- United States

- /

- Entertainment

- /

- NYSE:IMAX

IMAX (IMAX) Valuation Check After JPMorgan Upgrade and China Partnership with Wanda Film

Reviewed by Simply Wall St

IMAX (IMAX) just caught investors attention after a JPMorgan upgrade and a fresh tie up with Wanda Film in China, moves that arrive alongside deepening content partnerships and a stronger blockbuster pipeline.

See our latest analysis for IMAX.

The JPMorgan upgrade and the Wanda Film deal appear to be contributing to a solid run, with IMAX’s share price up 11.5% over the past month and 55.5% year to date, while three-year total shareholder returns above 180% suggest momentum is still very much on the front foot.

If IMAX’s recent performance has you thinking more broadly about the sector, it is worth exploring high growth tech and AI stocks for other tech-driven media and entertainment names that could be building similar momentum.

With IMAX trading near record highs yet still sitting at a hefty implied discount to some fair value estimates, investors now face a familiar dilemma: is there still a buying opportunity here, or has the market already priced in the next leg of growth?

Most Popular Narrative: 0.6% Overvalued

With IMAX closing at $39.04 against a most popular narrative fair value of about $38.81, the story hinges on sustained earnings power and premium-screen scale.

Operating leverage from cost discipline, capital light joint venture models, and advances in proprietary projection or distribution technology (e.g., streaming for live events) is driving sustained margin expansion and cash generation, directly benefiting net margins and enabling opportunistic reinvestment or shareholder returns.

Want to see the engine behind that near premium valuation? This narrative quietly leans on compounding revenue growth, rising margins, and a bold future earnings multiple. Curious which assumptions really carry the model? The full story spells out the numbers that make this fair value tick.

Result: Fair Value of $38.81 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting consumer attention toward at home entertainment and any stumble in the blockbuster pipeline could quickly pressure IMAX’s premium valuation narrative.

Find out about the key risks to this IMAX narrative.

Another View: Rich on Earnings

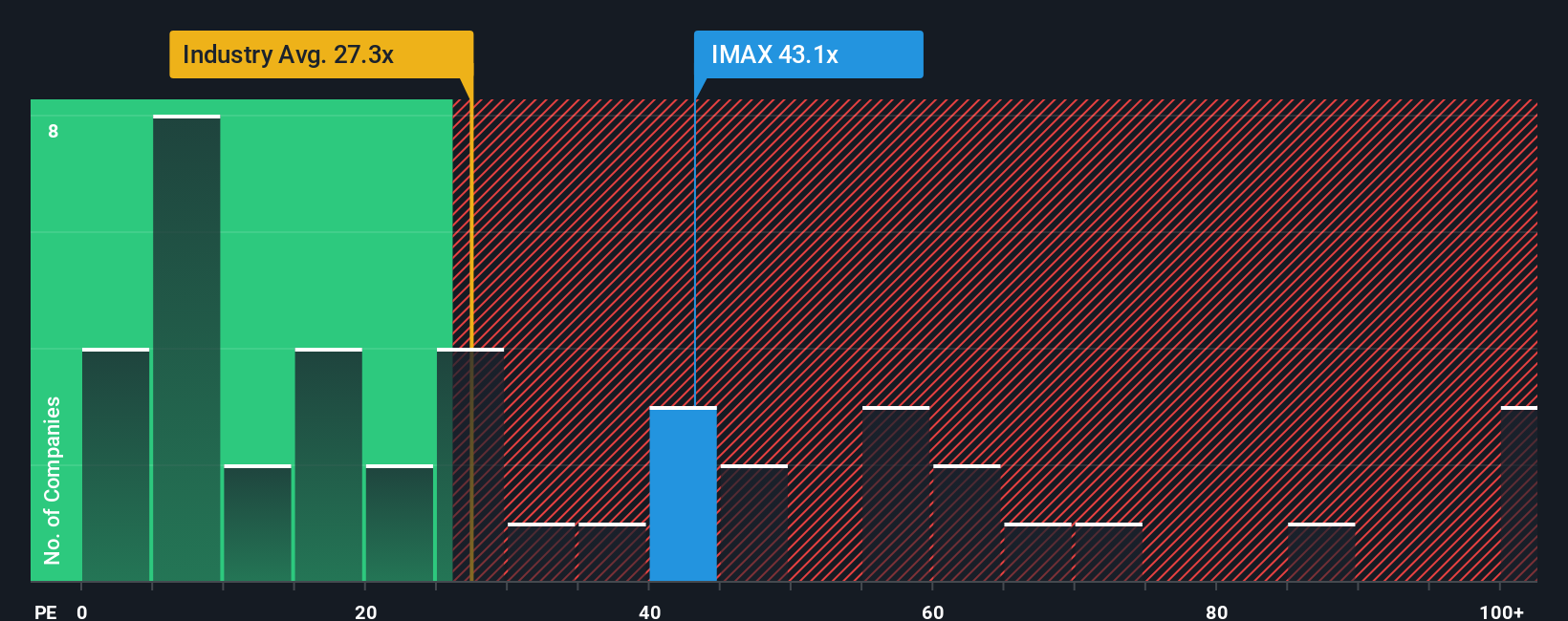

Viewed through its earnings multiple, IMAX appears far from cheap. The shares trade on a P/E of 53.1x, which is well above the US Entertainment industry at 20.3x, peers at 51x, and even our fair ratio of 22.1x. This suggests meaningful downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out IMAX for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own IMAX Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a custom IMAX narrative in just minutes using Do it your way.

A great starting point for your IMAX research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before the market’s next big swing, use the Simply Wall St Screener to uncover fresh, data led ideas that could sharpen and upgrade your portfolio.

- Capture early stage growth potential by reviewing these 3626 penny stocks with strong financials that already boast solid financial foundations and real traction.

- Target cash flow backed opportunities by focusing on these 913 undervalued stocks based on cash flows that the market has not fully appreciated yet.

- Strengthen your income stream by assessing these 13 dividend stocks with yields > 3% that balance reliable payouts with sustainable business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IMAX

IMAX

Operates as a technology platform for entertainment and events in the United States, Greater China, rest of Asia, Western Europe, Canada, Latin America, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)