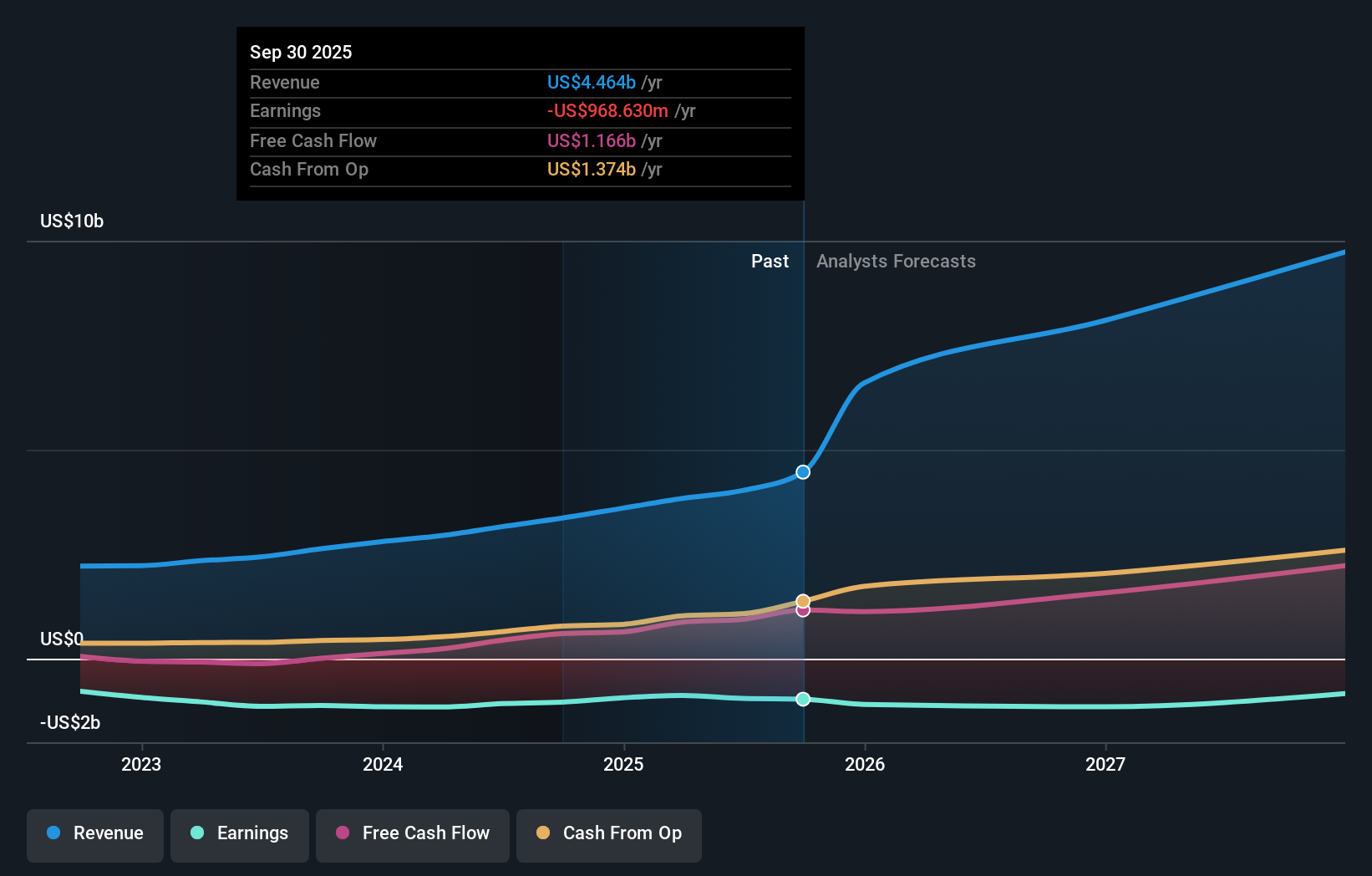

Operations: Roblox generates revenue primarily from its Internet Information Providers segment, amounting to $4.02 billion.

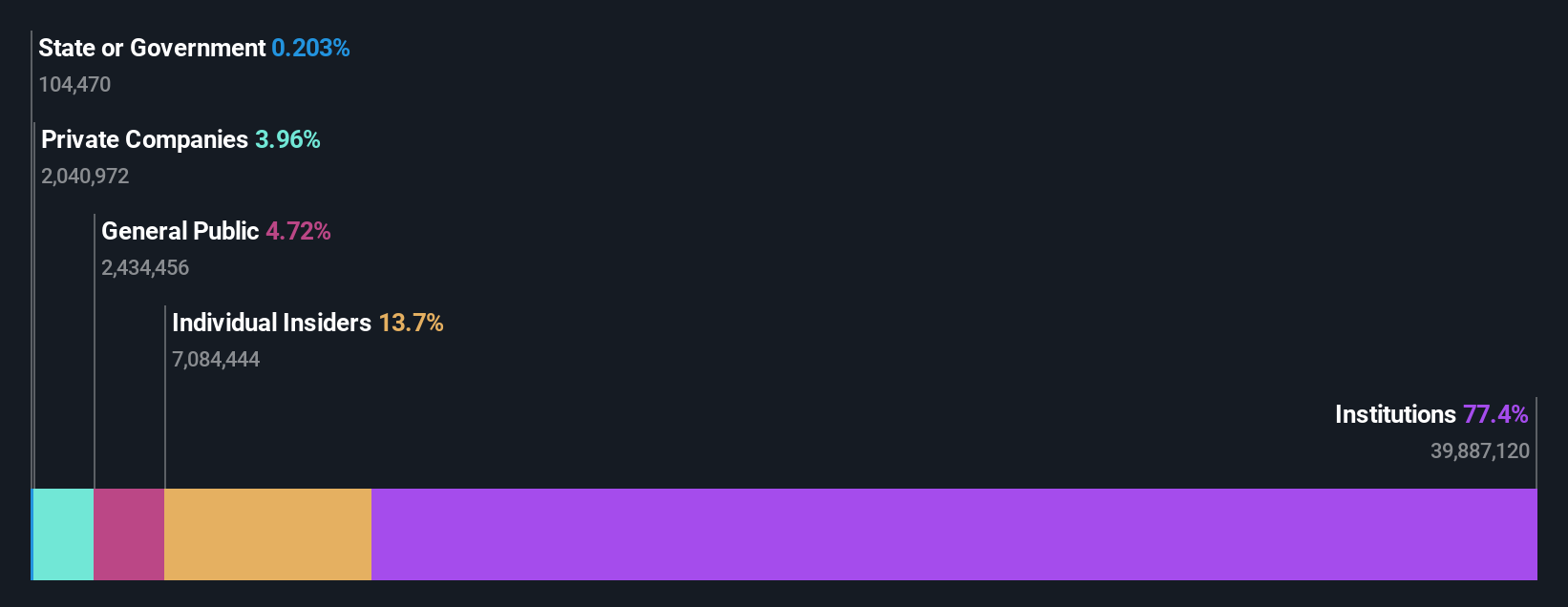

Insider Ownership: 11.1%

Revenue Growth Forecast: 21.8% p.a.

Roblox's growth potential is underscored by an expected 21.8% annual revenue increase, outpacing market averages, though profitability remains elusive in the near term. Despite recent legal challenges highlighting safety concerns, Roblox continues to innovate with new tools for creators and strategic partnerships like the International Age Rating Coalition to enhance platform safety. Insider activity shows more shares bought than sold recently, indicating confidence from those within the company despite ongoing challenges.

- Unlock comprehensive insights into our analysis of Roblox stock in this growth report.

- Our expertly prepared valuation report Roblox implies its share price may be too high.

Key Takeaways

- Gain an insight into the universe of 202 Fast Growing US Companies With High Insider Ownership by clicking here.

- Contemplating Other Strategies? Uncover 10 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBLX

Roblox

Operates an immersive platform for connection and communication in the United States and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives