As the post-election rally in the United States stock market begins to lose steam, major indexes have shown mixed performances, with investors recalibrating their expectations around interest rates following recent inflation data. Amidst this backdrop of fluctuating investor sentiment and economic indicators, growth companies with high insider ownership can offer unique appeal due to their potential alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 31.5% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.5% |

| Duolingo (NasdaqGS:DUOL) | 14.6% | 41.3% |

| On Holding (NYSE:ONON) | 31% | 29.7% |

| FTC Solar (NasdaqCM:FTCI) | 33.1% | 64.8% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 50% |

| Alkami Technology (NasdaqGS:ALKT) | 11.2% | 98.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

Let's dive into some prime choices out of the screener.

MediaAlpha (NYSE:MAX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MediaAlpha, Inc. operates an insurance customer acquisition platform in the United States and has a market capitalization of approximately $831.30 million.

Operations: The company generates revenue of $681.23 million from its Internet Information Providers segment.

Insider Ownership: 12.3%

Revenue Growth Forecast: 17.2% p.a.

MediaAlpha has demonstrated strong growth, reporting a significant increase in Q3 2024 sales to US$259.13 million from US$74.57 million the previous year, turning profitable with a net income of US$9.48 million. The company forecasts substantial revenue growth, expecting up to US$295 million in Q4 2024. Despite high volatility and negative shareholders' equity, its earnings are projected to grow significantly at 34.1% annually, outpacing the broader market's growth expectations.

- Delve into the full analysis future growth report here for a deeper understanding of MediaAlpha.

- In light of our recent valuation report, it seems possible that MediaAlpha is trading beyond its estimated value.

Mach Natural Resources (NYSE:MNR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mach Natural Resources LP is an independent upstream oil and gas company engaged in acquiring, developing, and producing oil, natural gas, and natural gas liquids in the Anadarko Basin region with a market cap of approximately $1.67 billion.

Operations: The company's revenue is primarily derived from its oil and gas exploration and production segment, which generated $834.33 million.

Insider Ownership: 26.5%

Revenue Growth Forecast: 14.3% p.a.

Mach Natural Resources is poised for growth, with forecasted revenue expansion of 14.3% annually, surpassing the US market average. Despite recent shareholder dilution and high debt levels, the company is expected to achieve profitability within three years. Recent production results show robust oil and gas output, contributing to quarterly revenues of US$209 million. However, the dividend yield of 18.46% raises sustainability concerns due to inadequate earnings coverage. Analysts anticipate a potential stock price increase of 45.6%.

- Click here and access our complete growth analysis report to understand the dynamics of Mach Natural Resources.

- The valuation report we've compiled suggests that Mach Natural Resources' current price could be quite moderate.

XPeng (NYSE:XPEV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: XPeng Inc. is a company that designs, develops, manufactures, and markets smart electric vehicles in the People’s Republic of China with a market capitalization of approximately $12.96 billion.

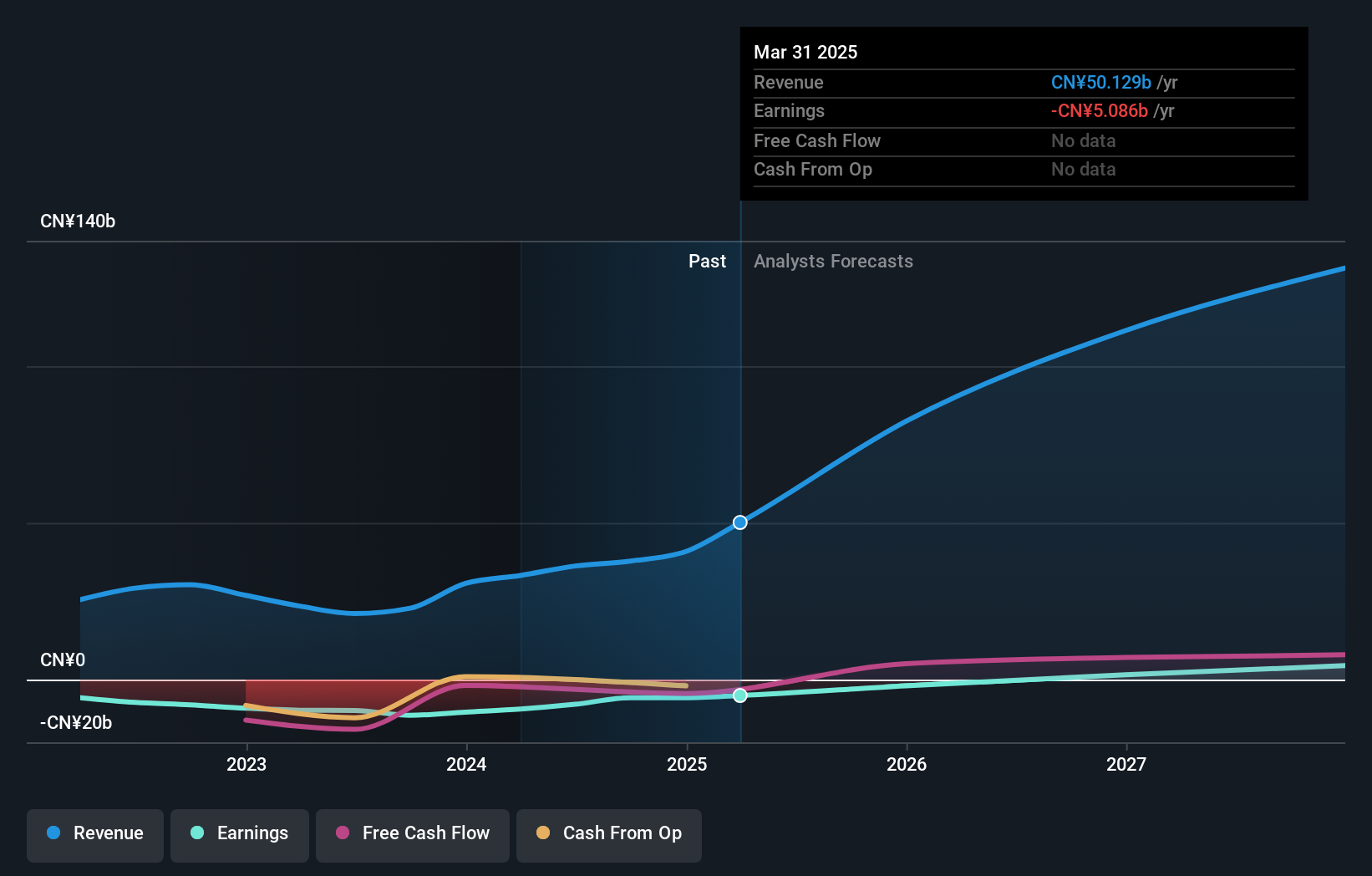

Operations: The company generates revenue primarily from its Auto Manufacturers segment, which amounted to CN¥36.24 billion.

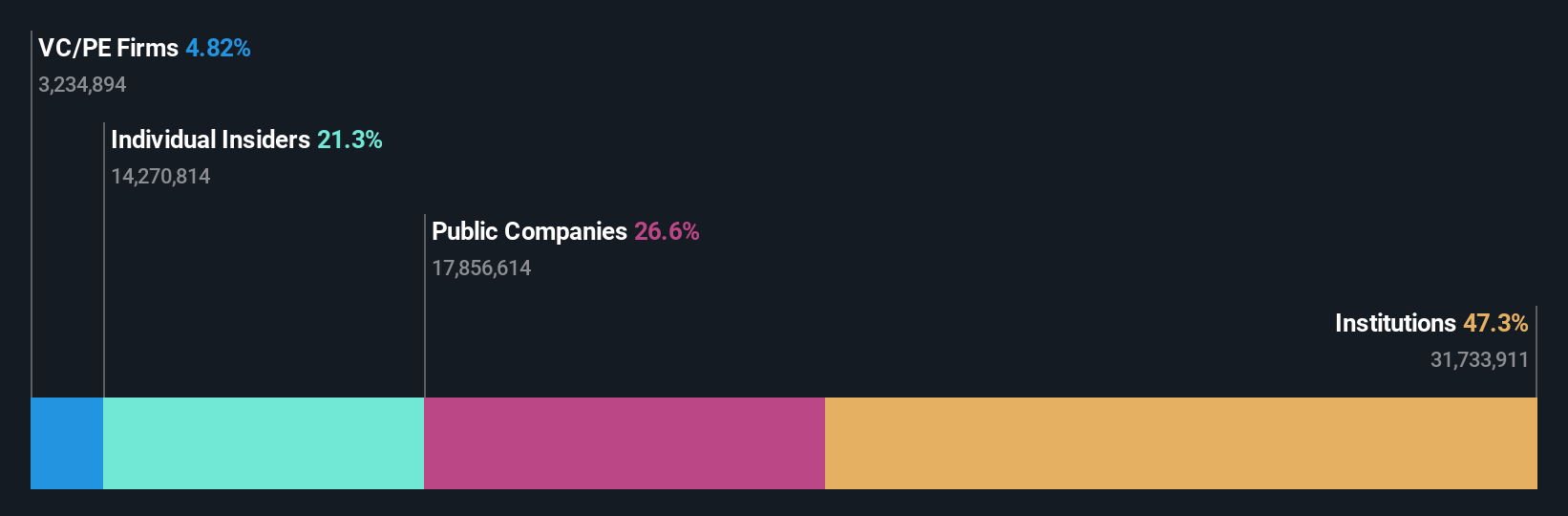

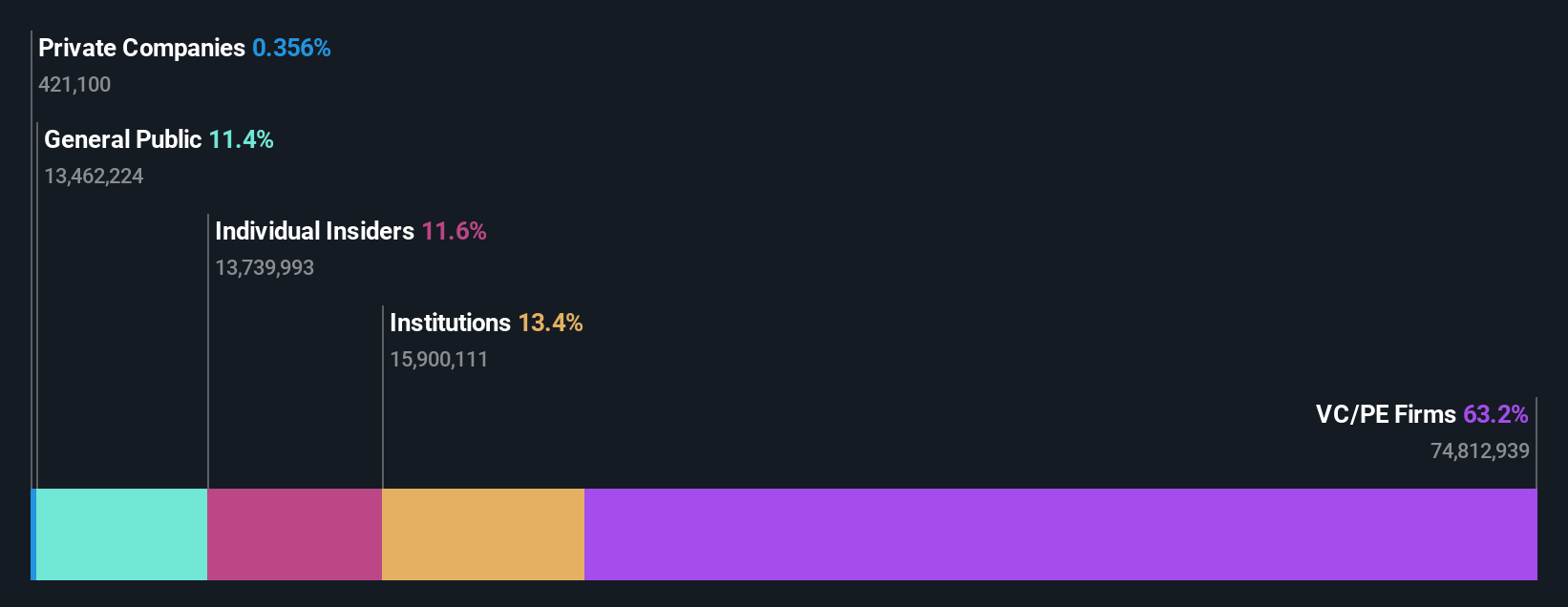

Insider Ownership: 23.5%

Revenue Growth Forecast: 27.3% p.a.

XPeng's substantial insider buying over the past three months highlights confidence in its growth potential, despite recent shareholder dilution. The company is forecast to achieve significant revenue growth at 27.3% annually, outpacing the US market and becoming profitable within three years. Recent innovations, such as the AI-defined P7+, underscore XPeng's commitment to cutting-edge technology and global expansion, with record vehicle deliveries further supporting its robust growth trajectory.

- Navigate through the intricacies of XPeng with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that XPeng is priced higher than what may be justified by its financials.

Where To Now?

- Take a closer look at our Fast Growing US Companies With High Insider Ownership list of 199 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MAX

MediaAlpha

Through its subsidiaries, operates an insurance customer acquisition platform in the United States.

High growth potential slight.