Over the last 7 days, the United States market has dropped by 1.0%, yet in the longer term, it has risen by 30% over the past year with earnings forecasted to grow by 15% annually. In this dynamic environment, identifying high growth tech stocks involves evaluating companies that demonstrate robust innovation and adaptability to capitalize on emerging opportunities.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 23.83% | 24.32% | ★★★★★★ |

| Sarepta Therapeutics | 23.90% | 42.65% | ★★★★★★ |

| Clene | 78.50% | 60.70% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.45% | 70.66% | ★★★★★★ |

| Blueprint Medicines | 25.47% | 68.62% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 249 stocks from our US High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Geron (NasdaqGS:GERN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Geron Corporation is a late-stage clinical biopharmaceutical company dedicated to developing and commercializing therapeutics for myeloid hematologic malignancies, with a market capitalization of approximately $2.29 billion.

Operations: The company generates revenue primarily from the development of therapeutic products for oncology, totaling $29.48 million.

Geron's trajectory in high-growth tech is marked by significant R&D initiatives and strategic leadership appointments, notably with Dr. Joseph Eid's recent role as EVP of R&D, enhancing its focus on innovative medical strategies for its key product, RYTELO™. The firm’s commitment to growth is underscored by a substantial increase in revenue from $0.164 million to $28.27 million year-over-year and a reduction in net loss from $44.81 million to $26.45 million, reflecting a robust 51.8% revenue growth rate and an anticipated earnings surge of 72.4%. Additionally, Geron secured a senior secured term loan facility up to $250 million, ensuring ample capital for future endeavors and underscoring its aggressive pursuit of breakthroughs in myeloid hematologic malignancies with the novel telomerase inhibitor imetelstat.

- Click here to discover the nuances of Geron with our detailed analytical health report.

Gain insights into Geron's historical performance by reviewing our past performance report.

Crane NXT (NYSE:CXT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Crane NXT, Co. is an industrial technology company that offers solutions for securing, detecting, and authenticating critical assets, with a market capitalization of $3.23 billion.

Operations: Crane NXT generates revenue primarily from two segments: Crane Payment Innovations, contributing $873.40 million, and Security and Authentication Technologies with $571.20 million.

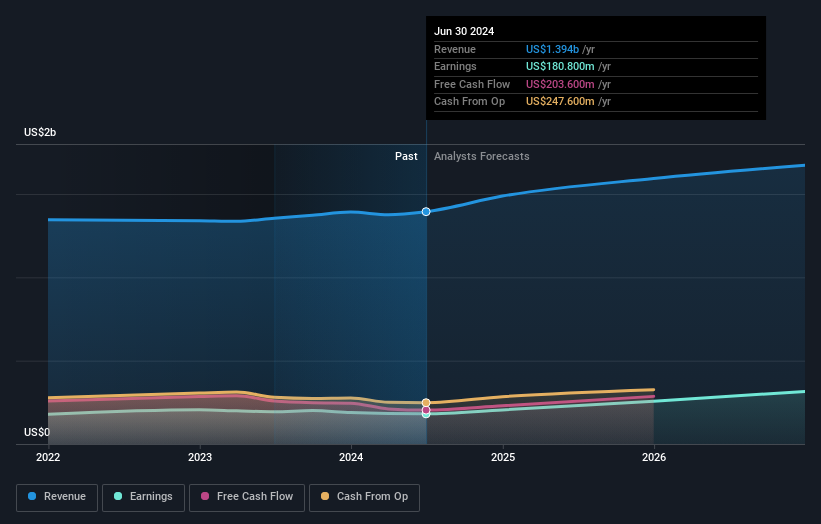

Crane NXT's recent strategic acquisitions and executive appointments underscore its commitment to diversifying and strengthening its tech portfolio. Despite a slight dip in net income from $51.9 million to $47.1 million in the third quarter of 2024, the company has shown resilience with a steady sales increase to $403.5 million, up from $352.9 million the previous year, reflecting a growth rate of 13.1%. Looking ahead, Crane NXT is poised for robust earnings expansion with an anticipated annual profit surge of 23.3%, driven by its aggressive M&A strategy and innovative product integrations like Smart Packaging assets from TruTag Technologies. This approach not only enhances product security but also positions Crane NXT favorably within the high-tech industry's evolving landscape.

- Delve into the full analysis health report here for a deeper understanding of Crane NXT.

Explore historical data to track Crane NXT's performance over time in our Past section.

Lions Gate Entertainment (NYSE:LGF.A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lions Gate Entertainment Corp. operates in the film, television, subscription, and location-based entertainment sectors across the United States, Canada, and internationally, with a market cap of approximately $1.70 billion.

Operations: Lions Gate Entertainment generates revenue primarily through its Media Networks ($1.48 billion), Motion Picture ($1.61 billion), and Television Production ($1.38 billion) segments, with significant contributions from each sector to its overall financial performance.

Lions Gate Entertainment has demonstrated a notable resilience in its financial journey, despite facing industry headwinds. In the recent quarter, while sales dipped slightly to $948.6 million from $1,015.5 million year-over-year, the reduction in net loss from $886.2 million to $163.3 million signals a robust improvement in operational efficiency and cost management. The company is expected to pivot into profitability with an impressive forecasted earnings growth of 118.5% per year over the next three years, outpacing many peers in the entertainment sector where average growth remains sluggish. This potential turnaround is underpinned by strategic adjustments and a focus on high-margin areas which could redefine its market stance amidst evolving consumer preferences and digital transformations within the media landscape.

Key Takeaways

- Reveal the 249 hidden gems among our US High Growth Tech and AI Stocks screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Crane NXT, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CXT

Crane NXT

Operates as an industrial technology company that provides technology solutions to secure, detect, and authenticate customers’ important assets.

Undervalued with moderate growth potential.