- United States

- /

- Life Sciences

- /

- NasdaqGS:CTKB

Open Lending Leads Our Trio Of Promising Penny Stocks

Reviewed by Simply Wall St

As the U.S. stock market grapples with concerns over tariffs and economic uncertainties, major indices like the S&P 500 and Nasdaq have experienced significant declines. Despite these challenges, penny stocks—often representing smaller or newer companies—continue to offer intriguing opportunities for investors seeking growth at lower price points. When these stocks are supported by strong financial health, they can provide potential upside without many of the typical risks associated with this investment area.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.7902 | $5.74M | ★★★★★★ |

| Safe Bulkers (NYSE:SB) | $3.80 | $400.14M | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $126.25M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Sensus Healthcare (NasdaqCM:SRTS) | $4.60 | $75.88M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.39 | $72.49M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.68 | $137.93M | ★★★★★☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.21 | $21.46M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8945 | $80.45M | ★★★★★☆ |

| TETRA Technologies (NYSE:TTI) | $3.32 | $439.55M | ★★★★☆☆ |

Click here to see the full list of 745 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Open Lending (NasdaqGM:LPRO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Open Lending Corporation offers lending enablement and risk analytics solutions to financial institutions and automakers in the United States, with a market cap of approximately $569.30 million.

Operations: The company's revenue is primarily derived from its Internet Information Providers segment, totaling $95.89 million.

Market Cap: $569.3M

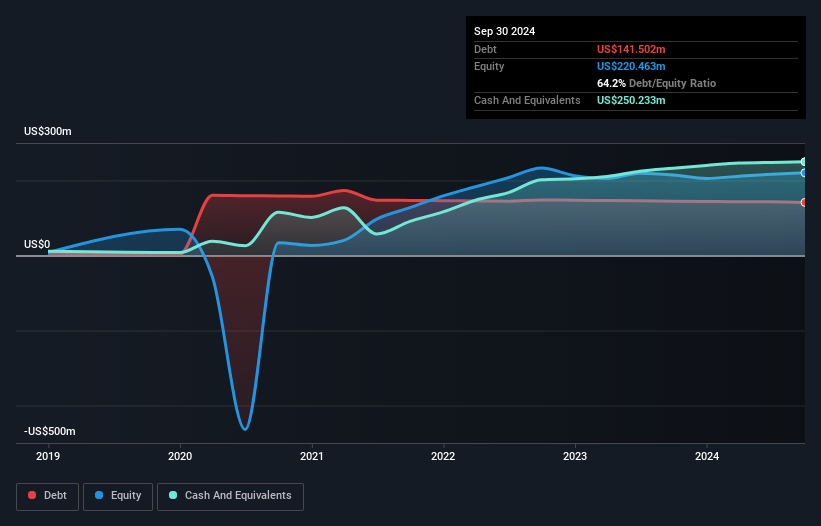

Open Lending Corporation, with a market cap of US$569.30 million, offers lending solutions that have shown high-quality earnings despite recent negative earnings growth. The company trades significantly below its estimated fair value and maintains more cash than total debt, ensuring strong liquidity with short-term assets of US$294.7M covering liabilities. While the debt-to-equity ratio has risen over five years, operating cash flow adequately covers this debt. Recent partnerships enhance their Lenders Protection™ program's reach in automotive finance, supporting near- and non-prime borrowers through advanced loan structuring and pricing strategies. Executive changes include co-founder John J. Flynn transitioning to a consultancy role in 2025.

- Click here and access our complete financial health analysis report to understand the dynamics of Open Lending.

- Review our growth performance report to gain insights into Open Lending's future.

Cytek Biosciences (NasdaqGS:CTKB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cytek Biosciences, Inc. is a cell analysis solutions company offering tools that support scientific progress in biomedical research and clinical applications, with a market cap of approximately $580.28 million.

Operations: The company's revenue is primarily derived from its Scientific & Technical Instruments segment, which generated $200.45 million.

Market Cap: $580.28M

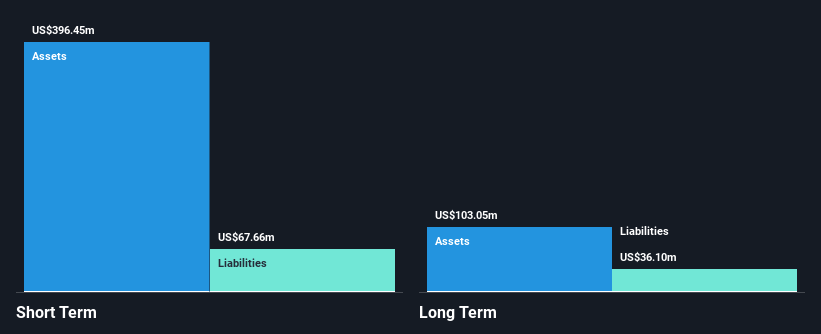

Cytek Biosciences, Inc., with a market cap of US$580.28 million, has shown stability in weekly volatility and maintains a robust cash position with short-term assets of US$396.4 million exceeding both short- and long-term liabilities. Despite being unprofitable, the company reported 2024 revenue of US$200.45 million and reduced its net loss to US$6.02 million from the previous year. The recent shelf registration filing for approximately $31 million could support future growth initiatives while maintaining shareholder value as there was no significant dilution over the past year. Earnings are forecasted to grow significantly, indicating potential upside if profitability improves.

- Click here to discover the nuances of Cytek Biosciences with our detailed analytical financial health report.

- Assess Cytek Biosciences' future earnings estimates with our detailed growth reports.

Nextdoor Holdings (NYSE:KIND)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nextdoor Holdings, Inc. operates a neighborhood network connecting neighbors, businesses, and public agencies both in the United States and internationally, with a market cap of approximately $664.44 million.

Operations: The company generates revenue primarily from its Internet Information Providers segment, totaling $247.28 million.

Market Cap: $664.44M

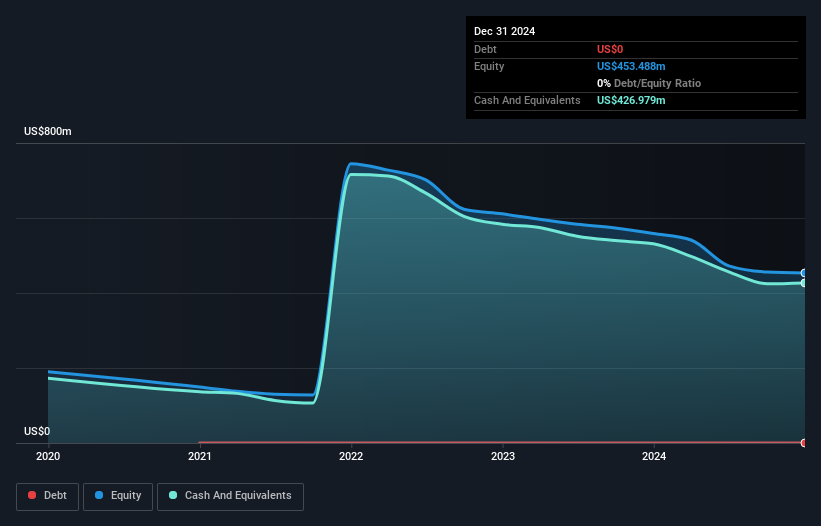

Nextdoor Holdings, Inc., with a market cap of US$664.44 million, reported 2024 revenue of US$247.28 million and reduced its net loss to US$98.06 million from the prior year. Despite being unprofitable with a negative return on equity, the company benefits from no debt and strong short-term assets of US$466.7 million exceeding liabilities. Recent share buybacks and stable weekly volatility suggest efforts to stabilize shareholder value while maintaining liquidity for over three years based on current cash flow trends. The new CRO appointment aims to drive revenue growth through enhanced ad platform strategies leveraging first-party data insights.

- Navigate through the intricacies of Nextdoor Holdings with our comprehensive balance sheet health report here.

- Gain insights into Nextdoor Holdings' future direction by reviewing our growth report.

Turning Ideas Into Actions

- Embark on your investment journey to our 745 US Penny Stocks selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CTKB

Cytek Biosciences

A cell analysis solutions company, provides cell analysis tools that facilitates scientific advances in biomedical research and clinical applications.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives