- United States

- /

- Media

- /

- NYSE:NIQ

Is NIQ Global Intelligence’s Valuation Fair After Recent Data Partnerships and Price Surge?

Reviewed by Bailey Pemberton

- Curious whether NIQ Global Intelligence is a smart buy right now? You are not alone, and it all comes down to how the market values its potential and risks.

- The stock has recently seen a swing, gaining 10.7% in the last week and 4.5% over the past month, though it is still down 25.5% year to date. This suggests shifting investor sentiment and possible new opportunities.

- Recent news coverage has centered on NIQ Global Intelligence’s expanding data partnerships and growing momentum in key markets. Several industry commentators have cited new client wins and tech rollouts as catalysts for renewed investor interest. These developments add valuable context to the latest price rallies and hint at further changes on the horizon.

- According to a detailed valuation breakdown, NIQ Global Intelligence earns a score of 5 out of 6 for being undervalued, but classic valuation ratios are only part of the story. Let’s dig deeper into how these valuations work and why the real answer to "is NIQ Global Intelligence good value?" might surprise you by the end of this article.

Approach 1: NIQ Global Intelligence Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a business is worth today by projecting the company’s future free cash flows and then discounting them back to their present value. This approach is widely used because it takes into account the earnings power the company is expected to generate over time, rather than just current profits.

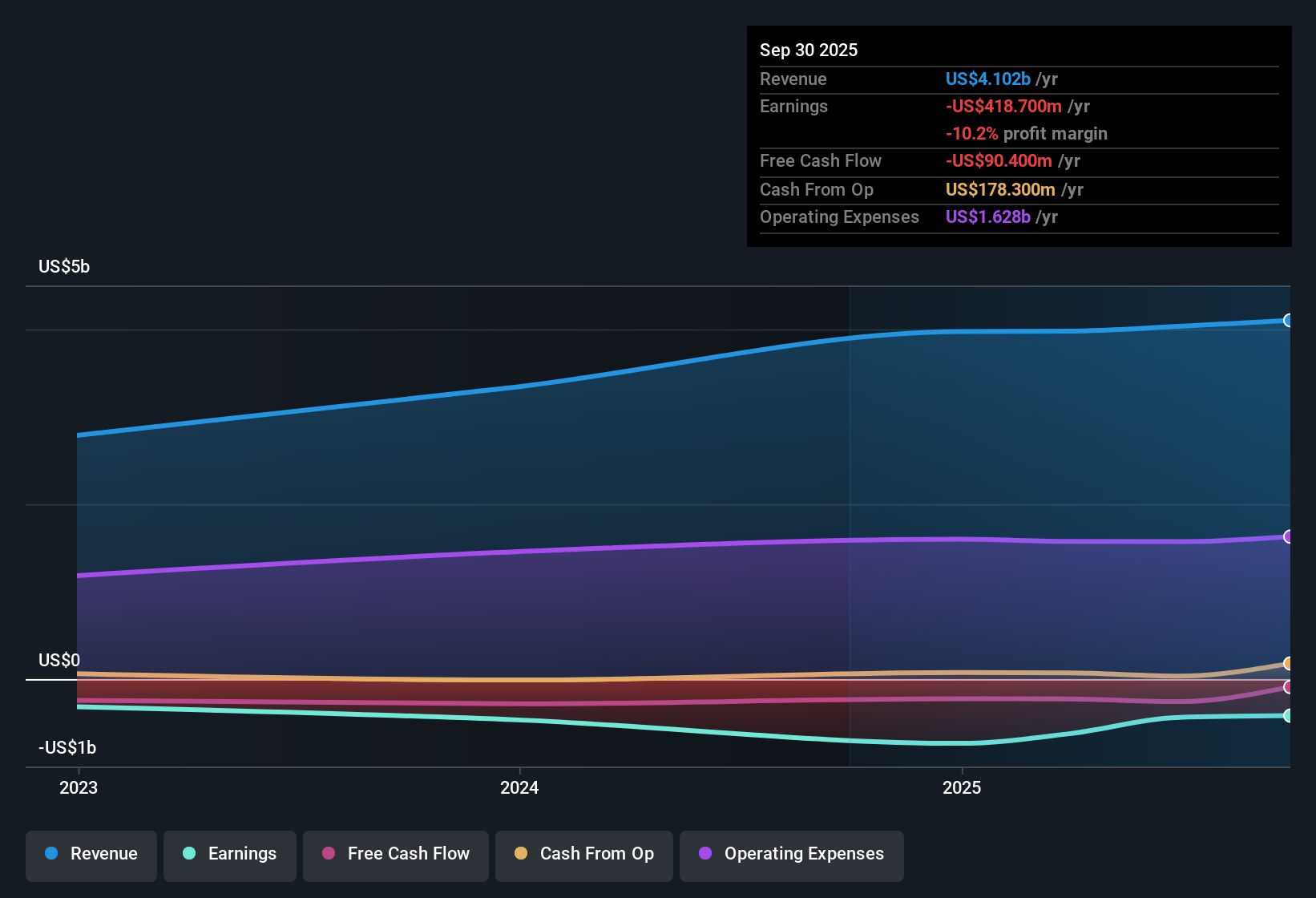

For NIQ Global Intelligence, the DCF analysis begins with its latest twelve-month free cash flow, which stands at $-132.3 Million, reflecting short-term investment and transitional phases. Analyst projections suggest a sharp turnaround, forecasting free cash flow to reach $253.6 Million by 2026 and then increasing to $880.8 Million by 2035. Note that only the next five years are based on analyst estimates, while the following years rely on modeled assumptions and industry trends.

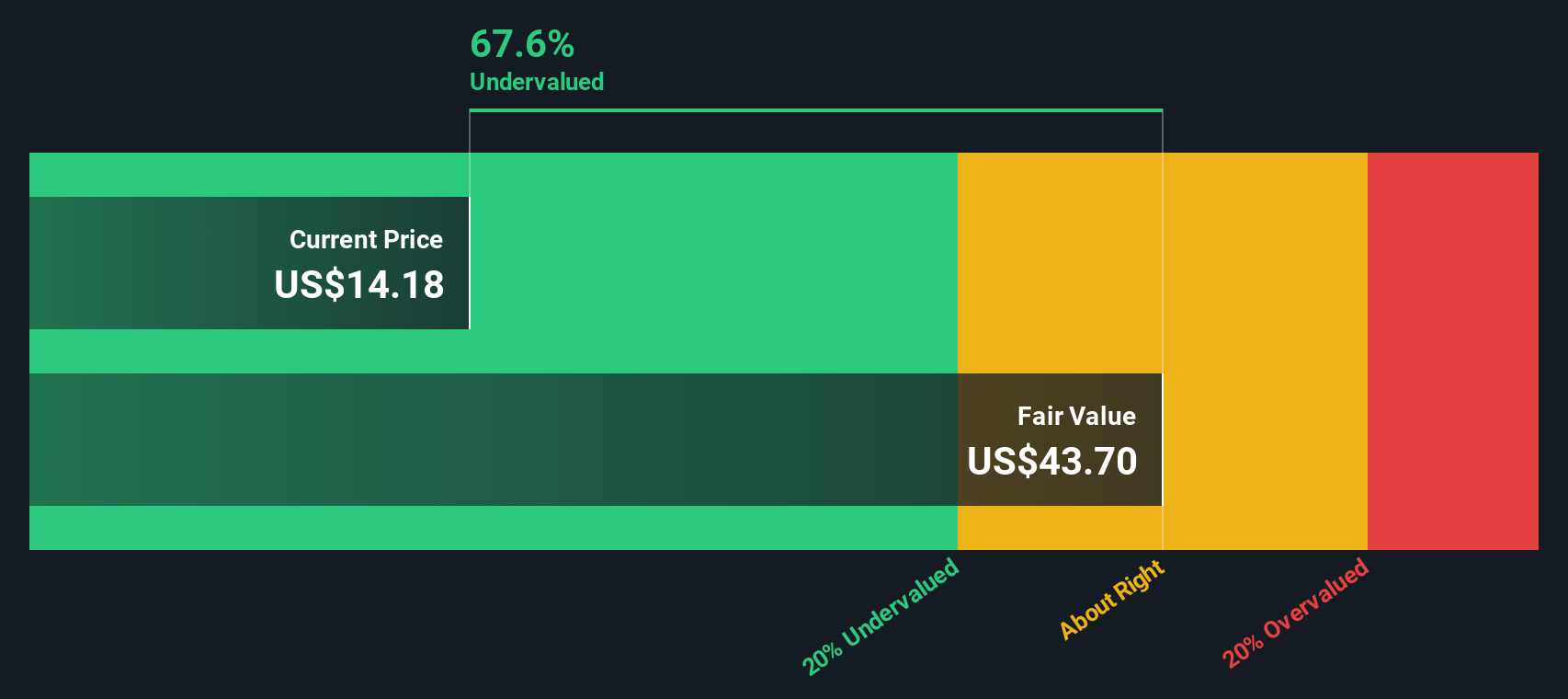

According to the 2 Stage Free Cash Flow to Equity model, the intrinsic value of NIQ Global Intelligence is calculated at $43.74 per share. This is significantly higher than its current trading level and implies a possible 67.6% discount from estimated fair value.

The conclusion, based on cash flow fundamentals and growth projections, is clear: as of now, NIQ Global Intelligence appears notably undervalued according to the DCF perspective.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests NIQ Global Intelligence is undervalued by 67.6%. Track this in your watchlist or portfolio, or discover 899 more undervalued stocks based on cash flows.

Approach 2: NIQ Global Intelligence Price vs Sales

The Price-to-Sales (P/S) multiple is often used to value companies, especially those that may not yet be consistently profitable or are in the midst of significant transformation. This metric is helpful because it relates the company’s market value directly to its revenues, making it useful for businesses like NIQ Global Intelligence where short-term earnings may not fully capture future growth potential or transitional investments.

A "normal" or fair P/S ratio varies across industries and companies depending on factors like revenue growth expectations, profitability, and risk. Higher growth or stronger profit margins can justify a premium, while elevated risks can limit what investors are willing to pay for each dollar of sales.

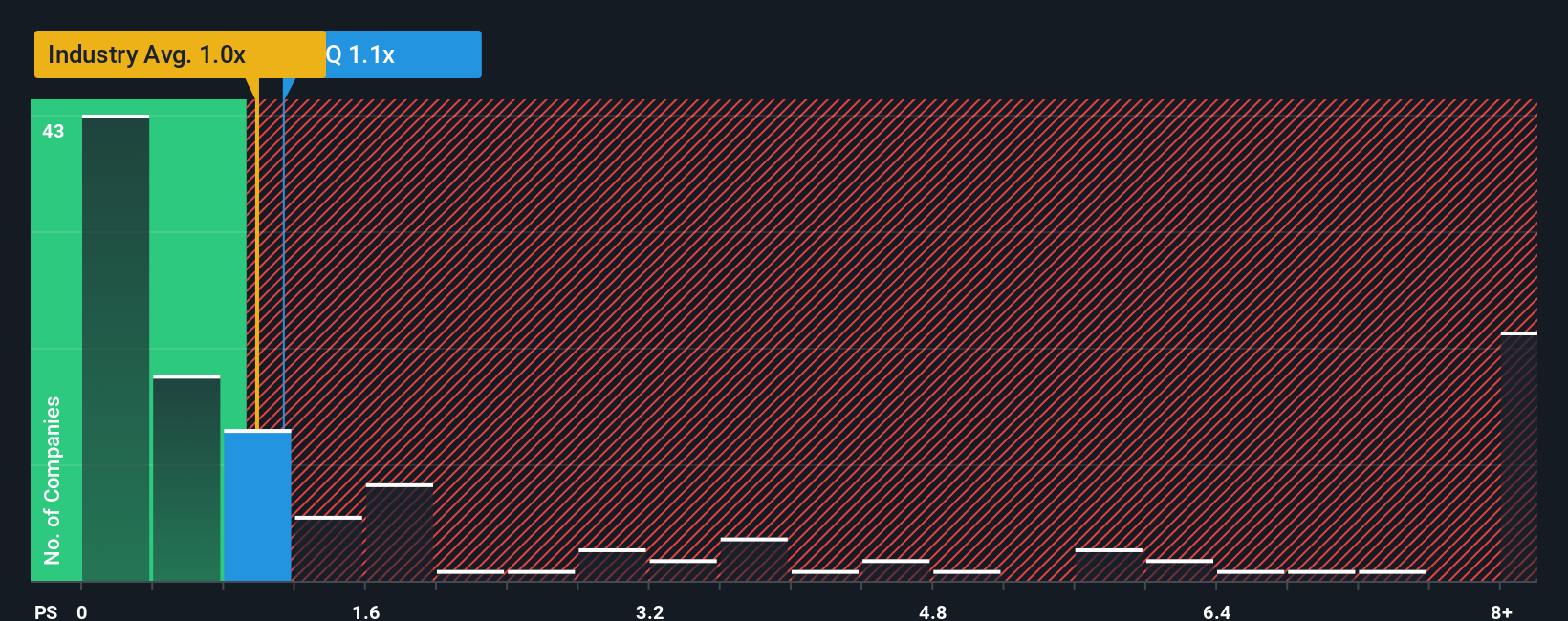

NIQ Global Intelligence currently trades at a P/S ratio of 1.02x. This is slightly below the Media industry average of 1.04x and well below the peer average of 2.23x. At first glance, this suggests the stock might be undervalued compared to peers and the broader sector.

However, to get a truer sense of value, Simply Wall St’s proprietary "Fair Ratio" is considered. The Fair Ratio estimates what P/S multiple is truly justified for NIQ Global Intelligence, factoring in growth outlook, profit margins, industry dynamics, company size, and specific risks. This approach digs deeper than basic peer or industry comparisons and delivers a tailored benchmark more closely aligned to the company’s unique situation.

Comparing NIQ Global Intelligence’s current P/S multiple to its Fair Ratio shows they are nearly identical, signaling that the stock is valued about right on this key measure.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1418 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your NIQ Global Intelligence Narrative

Earlier we mentioned that there is a better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, powerful tool that lets you connect your view of NIQ Global Intelligence’s story to real financial numbers, including estimates for future revenue and profit margins. This allows you to create your own fair value for the stock.

Instead of just looking at the numbers in isolation, Narratives allow you to explain your investment perspective and see how it plays out through customized forecasts and fair value calculations. Narratives link the company’s journey to actual financial forecasts, making it easy to see if your outlook lines up with the current market price.

Available on Simply Wall St’s Community page, Narratives are already used by millions of investors to support their decisions. When new information such as news or earnings updates appear, Narratives respond dynamically so your view remains up to date.

For example, one investor might build a Narrative expecting a rapid turnaround and significantly higher fair value, while another is more cautious and reflects lower growth and a more conservative fair value. Using Narratives helps investors decide for themselves when NIQ Global Intelligence is a smart buy, hold, or sell.

Do you think there's more to the story for NIQ Global Intelligence? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NIQ Global Intelligence might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NIQ

NIQ Global Intelligence

A consumer intelligence company, provides software applications and analytics solutions.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)