- United States

- /

- Media

- /

- NYSE:NIQ

Is NIQ Global Intelligence (NYSE:NIQ) Trading Below Fair Value? A Fresh Look at Current Valuation

Reviewed by Simply Wall St

Price-to-Sales Ratio of 1.3x: Is it justified?

The latest valuation analysis indicates that NIQ Global Intelligence is currently trading at a price-to-sales ratio of 1.3x, which is well below the average of its peer group at 2.7x. This suggests that NIQ may be undervalued relative to its competitors when measured by top-line revenue, even as the wider market maintains a more cautious stance toward the company.

The price-to-sales ratio compares a company's market capitalization to its annual sales. This makes it a useful indicator for businesses like NIQ where profits are negative or volatile. It allows investors to assess how much they are paying for each dollar of sales and offers a way to compare companies that may not yet be profitable but still generate significant revenues.

Despite challenges in profitability, NIQ's relatively low price-to-sales ratio indicates the market is either underpricing its future growth potential or is factoring in execution and profitability risks. With top-line growth remaining positive, this multiple could be attractive for valuation-focused investors seeking opportunities where expectations are not overly stretched versus sales performance.

Result: Fair Value of $22.88 (UNDERVALUED)

See our latest analysis for NIQ Global Intelligence.However, continued net losses and uncertain profit trends for NIQ Global Intelligence remain key risks that could limit upside, even with attractive valuation metrics.

Find out about the key risks to this NIQ Global Intelligence narrative.Another View: What Does the DCF Model Say?

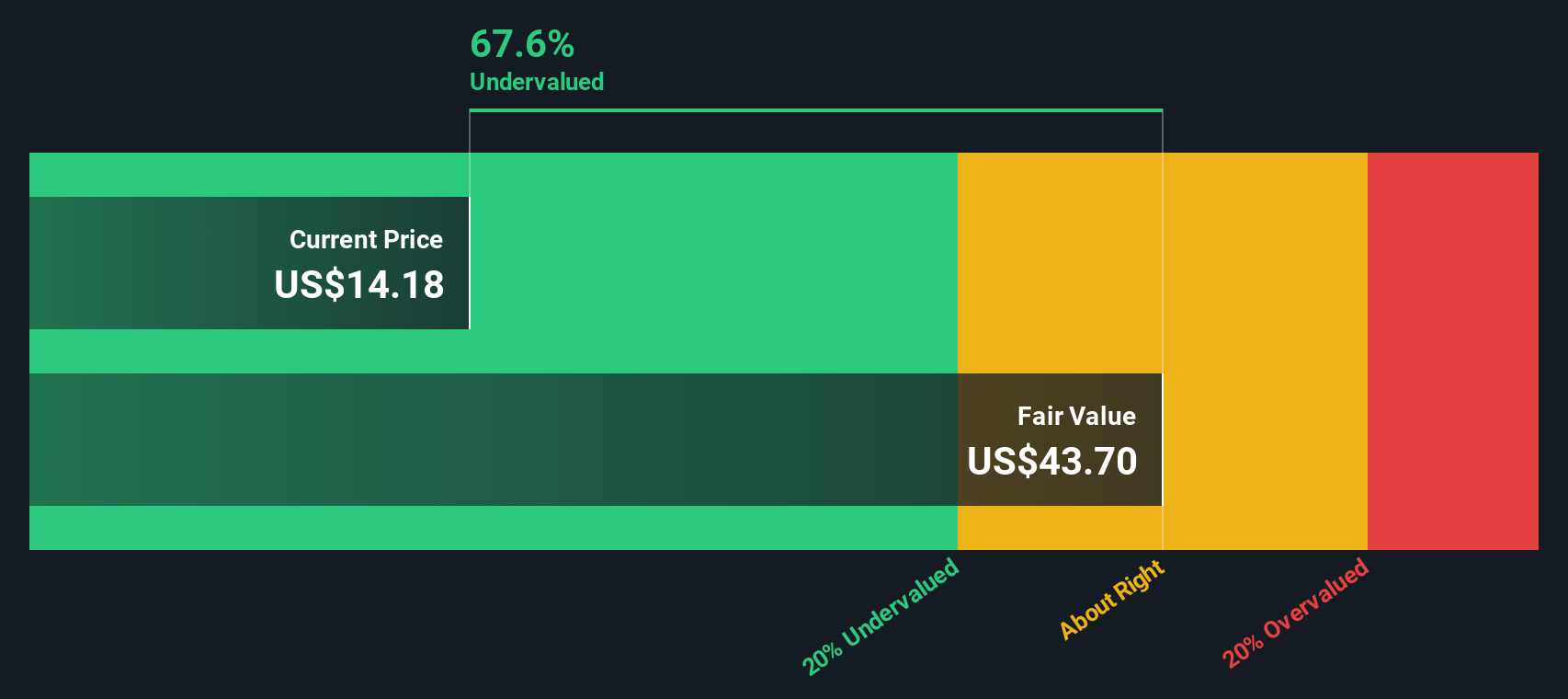

While the price-to-sales approach suggests NIQ Global Intelligence could be undervalued, our DCF model presents a similar perspective and supports the case for value at current prices. Could a rebound be on the horizon, or is caution still warranted?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own NIQ Global Intelligence Narrative

If you see the numbers differently, or want to test your own assumptions, it only takes a few minutes to build your own perspective. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding NIQ Global Intelligence.

Looking for More Standout Opportunities?

Expand your investment horizons and stay ahead of the pack by checking out other promising stocks and sectors using the Simply Wall Street Screener. Don’t let lucrative trends or hidden gems slip past you. Position yourself where strong growth stories begin.

- Uncover high-yield opportunities by targeting companies that consistently offer dividend stocks with yields > 3% for reliable income and long-term value.

- Jump on the artificial intelligence wave with stocks set to redefine industries. See which innovators are leading in AI penny stocks.

- Capture hidden value by pinpointing stocks currently trading below their intrinsic worth. Let our screener highlight undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NIQ Global Intelligence might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:NIQ

NIQ Global Intelligence

A consumer intelligence company, provides software applications and analytics solutions.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion