- United States

- /

- Entertainment

- /

- NYSE:IMAX

Did Tron: Ares’ Blockbuster IMAX (IMAX) Performance Just Shift the Premium Cinema Investment Narrative?

Reviewed by Sasha Jovanovic

- Disney's "Tron: Ares" topped the weekend box office in the past week, earning US$33.5 million domestically and US$60.5 million worldwide, with IMAX accounting for US$6.6 million, or about 20%, of the domestic haul from premium screens.

- This strong IMAX contribution underlines the growing importance of premium cinema formats in driving audience turnout and box office performance for major releases.

- We'll explore how IMAX's significant role in premium formats for "Tron: Ares" impacts its broader investment narrative and future outlook.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

IMAX Investment Narrative Recap

Owning IMAX means believing in the ongoing appeal of premium theatrical experiences and the company's ability to capture a disproportionate share of blockbuster-driven attendance. While the strong IMAX share in Disney's "Tron: Ares" weekend reinforces this narrative, the news is unlikely to shift the near-term catalyst, which remains tied to the continued release schedule of major tentpole films, though any disruption or volatility in this pipeline still looms as the principal business risk.

From recent company updates, the Apple Cinemas agreement stands out: five new IMAX systems and upgrades at three locations in the U.S. are slated for 2026, aligning with IMAX's strategy to grow its global footprint. This expansion directly supports the catalyst of geographic diversification and network scale, as highlighted by large openings like "Tron: Ares," but ongoing risks around content supply persist.

However, it's essential for investors to recognize that, despite strong box office showings, IMAX's reliance on blockbuster releases means that if the film pipeline ...

Read the full narrative on IMAX (it's free!)

IMAX's outlook anticipates $466.0 million in revenue and $74.0 million in earnings by 2028. This is based on an expected annual revenue growth rate of 8.7% and an earnings increase of $41.2 million from the current $32.8 million.

Uncover how IMAX's forecasts yield a $34.36 fair value, a 10% upside to its current price.

Exploring Other Perspectives

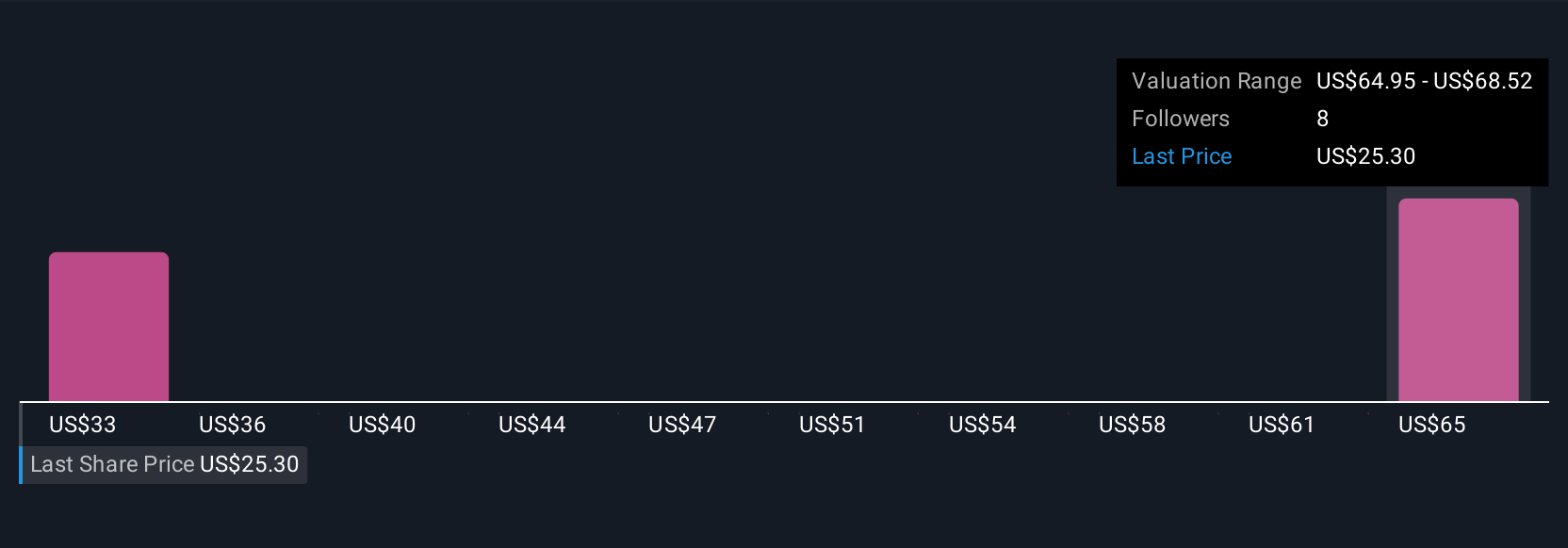

Simply Wall St Community members estimate IMAX's fair value between US$34.36 and US$57.96, from two distinct forecasts. With blockbuster content volatility remaining a key risk to revenue growth, it's important to assess how varied views may shape your own expectations.

Explore 2 other fair value estimates on IMAX - why the stock might be worth just $34.36!

Build Your Own IMAX Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IMAX research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free IMAX research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IMAX's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IMAX

IMAX

Operates as a technology platform for entertainment and events in the United States, Greater China, rest of Asia, Western Europe, Canada, Latin America, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)