- United States

- /

- Entertainment

- /

- NYSE:HUYA

Subdued Growth No Barrier To HUYA Inc. (NYSE:HUYA) With Shares Advancing 25%

HUYA Inc. (NYSE:HUYA) shares have had a really impressive month, gaining 25% after a shaky period beforehand. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

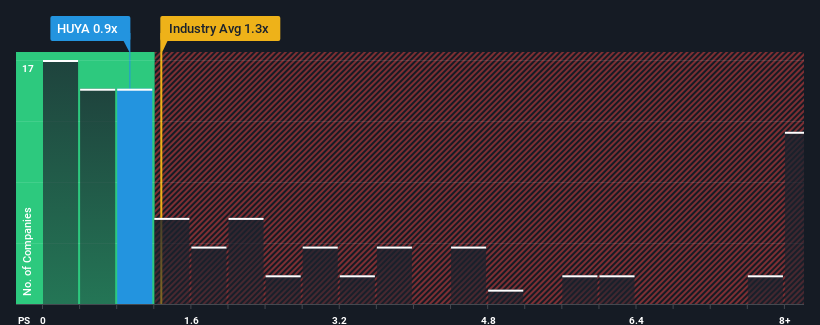

In spite of the firm bounce in price, it's still not a stretch to say that HUYA's price-to-sales (or "P/S") ratio of 0.9x right now seems quite "middle-of-the-road" compared to the Entertainment industry in the United States, where the median P/S ratio is around 1.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for HUYA

What Does HUYA's Recent Performance Look Like?

While the industry has experienced revenue growth lately, HUYA's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think HUYA's future stacks up against the industry? In that case, our free report is a great place to start.How Is HUYA's Revenue Growth Trending?

In order to justify its P/S ratio, HUYA would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 24%. The last three years don't look nice either as the company has shrunk revenue by 28% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 1.7% per year as estimated by the eleven analysts watching the company. That's not great when the rest of the industry is expected to grow by 9.8% per year.

With this information, we find it concerning that HUYA is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Final Word

HUYA appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our check of HUYA's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for HUYA with six simple checks will allow you to discover any risks that could be an issue.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if HUYA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:HUYA

HUYA

Through its subsidiaries, operates game live streaming platforms in the People’s Republic of China.

Good value with adequate balance sheet.