- United States

- /

- Media

- /

- NYSE:CTV

Innovid Corp. (NYSE:CTV) Stock's 41% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Unfortunately for some shareholders, the Innovid Corp. (NYSE:CTV) share price has dived 41% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 86% loss during that time.

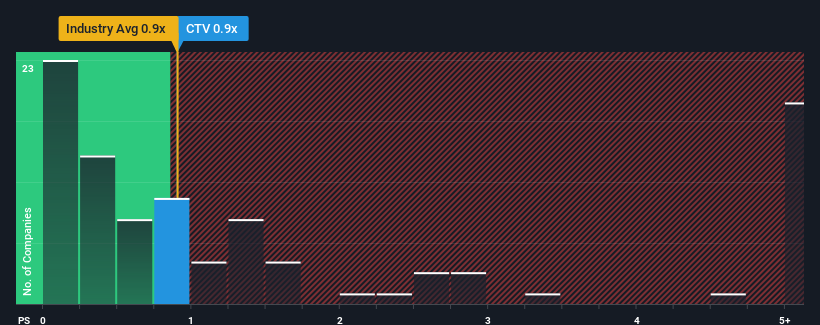

In spite of the heavy fall in price, there still wouldn't be many who think Innovid's price-to-sales (or "P/S") ratio of 0.9x is worth a mention when it essentially matches the median P/S in the United States' Media industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Innovid

How Has Innovid Performed Recently?

With revenue growth that's superior to most other companies of late, Innovid has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Innovid.How Is Innovid's Revenue Growth Trending?

Innovid's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 41% gain to the company's top line. Pleasingly, revenue has also lifted 126% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 10% per annum as estimated by the four analysts watching the company. That's shaping up to be materially higher than the 3.5% per year growth forecast for the broader industry.

With this information, we find it interesting that Innovid is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Innovid's P/S Mean For Investors?

Innovid's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite enticing revenue growth figures that outpace the industry, Innovid's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Before you take the next step, you should know about the 2 warning signs for Innovid that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CTV

Innovid

Operates an independent software platform that provides ad serving, measurement, and creative services.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives