- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:WB

What Weibo (WB)'s S&P Global BMI Index Addition Means For Shareholders

Reviewed by Sasha Jovanovic

- Weibo Corporation (SEHK:9898) was recently added to the S&P Global BMI Index, enhancing the company’s profile among international investors and index-tracking funds.

- This index inclusion could attract increased institutional attention, as it may prompt portfolio rebalancing by global funds that reference the S&P Global BMI Index.

- We’ll explore how gaining global visibility via index addition could shape Weibo’s investment outlook and continued digital media evolution.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Weibo Investment Narrative Recap

For investors to be long-term shareholders in Weibo, they need confidence in the company’s ability to fend off intensifying competition in China’s digital media arena, monetize its user base, and adapt to shifting trends in digital advertising. The recent S&P Global BMI Index addition lifts Weibo’s profile among institutional investors and could fuel short-term trading activity, but is unlikely to materially affect the most pressing short-term catalyst: whether the company can sustain growth in ad revenues amid competitive and regulatory pressures, and its biggest risk, ad spend volatility and evolving user behaviors.

Weibo’s most recent Q2 2025 results provide relevant context: revenue climbed to US$444.8 million and net income increased to US$125.69 million, both up year over year, reflecting improved profitability. Continued earnings growth is encouraging for holders, but the effectiveness of new AI-powered ad and content tools, as outlined in management’s current platform focus, may be what shapes the company’s ability to drive future monetization and withstand changes in digital ad demand. But while index inclusion can boost visibility and prompt fund flows, investors must also consider regulatory shifts and ad market headwinds...

Read the full narrative on Weibo (it's free!)

Weibo's outlook projects $1.9 billion in revenue and $416.6 million in earnings by 2028. This is based on analysts expecting 2.8% annual revenue growth and a $44.5 million increase in earnings from $372.1 million today.

Uncover how Weibo's forecasts yield a $11.96 fair value, a 7% downside to its current price.

Exploring Other Perspectives

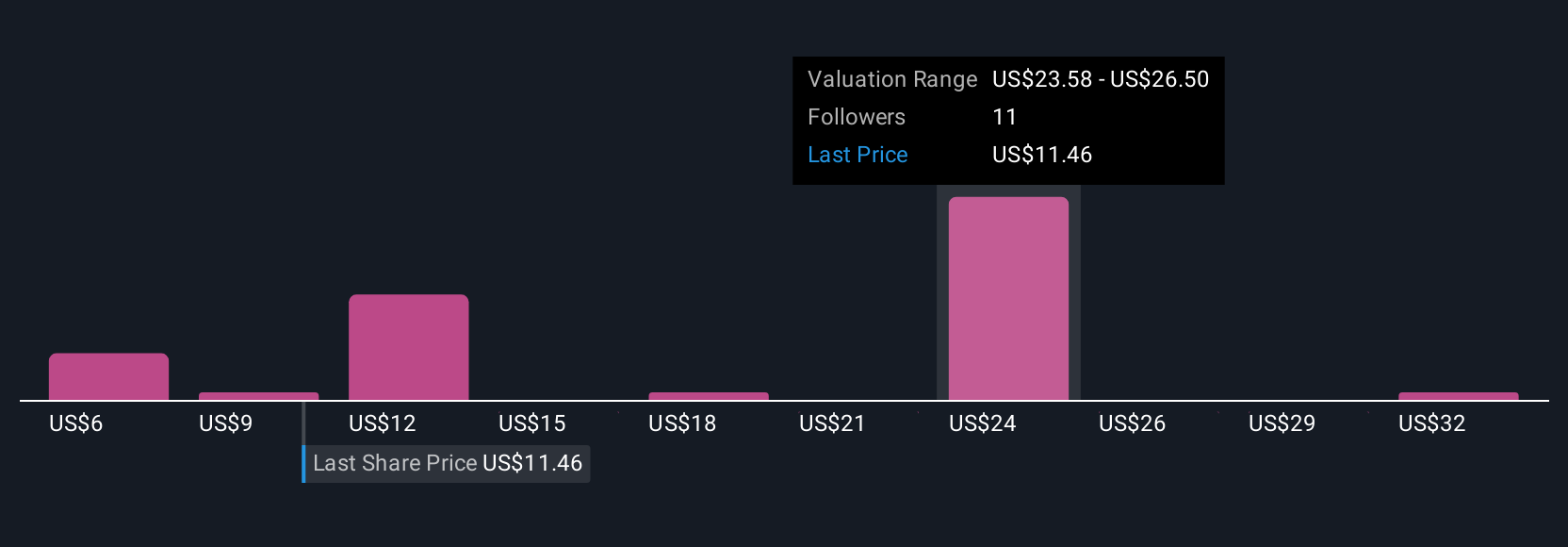

Eight community members in the Simply Wall St Community estimated Weibo’s fair value from US$6.08 to US$35.25 per share. With shifting digital ad trends and competition top of mind, you can explore a wide range of investor viewpoints on Weibo’s prospects.

Explore 8 other fair value estimates on Weibo - why the stock might be worth over 2x more than the current price!

Build Your Own Weibo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Weibo research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Weibo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Weibo's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Weibo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WB

Through its subsidiaries, operates as a social media platform for people to create, discover, and distribute content in the People’s Republic of China.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives