- United States

- /

- Media

- /

- NYSE:IBTA

Additional Considerations Required While Assessing Ibotta's (NYSE:IBTA) Strong Earnings

Despite announcing strong earnings, Ibotta, Inc.'s (NYSE:IBTA) stock was sluggish. We did some digging and found some worrying underlying problems.

An Unusual Tax Situation

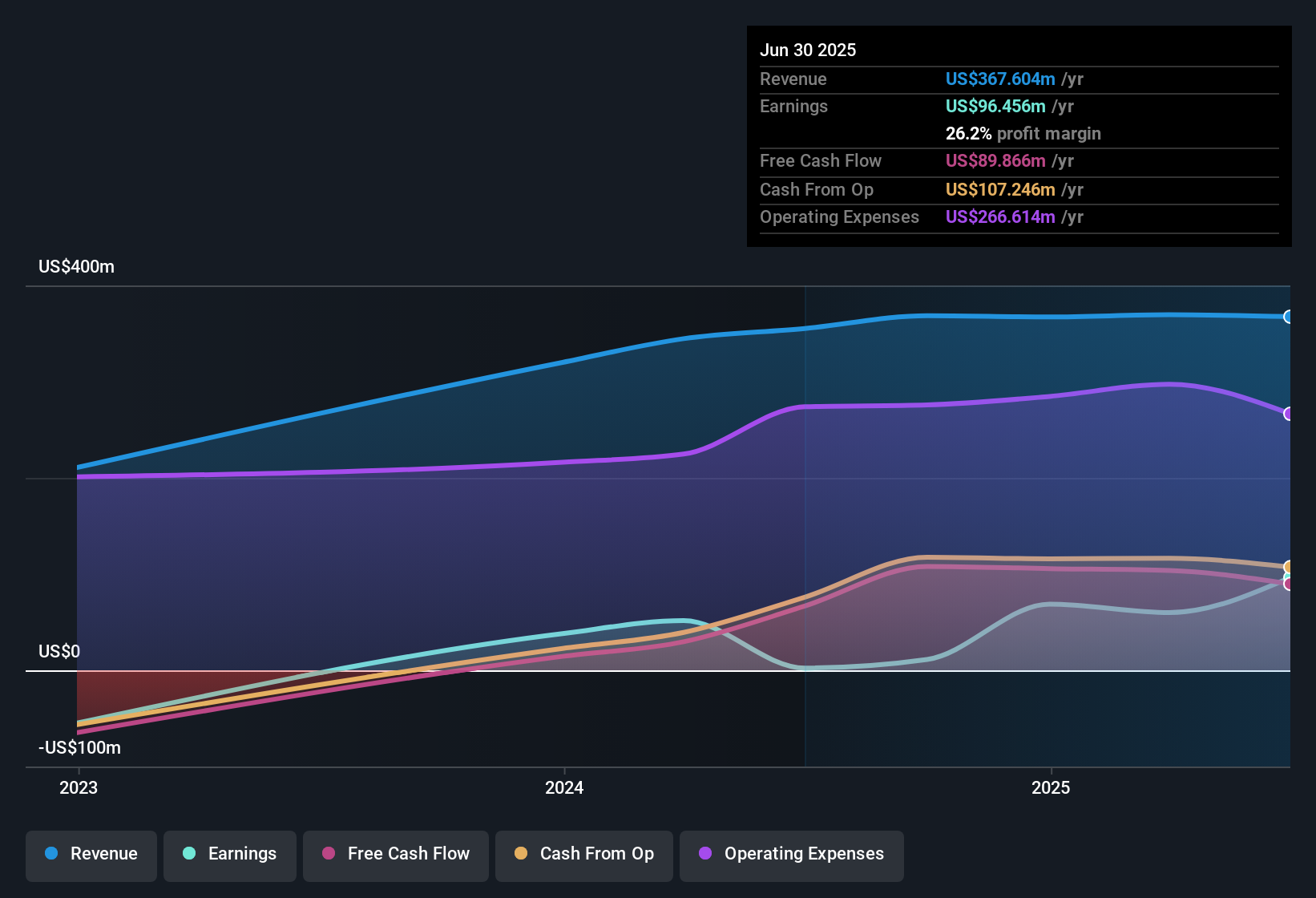

Ibotta reported a tax benefit of US$50m, which is well worth noting. This is meaningful because companies usually pay tax rather than receive tax benefits. We're sure the company was pleased with its tax benefit. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Ibotta's Profit Performance

In its most recent report, Ibotta disclosed a tax benefit, as we discussed above. Tax is usually an expense, not a benefit, so we don't think the reported profit number is a particularly good guide to the earning potential of the business. As a result, we think it may well be the case that Ibotta's underlying earnings power is lower than its statutory profit. But the happy news is that, while acknowledging we have to look beyond the statutory numbers, those numbers are still improving, with EPS growing at a very high rate over the last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. When we did our research, we found 2 warning signs for Ibotta (1 is a bit unpleasant!) that we believe deserve your full attention.

Today we've zoomed in on a single data point to better understand the nature of Ibotta's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:IBTA

Ibotta

A technology company, provides digital promotion services to clients in the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Sunny Returns with On the Beach

High Quality Business and a true compounding machine

Roche Holding AG To Benefit From Strong Drug Pipeline In 2027 And Beyond

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

AMZN: Acceleration In Cloud And AI Will Drive Margin Expansion Ahead

Trending Discussion

AGAG still in exploration, in bull market, such company will be the last to participate. It's high risk but can results in 20-30 baggers potential. The best play with current bull are with producers or near-producer miners, you can get 5-10 baggers with much lower risk. See my analysis on santacruz silver, andean silver.