- United States

- /

- Interactive Media and Services

- /

- NYSE:ATHM

Does Autohome’s (ATHM) Dividend Reveal a Shift in Capital Allocation Priorities?

Reviewed by Sasha Jovanovic

- Autohome Inc. recently announced that its board of directors approved a cash dividend of US$0.59 per ADS (or US$0.1475 per ordinary share), totaling approximately RMB 0.5 billion, for shareholders of record as of October 20, 2025, with payments expected in November.

- This dividend decision signals confidence in the company’s financial position and highlights Autohome's ongoing commitment to shareholder returns through capital distribution.

- We’ll explore how Autohome’s newly approved dividend payout reflects on its investment thesis and future cash flow priorities.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Autohome Investment Narrative Recap

To be a shareholder in Autohome, you need to believe in the company’s ability to sustain its leadership in China’s digital automotive sector, capitalize on advanced AI tools and platform integrations, and maintain relevance amid tightening industry competition and changing consumer behavior. The newly announced US$0.59 per ADS dividend underlines confidence in near-term cash generation but does not materially shift the biggest current risk: continued gross margin compression driven by price wars, overcapacity, and client concentration among large OEMs. The main short-term catalyst, namely advances in digital engagement and AI-powered offerings to boost ad revenue, remains central to the investment thesis.

Among recent announcements, Haier Group’s acquisition of a 43% stake in Autohome in August stands out, as new ownership could bring added resources and influence over future business priorities. While this is not directly tied to the latest dividend news, it intersects with Autohome’s need to move quickly on digitalization and retail innovations, important levers for revenue stability and margin recovery if competitive pressures persist.

Yet, against these promising developments, investors should not overlook the persistent risks to gross margin sustainability that could...

Read the full narrative on Autohome (it's free!)

Autohome's outlook anticipates CN¥7.5 billion in revenue and CN¥1.8 billion in earnings by 2028. This implies a 3.7% annual revenue growth rate and an earnings increase of CN¥0.3 billion from the current CN¥1.5 billion.

Uncover how Autohome's forecasts yield a $28.87 fair value, in line with its current price.

Exploring Other Perspectives

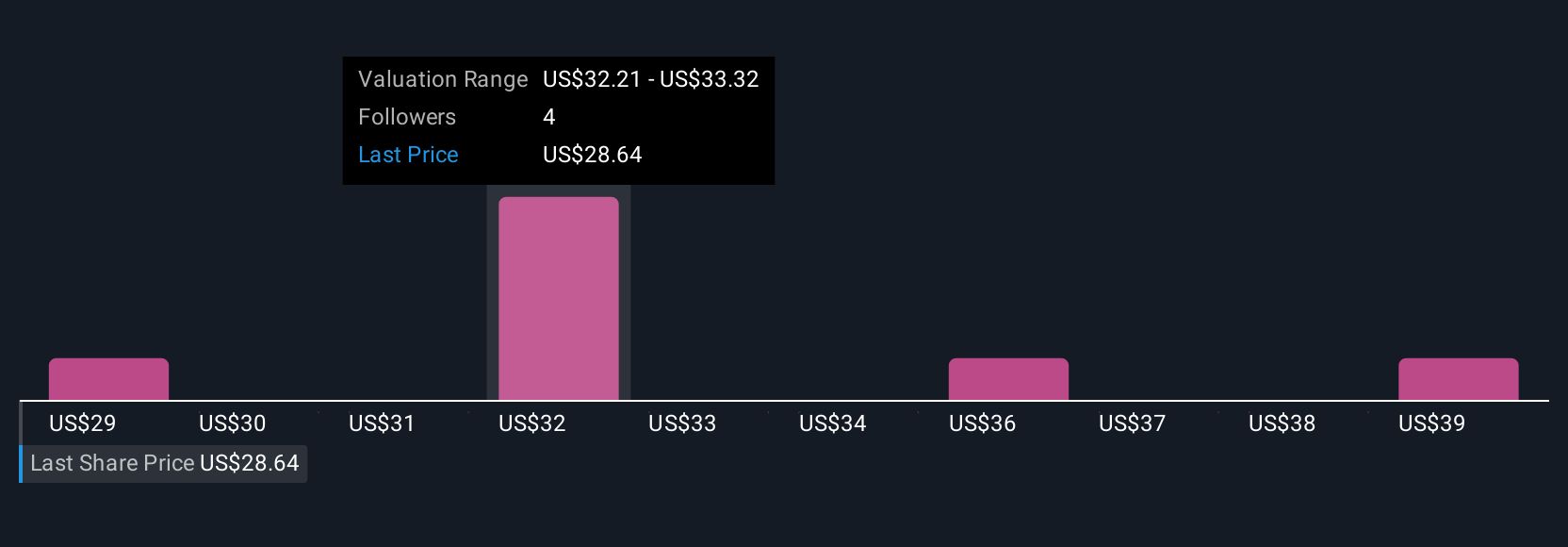

Fair value estimates from the Simply Wall St Community span from US$28.87 to US$40, with four distinct analyses. While opinions differ, many are weighing the challenge of gross margin compression and industry competition for Autohome’s future profitability.

Explore 4 other fair value estimates on Autohome - why the stock might be worth just $28.87!

Build Your Own Autohome Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Autohome research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Autohome research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Autohome's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATHM

Autohome

Operates as an online destination for automobile consumers in the People’s Republic of China.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)